Posted February 09, 2026

By Sean Ring

Take The Money and Rotate

The toughest part of playing chicken with the market is knowing when to flinch.

I took a big bite of the apple with my overconcentrated miners portfolio and decided that I wanted to sleep this past weekend. So I sold the positions I was stopped out of, and took the rest off the table after reviewing their charts.

But before I get into today’s edition, I’ll do some housekeeping first.

The Mailbag Answered

Tory H., Mike H., and Christopher V., I’ve passed on your kind words to Nick Riso for his most excellent article on the silver gamma squeeze.

Basil O. and David K., yes, Wall Street loves a rug pull and my hair falling out (if I had any left!).

Rick H., I’ve passed on your kind words to Byron King for his great article on Trump’s Victory at Sea.

Bruce R., keep on stacking and relaxing!

Lou P., I respectfully disagree with Michael Saylor. Bitcoin’s chart tells a different story.

Ron V., if The Donald loses the midterm elections, you may very well be right!

Damon C., Dave D., John T., and John L., thank you all for writing in, as well.

I’ll print this one question, as it pertains to the rest of this Rude:

Sean,

Could you say a little something about your thoughts on silver stocks? We have reached the prices you suggested on some, and I was wondering if we should continue to hold or think about taking profits.

Thanks,

Bob H.

What About Silver Stocks?

Bob, I kept hearing in my head what my friend and colleague Enrique Abeyta said at our Nashville conference last year. I’ll paraphrase: “We want you to make money, and we want you to keep most of it.” That is, you’re never going to sell at the exact top, but we don’t want you to watch all the way down as your gains fall to zero. So take some gains. It’s sound advice.

That may be disappointing to some gold and silverbugs, but that’s them. I made an enormous amount of money this past year, and I hope you have, too.

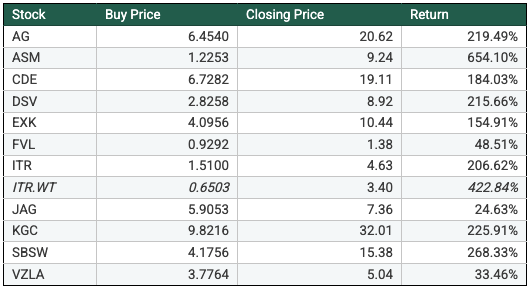

The final tally for my unofficial Rude portfolio is as follows:

As my broker didn’t send me my selling prices, I used Friday’s low price to get the most conservative estimate of my returns. (Except for VZLA, which I had sold on Wednesday.) Also, note I owned ITR.WT instead of the stock ITR, but include both for completeness.

The good news is that if you haven’t sold and want to, these stocks look like they will open much higher than Friday’s low price. And if you’re still happy to hold, great.

For me, though, that’s not a bad haul.

However, let me make one thing clear: gold, silver, platinum, palladium, copper, aluminum, lithium, and the rest of the metals have far more upside. And all these companies I owned, and most that I had sold previously, are excellent companies.

It will likely take them a bit of time to recover from the monkeyhammering they got over the past two weeks. In fact, we may have more downside in our immediate future.

If I’m wrong, I can always get back in.

The Chart

Yes, silver is trading above its 50-day moving average. Yes, silver’s macro story is still valid. Yes, we can’t get it out of the ground fast enough for Samsung.

But that chart is ugly. And it activated a new downside target of… gulp… $36.

Now, will silver trade that far down? No.

But silver may trade down to the $55/$45 area and retest that all-important level before taking off again. And if you notice the RSI under the candlestick chart, we’re still not oversold at these levels. Food for thought.

One of the reasons I was happy to sell my mining stocks is that every one of them has an activated downside target, most between 33% and 45% down. Yikes!

Gold’s chart looks far healthier.

Paradigm’s Picks

Good friend and Daily Reckoning editor Adam Sharp has been spot on about Brazil. He called it ages ago, and look at these lovely charts:

For both of these stocks, let's wait until they reestablish their recent highs before getting in.

And if you’re uncomfortable with single stocks in Brazil, here’s its ETF:

Again, wait until it retakes its recent high.

The hardest-working man in the newsletter business, my friend and ace analyst Dan Amoss, has liked oil services for some time now, as well.

Both Exxon and Chevron are great companies that have outrun oil’s recent rally. And I love AROC, my pick in Nashville, though it’s a bit overcooked right now.

Paradigm’s favorite rock kickers, Byron King and Matt Badiali, are big copper bulls.

Again, I’d wait until these retake their recent highs, just to be sure.

Matt also likes aluminum, as he wrote back in December.

Alcoa looks like it's in the process of making a bull flag.

As you can see, there are plenty of hot sectors to invest in besides silver.

Wrap Up

After a historic run (and crash) in silver, it was time for me to take the gains. I may get back in soon. But there are plenty of good alternatives out there.

I’ve listed a few from my friends and colleagues. Do some due diligence and see if they suit your portfolio.

We’ll keep the trade ideas coming.

Vicious Patriotism

Posted March 05, 2026

By Sean Ring

Don’t Overprice Risk with Mining Companies

Posted March 04, 2026

By Matt Badiali

America First!

Posted March 03, 2026

By Sean Ring

WAR! What’s It Good For?

Posted March 02, 2026

By Sean Ring

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring