Posted November 02, 2023

By Sean Ring

Ten Glittering Reasons to Buy Gold Right Now

If you read yesterday’s Monthly Asset Class Report, you could feel my anger at the gold price action that ended the month.

We were so close to closing over $2,000 on the monthly charts for the first time. But something - we can’t say what (even if we know) - clubbed gold over the head right before the close.

I suspect it was the Fed’s minions on Wall Street who dutifully sold to keep the world under the delusion - for just a bit longer - that the USG hasn’t lost control of its budget, money supply, or senses.

But as my good friend and colleague Alan Knuckman said, “The longer you hold something down, the more furious the breakout will be.”

And he’s absolutely right. But before I elaborate, a quick heads-up for you:

Tomorrow, my friend and frequent Rude contributor Byron King will be on Rickards Uncensored. No one knows the intersection of the military, energy, and mining like Byron. Join Byron and Paradigm Press Executive Publisher Matt Insley for an in-depth session on gold, oil, and the situation in the Middle East. We hope to see you at 10 a.m. ET tomorrow!

Now, I will give you ten great reasons to buy gold right now if you haven’t already. Then, I will show you some charts that will strengthen your gold resolve.

Ten Great Reasons to Buy Gold Right Now

- Wealth Preservation: Gold has been a long-standing store of value that retains its purchasing power over time. It can be a safety net against inflation and currency devaluation.

- Hedge Against Crisis: Gold often performs well during inflationary periods but not perfectly. It’s more of a “crisis hedge” than an inflation hedge. When investors anticipate the value of money decreasing rapidly, gold often increases. And while Jay Powell’s monetary policy has tightened considerably, Congress’ ludicrous fiscal policy has not. How much more money is going to Ukraine, Israel, and Taiwan? When will war games turn into war?

- Diversification: You don’t have to back up the truck and put everything into gold. Just adding gold to a portfolio provides diversification, which reduces risk. It often has a negative correlation to stocks and other financial instruments.

- Safe Haven: During geopolitical tension or economic uncertainty, investors often flock to gold as a safe haven asset. Ukraine was already a messy situation, but Israel and Hamas have taken that messiness to a whole new level.

- Liquidity: Everyone loves gold and is a buyer. It’s a highly liquid asset that can be sold quickly and easily if needed, which can be beneficial in an emergency.

- Capital Appreciation: While gold is often viewed as a wealth preservation tool, there's also the potential for capital appreciation, especially during market conditions like high inflation or geopolitical unrest. And with the technical outlook I’ll explain later, this is the perfect moment to make your first purchase—or additional purchases.

- Tangible Asset: Unlike stocks and bonds, gold is a tangible asset that some investors find appealing. Dig a hole in your backyard and throw your gold in it. Just don’t tell anyone you’ve done that.

- Central Bank Buying: Central banks worldwide hold gold as part of their reserves, which can provide security and confidence in gold's value. And they’ve been buying a lot lately. I’ll elaborate below.

- Historical Performance: Gold has a long history of holding value and has been a sought-after asset for millennia.

- Low Volatility: Unlike many other assets - Bitcoin comes to mind - gold often has lower volatility, providing a steadier investment over the long term.

Let’s elaborate on some of these points.

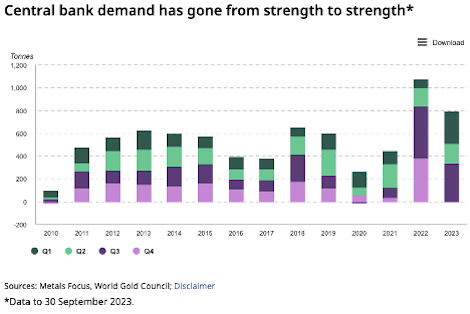

Central Banks Are Buying

According to State Street Global Advisors:

Global central banks posted their largest-ever annual purchase of gold in 2022 — an estimated 1,083 metric tons. And the buying spree has continued, with 387 metric tons of net gold purchased in the first half of 2023.

And that’s continued into Q3, according to the World Gold Council:

Central bank demand for gold saw no let-up in Q3, building on the record-breaking first half of the year. Global official gold reserves rose by 337t, 120% higher q/q, and the second highest third quarter total following Q3 2022. On a y-t-d basis,central banks have bought an astonishing net 800t, 14% higher than the same period last year.

If the CBs are buying, shouldn’t you be?

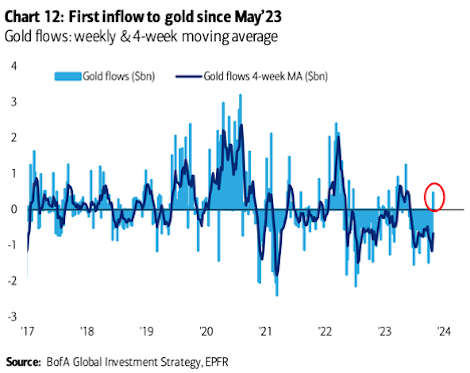

Retail Buying

My friend and colleague Dan Amoss posted this in our editorial channel yesterday. This chart is from Michael Hartnett of Bank of America:

Dan wrote:

I've often noted that when the RIA/financial advisor channel wants in on the bandwagon, they buy GLD and chase momentum. When GLD outpaces gold futures on an intraday trading basis, the authorized participants create "new" GLD shares and buy the underlying gold for delivery to GLD custodian vaults… I expect these flows to be more frequent and long-lasting as stocks are choppier in a higher interest environment.

This month saw the first inflows since May 2023. It could be the start of a new trend.

Now, let’s quickly look at the technical picture

Monthly Gold

We’re so close! We didn’t close above $2,000 for reasons you’ll soon see. But as my good friend and colleague Zach Scheidt says, “There’s no such thing as a triple top.”

He’s right. Think of this as a three-year consolidation pattern. It’ll break up, and when it does, it’ll be glorious.

Daily Gold

After a staggering hit on the monthly close (below), gold has had a rough few days. The 50-day MA will rally above the 200-day MA, following the next upward thrust in price.

The next stop will be $2,150. Then $2,350. And then the inflation-adjusted highs of $3,000. After that, the sky - or government and central bank incompetence - is the limit. And quite frankly, those two things seem unlimited lately.

Five Minute Gold

Dave “Resourceful” Gonigam of Paradigm Pressroom’s Five Bullets fame posted this yesterday, as well.

It shows what happened near the close as gold headed over $2,000—dirty, dirty bastards.

Wrap Up

God loves you. Wanna know how I know that?

He’s giving you yet another opportunity to buy gold if you haven’t already.

Three times, gold has bumped its head on $2,000 and relented, giving you a chance to get in.

Be brave and make the move now. There probably won’t be a fourth chance. You don’t have to spend everything. Just enough to protect you and yours.

Instead of “Good luck,” I’ll say, “Bon courage!”

You don’t need the subtitles for that one.

Have a great day!

Empire At Gunpoint

Posted January 05, 2026

By Sean Ring

It's Been a Metals Year... and a Pick!

Posted January 02, 2026

By Sean Ring

The U.S. Equity Indices and What They Mean

Posted December 30, 2025

By Sean Ring

The Shape of Things to Come

Posted December 29, 2025

By Jim Rickards

A Copper Melt-Up in 2026, and “Tech” Meltdown

Posted December 26, 2025

By Byron King