Posted November 01, 2023

By Sean Ring

October 2023: Monthly Asset Class Report

Happy Hump Day - especially if you’re a gold bug or crypto bro!

This month, things got back on trend.

Equities fell quite a bit, especially the IWM’s small caps and the Nazzie.

But let’s talk about those alternative assets.

Gold and silver were crushed at the end of last month. (No idea who did that… 🤥)

But somehow, gold staged a resurrection worthy of Steve Jobs’ Second Act. We just missed closing above $2,000 on the monthly charts for the first time.

If you ask me, the “vested interests” pummeled gold at the end of the day to ensure the algos wouldn’t mindlessly buy all day today. Think I’m crazy? How about this:

That’s the chart of the Dec Gold future. It was about to rocket, then got crushed going into the afternoon. That guaranteed a close below $2,000 on the monthly charts—dirty bastards.

And crypto? Well, Bitcoin shot the lights out. The Bitcoin Maximalists will be insufferable for another month. That chart is nuts. You’ll see it below.

Without further ado, let’s get into the charts.

S&P 500

Well, we fell straight through the 200-day moving average, though we’ve had a nice rebound the first two days of the week.

I wouldn’t be surprised to see more upside, but the downside risks are far more significant.

The bearish price target now looks like 3750.

Nasdaq Composite

There’s been more downside on tech. We’re not in bear market territory yet, but we’re heading that way.

The next downside target is 12,050.

Russell 2000 (Small caps)

We hit the 162.50 downside target I set last month.

This week, we’ve seen a bit of a respite, as in the majors. If we break down through this level, 149 is our next target. If we break to the upside, we could head back to 197.

My view is to the downside.

The US 10-Year Yield

Okay, the 10-year continues its rise, and I don’t think it’ll go anywhere but up for the time being.

Another 29 basis points to the upside, briefly breaching the 5.0% mark, before backing off.

Unless and until Jay Powell pivots, the ten-year yield will climb this wall of worry.

Dollar Index

We didn’t hit 108, but give it time. We’re up another point this month because the world needs more dollars.

That sounds remarkable, but there’s a dollar shortage in the world markets, and foreign corporations are paying over the odds to get them.

A Powell Pivot changes the story, but not yet.

USG Bonds

We didn’t hit 80 yet, but we fell off a cliff again.

If the US Treasury has to issue trillions of dollars worth, they will be worth less, correct?

We may catch our breath here, but I won’t call it a bottom.

Investment Grade Bonds

From last month:

After being rangebound between 103 and 108 for the entire year, we finally got our break to the downside.

Next stop: 96.

High Yield Bonds

We didn’t hit 71.5, but we got close.

As junk bonds act like equity, we saw a rebound in the last two weeks.

I think the bears will win this one. Next target: 67, then onto 62.

Real Estate

Indeed, we reached 72 this month, as I said we would.

The next level is 64.

Energy: West Texas Intermediate (Oil)

“To war! Oil’s down 10%!”

Those two headlines don’t make sense to me, and yet, that’s what happened.

If war and the economy meet, and war takes a beating this bad, the economy must be awful. Of course, government stats won’t tell you that, and neither will Paul Krugman.

But I have a hard time believing oil will stay down for long.

But my charts say 73 is the downside target. Ouch!

Base Metals: Copper

We’re back down to 3.65.

The price looks depressed, so I’ll keep my 3.60 call. Past there, 3.35.

Precious Metals: Gold

I hope you held onto your gold. Of course you did!

After last month’s monkey hammering, we immediately recovered.

It’s a shame we didn’t close above 2,000, though, as the algos would have gone apeshit.

Apologies for the simian metaphors.

Precious Metals: Silver

Waiting for silver to pop is like Waiting for Godot.

I have no further comment.

Cryptos: Bitcoin

BOOM! There’s your pop!

Bitcoin was up about 25% in October. Not bad, not bad at all.

Next stop: 35,650.

Cryptos: Ether

The “silver” of crypto. Yawn, for now.

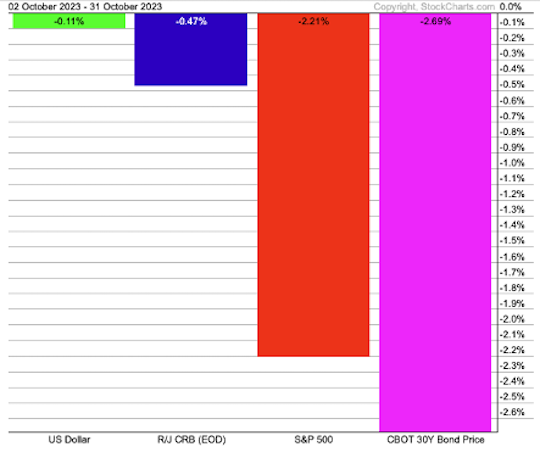

Trad Asset Class Summary

It was a crappy month all around.

The USD was the least lousy performer, slightly down 0.11%.

Commodities as a whole didn’t do much, down 0.47%.

The SPX had another down month at -2.21%.

And once again, bonds won the “horse’s ass” trophy, registering a -2.69% return.

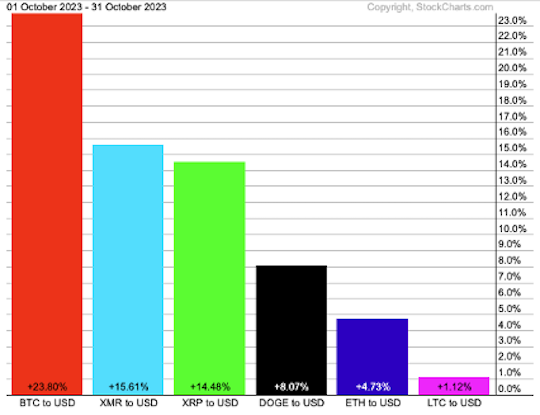

Crypto Class Summary

Thanks to the war, misguided monetary policy, prolifigate fiscal policy, and generally good things happening in the crypto ecosystem, cryptocurrencies had a great month.

Bitcoin was up nearly 25%, while Monero was up 15.61%. Ripple was up 14.48%, while Dogecoin was up a touch over 8%. Surprisingly, Ether only registered a 4.73% gain, while Litecoin was up a measly 1.12%.

Wrap Up

Gold is rising while the equity markets tumble. Bonds stink to high heaven.

But crypto… crypto is rising like a phoenix from the fire.

Finally, let’s take a moment, courtesy of the Twitterverse:

Credit: @GigBasedTrad

Have a wonderful rest of your week!

It's Been a Metals Year... and a Pick!

Posted January 02, 2026

By Sean Ring

The U.S. Equity Indices and What They Mean

Posted December 30, 2025

By Sean Ring

The Shape of Things to Come

Posted December 29, 2025

By Jim Rickards

A Copper Melt-Up in 2026, and “Tech” Meltdown

Posted December 26, 2025

By Byron King

Bonding Over Christmas

Posted December 25, 2025

By Sean Ring