Posted October 10, 2024

By Sean Ring

How I’m Playing the Metals Rally

When I wrote about three weeks ago that I had sold my stocks, I had a funny feeling I’d be back in sooner rather than later. It seems I prefer the frying pan of the markets to the fiery waiting of purgatory.

Jay Powell announced his 50-basis-point cut at the September Fed meeting, and I was surprised. A 50-basis-point cut was too much, too late. The market would know that Jay knew something was wrong with the financial plumbing, which would be bad for the stock market.

The stock market initially fell on the news but rallied hard the following day. Yesterday, the SPX made a new all-time high.

Move Over, Laowai

After the Fed cut, the People’s Bank of China (PBOC) had to get involved. Their monetary stimulus would provide an unforeseen fillip to the commodities markets. After all, when China does something, it’s inevitably big.

The PBOC rolled out its biggest moves since the pandemic to stabilize the economy and revive market confidence.

It worked initially, but it’s since started to stall. Nevertheless, with the world’s two biggest economies easing, this is massively bullish for commodities, especially gold.

How I Express My View

Two days ago, I wrote about all the different ways you can invest in gold. Yesterday, I mentioned that I like single mining stocks, especially in this historic time. When the big central banks start quantitative easing again, it’ll destroy our dollars’ purchasing power, rocketing gold and silver prices.

That doesn’t mean you have to!

If you’re more comfortable with the mining ETFs, by all means, invest there. If you’re even more conservative and just like owning gold and silver coins, that’s just fine.

Today’s piece aims to show you how I’m doing it. Pick and choose what you like. Discard what you don’t.

And consult a professional investment advisor you trust. How do you know who to trust? First, make sure they’re rich themselves. That’s a good start. After that, trust your instincts.

So here’s what I’ve got in my miners' portfolio.

The Miners That Made It

Avino Silver and Gold (ASM), Hecla (HL), Kinross Gold (KGC), and SilverCrest (SILV) all return to the portfolio.

After a prolonged absence, First Majestic (AG) and Sibanye Stillwater (SBSW) are back in my portfolio.

Endeavor Silver (EXK) and Coeur Mining (CDE) are new entrants.

ASM

Usually, we save the best for last. But this may be the pick of the litter. Now that Coeur has bought SilverCrest, Avino is a sitting duck, ripe for a takeover.

It won’t be the 25-bagger everyone hoped for, but it’ll be a big earner once it's bought. As far as quick wins are concerned, this may be your best bet.

HL

After a huge weekly breakout, HL has had a rough four weeks. I don’t think it’s a false breakout. It’s just a rest before the climb. Hecla is a solid five-bagger once silver hits $75.

KGC

It's not a full breakout from KGC, but I like its chances. I’m looking for an initial move into the $12.50-$13.00 area.

According to ace metals stock analyst Don Durrett, “Kinross Gold is a major with 2 million oz of gold equivalent production. Their all-in costs (breakeven) for 2024 are projected to be around $1,550. Free cash flow should be around $1 billion at $2,000 gold. For every $100 gold price rise, their net profit will rise by around $200 million.”

Its annual dividend is $0.12, giving it a 1.27% dividend yield.

SILV

This is what Don Durrett had to say about the Coeur-SilverCrest merger:

1) Silvercrest had a pipeline problem (they didn't have one), and Coeur had a cost problem (they are too high). Both got fixed in this merger.

2) Coeur is now a monster. I already had it ranked as the #2 silver miner. They just got better. If you own either of these stocks, you just got handed a present.

3) You want to be overweight, Hecla and Coeur. Why? When sentiment finally improves for the gold/silver miners, these stocks will benefit in a huge way. Wall St, ETFs, Hedge funds, and private equity will buy them like candy. They are the go-to names!

Above $10.20, we’ll target $13.00.

AG

First Majestic Silver is a titan of the space and a must-own. AG has recovered nicely after falling off a cliff earlier in the year. Five weeks ago, it posted a massive bullish candle. Though it’s down this week, I expect it to recover.

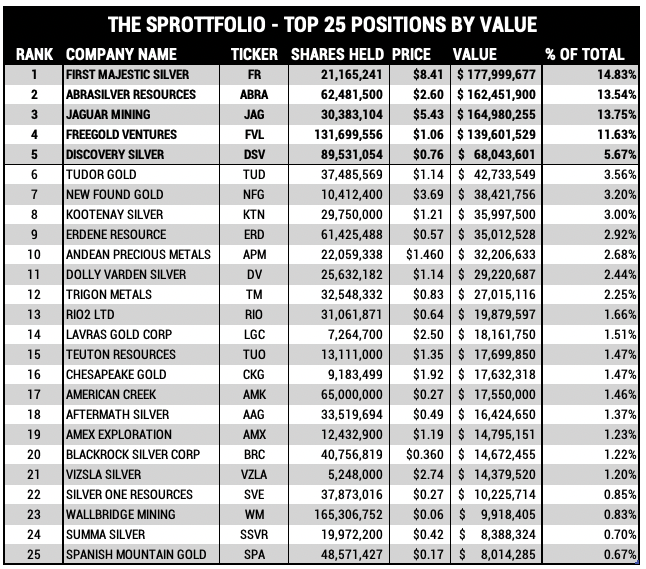

I also love the fact that this is Sprott’s largest position in their portfolio:

Credit: @num8ersguy

Confirmation bias or smart piggybacking? We’ll find out, won’t we?

SBSW

Market Confucius says, “He who picks bottoms gets smelly fingers.”

Well, the bottom is in here. Sibanye is a play on South Africa, which everyone hates right now. But with them in BRICS, they’re somewhat protected.

Once we get above $4.50, we target $5.75. Above $5.75, and we have smooth sailing until $9.75.

CDE

Coeur Mining just came off a double bottom and had two technical breakouts recently.

Taking over SILV was a masterstroke. See above.

EXK

Though riskier, I like Endeavour Silver’s chances.

The upside target for EXK is $11.25.

Wrap Up

Some of these stocks are riskier, but most are solid companies that will do well in a commodities bull market.

Also, you may have noticed most of my picks are silver miners. Right now, I’m a “greed” guy, not a “fear” guy.

I invested 9.5% of my portfolio in each stock.

23.4% of my portfolio remains in cash, waiting for the right time to take advantage of Ray Blanco’s excellent tech and biotech picks. Like Warren Buffett, I’m keeping some powder dry for now.

None of this is financial advice; it’s just the unvarnished truth of what I’m doing now.

I hope this helps.

The Most Expensive Way to Go Broke

Posted February 18, 2026

By Sean Ring

The Bears Gather

Posted February 17, 2026

By Sean Ring

Omar Khayyam: Poet, Rebel, Astronomer

Posted February 16, 2026

By Sean Ring

The Devil in Mexican Mining

Posted February 13, 2026

By Matt Badiali

Is Civil War on the Cards?

Posted February 12, 2026

By Jim Rickards