Posted April 08, 2024

By Sean Ring

Time To Swing For The Fences

I remember watching my favorite Yankee, Don Mattingly, get interviewed. The interviewer asked him about one of his ballplayers; by then, Donnie Baseball was a manager. The interviewer wondered if Mattingly thought this particular player should be hitting more home runs.

After a roundabout answer defending his player, Mattingly said, “Don’t get me wrong. Some balls should be hit out of the park.”

His answer struck me, as I was always taught that making good contact was the most important thing. Then again, I didn’t play baseball past 10th grade.

I thought about Mattingly again this morning, as there are balls we ought to put out of the park with respect to gold, silver, and copper.

To rephrase Mattingly’s quote in finance-speak, let’s turn to George Soros, who famously said, “It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

And this is one of those times to be correct and make a lot of money.

Undervalued Stocks

In her book, The Little Book of Big Profits From Small Stocks, Hilary Kramer explains that “breakout stocks” share three characteristics:

- Low-priced (mainly under $10).

- Undervalued.

- Have specific catalysts in the near future that put them on the threshold of breaking out to much higher prices.

Look at mining stocks compared to the gold price:

Right now, the gold and silver miners ($XAU) are near historical lows versus the price of gold ($GOLD).

As gold broke out and closed Friday at an all-time high of $2,345.40 per ounce, it makes sense that the miners should follow suit.

Silver closed at $27.50 on Friday. Once we break above $30, it’s off to the races. To remind you, silver breakouts follow gold breakouts. (Fear first, then greed, as our friend Rick Rule says). So, there’s nothing unusual going on right now.

Finally, copper looks like it’s breaking out as well. It closed at $4.24 on Friday. Once it gets above $4.40, it’ll challenge its all-time high of $4.90.

This opportunity in miners comes around every 10-12 years or so. I’d love it if you grab it with both hands.

But It’s Not a Time For Index Stocks

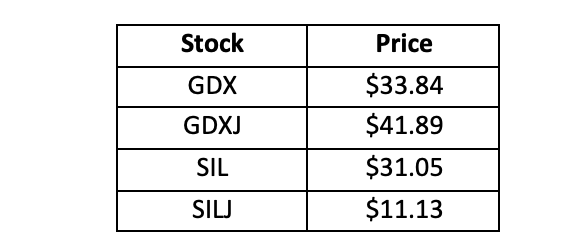

Sure, you go out and buy GDX (gold miners), GDXJ (junior gold miners), SIL (silver miners), or SILJ (junior silver miners). But that won’t be the move that will maximize you’re being right.

These indexes are averages by default, similar to any sector index out there.

That means if, for some reason, a mining stock underperforms, the average price will fall, and, hence, your return.

Here’s where they’re trading as of Friday’s close:

The only one I’d consider is SILJ because it’s near that $10 level Kramer mentioned.

Remember, it’s much easier for a stock to go from $10 to $15 than from $40 to $60, which is the same percentage return (50%).

You can spend much less capital on the cheaper stock if you wish to. Alternatively, you can spend the same amount of capital but buy more shares of the cheaper stock.

And sometimes, those cheap stocks become very expensive stocks.

Let’s look at some alternatives to the “usual suspects.”

Breakout Alternatives to The Usual Suspects

Disclaimer: I’m about to mention stocks I already own.

Gold

Opportunity: Instead of buying GDX, buy KGC.

In the Strategic Intelligence March Portfolio Update, Dan Amoss wrote:

In the Nov. 25, 2020 issue, we recommended Kinross Gold (NYSE: KGC). It owns a portfolio of reliably producing gold mines and projects in the U.S., Canada, Brazil, Mauritania, Chile, and Ghana.

On November 8, Kinross reported excellent results. It’s on track to meet 2023 annual guidance for production, cost of sales per ounce, all-in sustaining cost, and capital expenditures.

Production of 585,449 gold equivalent ounces was up 11% from last year. All-in sustaining costs were $1,296 per gold-equivalent ounce.

Kinross should keep its position as one of the best-performing large gold mining companies.

Silver

Opportunity: Instead of buying SIL, buy AG or SILV.

Dan Amoss wrote of AG:

On Dec. 18, 2020, we recommended a well-known, but underappreciated silver mining company: First Majestic Silver (NYSE: AG).

It owns three primary silver mines in Mexico and the Jerritt Canyon Gold Mine in Nevada.

On January 16, First Majestic announced Q4 production of 6.6 million silver-equivalent ounces. The breakdown was 2.6 million silver ounces and 46,585 gold ounces. It was a 6% sequential increase from Q3.

Management guided 2024 production from its three operating mines in Mexico of between 21.1 to 23.5 million silver-equivalent ounces (8.6 to 9.6 million ounces of silver and 150,000 to 167,000 ounces of gold). The decrease in forecasted gold production is primarily due to the temporary suspension of the Jerritt Canyon Gold Mine in Nevada announced in Q1 2023.

I like Silvercrest because it’s a cheap stock poised for a big breakout. Once we get above $7.50, we’re targeting $10.50 first. If we get above $13, the sky’s the limit. This is a great risk/reward trade.

Copper

Opportunity: Instead of buying FCX, buy HBM.

This came up on my stock scanner last week, and I bought it almost immediately.

But first, I had to ask Byron King, our Senior Geologist. He said, “Sturdy old company. They keep a low profile but do good work. Very efficiently run.”

That was all I needed to hear.

The first target is $10, with $13.75 the next.

Wrap Up

These “opportunities” are all under $10, undervalued, and have a significant catalyst waiting to thrust them to the moon.

While I hope they rocket, even their short—and medium-term targets will give you a boatload of moolah.

Some opportunities come and go all the time. But miners usually only rocket once a decade or so.

Take your best shot.

The Pentagon Pays the Piper

Posted March 06, 2026

By Byron King

Vicious Patriotism

Posted March 05, 2026

By Sean Ring

Don’t Overprice Risk with Mining Companies

Posted March 04, 2026

By Matt Badiali

America First!

Posted March 03, 2026

By Sean Ring

WAR! What’s It Good For?

Posted March 02, 2026

By Sean Ring