Posted September 22, 2025

By Sean Ring

The Last Cheap Ounces of Your Life

Newsletter editors are prone to hyperbole, and I'm no exception. We want you to read our stuff, and we want you to be interested in our writing to the point of obsession. I’ve done my best to avoid that pitfall, and just tell you what’s going on, merely shooting straight from the hip.

But today, I may sound hyperbolic. Here goes: we are now at the beginning of an event that may define our investing lifetimes. This is the moment gold bugs, silver bugs, and economists of the Austrian School variety have waited a lifetime for.

As pictures are worth 1,000 words, let me show you how gold and silver are trading in the overnight session:

Spot gold and silver are both at all-time highs, and I don’t think this is stopping anytime soon.

The Rude has been pounding the table about these metals since, oh, 50% ago, so I hope you've already bought. However, if you haven’t, this may genuinely be your last chance to buy at prices like these for a long time.

From what I can see, by year's end, we will have hit $4,000 in gold and $50 in silver. I know those aren’t bold predictions. They’re merely formalities.

Gold may indeed hit $10,000 before this is all over, and that’s 169% more to go. But the big one will be silver, which may just hit $400. And that’s about 815% higher from this point.

What’s going on?

Ex-Squeeze Me?

Paolo Schavione, a Goldman Sachs trader and Executive Director, wrote this in his latest research report:

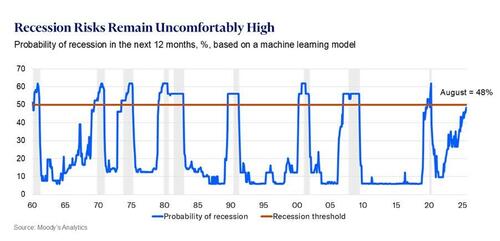

Moody’s recession model is flashing red: a 48% probability of a U.S. downturn in the next 12 months. It’s not above 50%, but historically, recession odds have never been this high without a recession following.

That headline keeps bears loud: they point to freight, trucks, autos, chemicals, and housing. And they’re not wrong: these cyclical, rate-sensitive sectors are showing recessionary stress — falling volumes, margins under pressure, payrolls being cut.

But the broader economy hasn’t cracked. Services, healthcare, tech, defense, AI — they’re still expanding. The tariff shock is behind us. The economy is adapting. The second derivative of growth is turning up.

We’ve been here before. Think 1999, post–August 1998 selloff. A liquidity-driven regime shift. Back then, the Fed’s rescue flipped the narrative, and the market became a slave to the tape.

That’s where we are again today: less about fundamentals, more about positioning and price action.

The U.S. consumer is spending freely and has never been so levered to the Equity market. Travel and discretionary spending are strong. There’s a sense that money is losing value anyway, so better to use it now than hold it.

The Fed was the key risk event — everyone bought protection into it. That protection is now unwinding, and the unwind itself is fuel. Crowded long-vol = asymmetric squeezes. Risk is shifting from fear to FOMO. Next 3–6 months: the economy rips, and markets rally hard.

“There’s a sense that money is losing value anyway, so better to use it now than hold it.”

Let that sink in for a minute.

I’ve got no doubt it’s true. But if the already indebted U.S. consumer starts spending even more, we will indeed have a meltup similar to the 1999 rally that preceded the 2000 Nasdaq peak and subsequent crash. To remind you, the “crash” lasted until October 2002, with the Nazzie falling nearly 80%.

Still, I think you’re far safer investing in gold, silver, and gold and silver mining stocks rather than tech stocks.

But first, let’s look at some silver charts.

Silver Charts

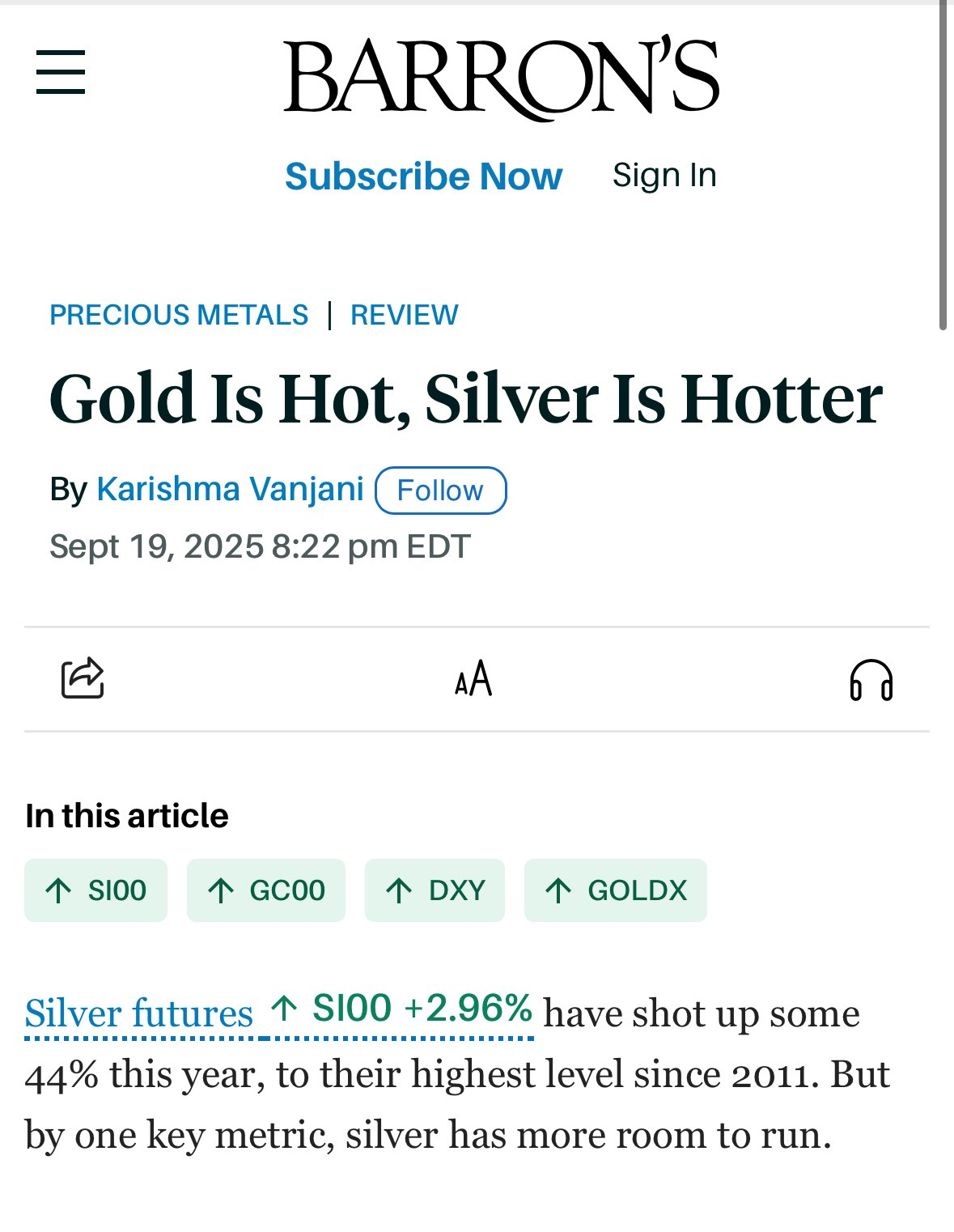

First off, the interns at Dow Jones & Co. have finally caught up with us:

We loved gold for years. Silver was frustrating as hell. But we knew once silver started to move, it would be even bigger than gold. Central bank buying has been bolstering our gold claims. Then, the Saudi government bought a bunch of SLV a few weeks ago. Great, but where was the retail buyer? Nowhere to be found.

Now, after this Barron’s piece, we can assume that at least the mass affluent will join the metals purchasing party. Bully for us!

Marin Katusa’s team will kick off our charts with this peach:

This is the “handle” in the 45-year-long cup-and-handle pattern for silver. Once silver breaks its previous all-time high, the sky is the limit… literally. We’re right there, and we may be accelerating into the move.

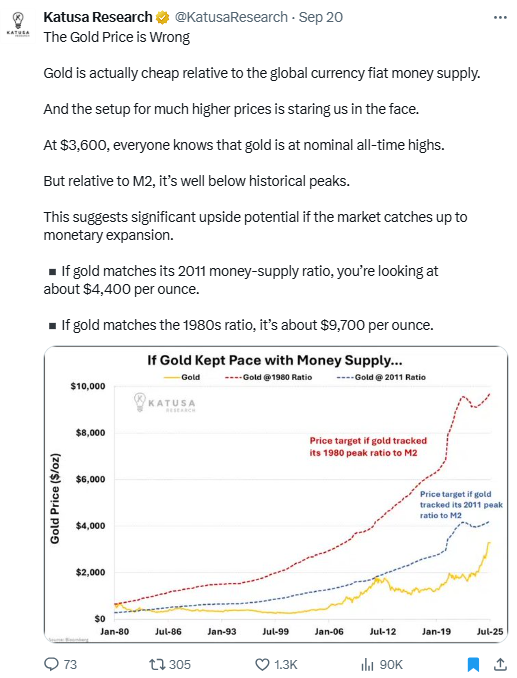

Another one from Katusa Research is this one about gold related to the money supply.

If the gold market catches up to the monetary supply expansion from 1980, it’d be trading at $9,700 per ounce. Impressive. However, at the current gold-silver ratio (GSR) of 85, that would yield $114 in silver.

At a more historically normal GSR of, say, 65, we would get $165 silver. That would put a rocket under our silver miners, wouldn’t it?

One last chart from our friends at Katusa Research:

The chart is similar to the first, but two things stand out. First, the RSI has moved into strong territory. Most TAs misread this as “overbought.” We can go much higher from here. When you come back through that 70 line, then you really worry your momentum is lost. Second, the comment about having a deficit of silver rather than a surplus is huge. Deficits are inventories short of the metal, which is massively bullish for pricing.

One last chart is about capital rotation, which gets its own section.

Capital Rotation

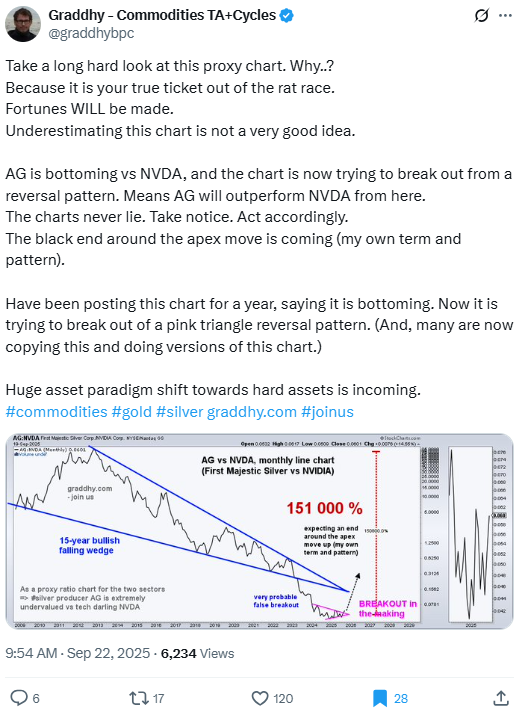

It’s one thing for our colleagues at Northstar Bad Charts to constantly bang on about the impending capital rotation from tech into metals. However, the story is now gaining traction.

Graddhy has produced an AG (First Majestic Silver - a Rude portfolio holding) v NVDA chart. After NVDA crushing AG for decades, it finally looks like this is turning around. If it works out this way, AG will rocket.

Ace mining analyst and writer Don Durrett has a $50 price target for AG. But that may be too low.

Change in Position

As a result of this silver run-up, I’ve decided to swing for the fences again. I was too conservative in buying AYA.TO, so I’ve instructed my broker to sell it today. It’s not that I don’t think it’s a good stock; far from it. I would like to take on more risk by investing in lower-priced silver stocks.

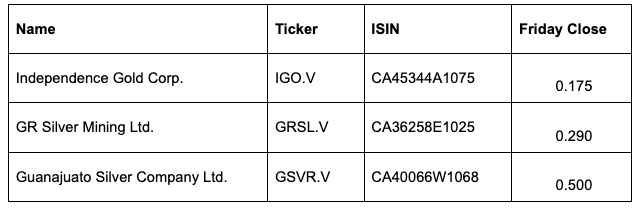

So, I’ll use the proceeds from the AYA sale to purchase the following:

These stocks are clearly high risk. In fact, they will be ⅓ each the size of my AYA.TO position. But as you may already know, I like swinging for the fences when I think I’ve got the probabilities on my side.

Wrap Up

The time for silver has come. We should see $50 soon. But even at $43, it’s amazingly attractive.

If you haven’t secured some, get some now. Back up the truck. Silver is scarce, and we’re entering a resource war with the rest of the world.

Get long silver and prosper.

L'oro dell'Italia

Posted December 05, 2025

By Sean Ring

The Border Threat No One Saw Coming

Posted December 04, 2025

By Sean Ring

Beating Inflation by Following the Trend

Posted December 03, 2025

By Sean Ring

The Curious Case of the Disappearing Silver

Posted December 02, 2025

By Sean Ring

Silver Surfing... and Bonus Tickers!

Posted December 01, 2025

By Sean Ring