Posted September 23, 2025

By Sean Ring

Silver Rockets, Miners Soar

My word, how good was yesterday?

It was one of those investing days I didn’t want to take my eyes off my phone, much to the chagrin of my family, who were constantly trying to get my attention. Wide-eyed and euphoric, I drank in as much of the trading session as I could’ve.

It was a sea of green across my screen for gold, silver, and the miners. Yesterday morning, I wrote about how we were going to take off. But not in my wildest dreams did I think we’d have a market like we did.

From yesterday’s Rude:

…we are now at the beginning of an event that may define our investing lifetimes. This is the moment gold bugs, silver bugs, and economists of the Austrian School variety have waited a lifetime for.

I thought that might be hyperbole. Now I think it’s inevitable.

Let’s review what happened.

Yesterday’s News

Spot gold finished at $3,746.60, up 1.68%. It may not look like much, but it’s another all-time high (ATH). More importantly, it was a big up candle after nearly two weeks of consolidation. We’ll be approaching $4,000 before you know it. As I write this morning, gold is up another $4 to $3,750.

Silver had a day for the ages. After Friday’s breakout, yesterday’s session took us all the way to $44.04, a gain of 2.24% on the day. As I write, silver is trading at $43.72. It’s off the pace a bit, but we’ve got to expect it to catch its breath after these last two sessions.

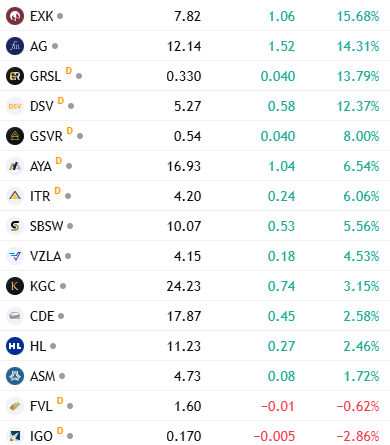

As for the portfolio, it was a near-universal up day for our stocks. As you are aware, I’ve instructed my broker to sell AYA and use the proceeds to buy GRSL, GSVR, and IGO. But I don’t have my fills yet, so I included all of them for now.

Though Freegold (FVL) was down a cent, its chart looks very healthy. Independence Gold (IGO) is a much riskier investment.

Endeavour Silver (EXK), First Majestic Silver (AG), and Discovery Silver (DSV) all posted well above 10% returns on the day. Each of them has earned between 86% and 90% since I’ve owned them.

They all have much more room to run, so if you’re interested in them, I’d just wait for the inevitable down day and then load up.

Where To From Here?

Things may calm down for a day or two, but the metals rocket has taken off. According to my charts, gold’s new target is $4,586, representing a 21.8% increase from its current level. Silver’s target is $53, representing an increase of over 20% from its current price.

Of course, they’re just targets. That means we may not even hit them. Or, we’ll hit them. Even better, we may hit and then far exceed them. We simply don’t know how far this train will run.

The trick here is not to try to pick out the top. Remember the adage, with an addendum from legendary trader Ed Seykota:

The trend is your friend ‘til the end when it bends.

We should wait until there are genuine signs of a trend change. Then, we can be sure we don’t get off the train a few stops too early. Yes, it’s better to get off a bit late. Getting emotional causes investors to make moves too soon. Breathe. Enjoy the profits. In this case, thinking and keeping your composure is far better than feeling.

Finally, let’s revisit the capital rotation thesis.

Why Metals and Not Tech?

I’ve discussed at length the idea of capital rotation. It’s simply a time when investors exit tech stocks and similar investments to invest in gold, silver, and mining stocks.

Back in the bear market of 2000–2002 on the Nasdaq, when most sectors bled red, the miners shone like a torch in the darkness. Gold stocks were the standout performers, ripping higher as investors sought safety.

The gold miners’ indexes clocked monster gains—double- and even triple-digit moves—while titans like Newmont and Barrick more than doubled their share prices. The metal itself crept up from the $260s to north of $300, and that modest rise was enough to light a fire under the equities.

Silver didn’t go as wild—up a mere 5% in 2002—but its miners still surfed the precious-metals tailwind, handily outpacing most other stocks. In short, gold and silver miners didn’t just outperform during that bear market—they delivered rare and exceptional returns when everything else was burning down.

If we were to experience another bear market in tech similar to that one, we should be prepared by learning from history.

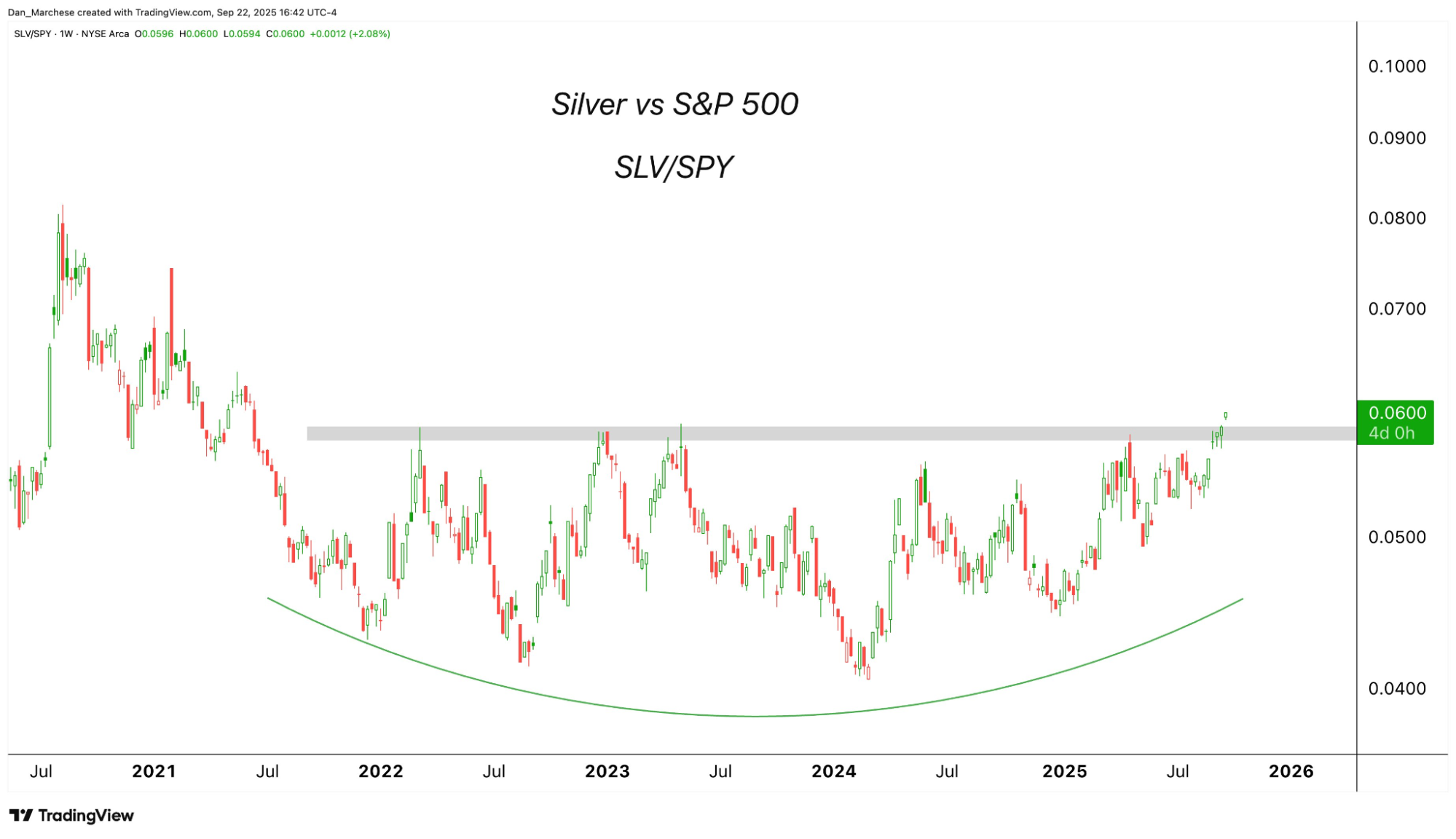

My friend and colleague Enrique Abeyta posted this chart on the Paradigm Press app this morning. It shows the Silver (SLV) ETF versus the S&P 500 ETF (SPY). After nearly four years, SLV has finally broken above a major resistance level at 0.06. This augurs well for a move up to 0.08 or higher.

The charts are telling us something, that’s for sure. However, this next story confirms something fishy is going on in tech.

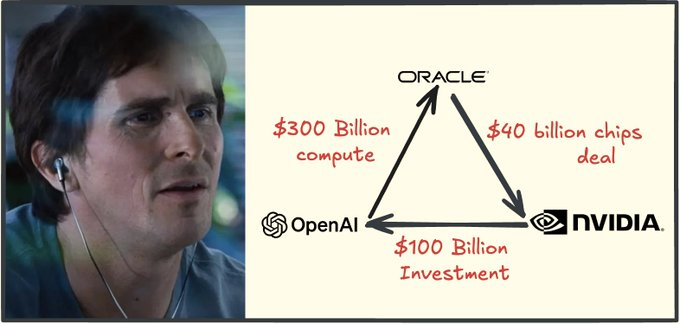

Let’s start with a meme:

Ok, here’s the story. NVDA has committed $100 billion to OpenAI for data centers. OpenAI committed $300 billion (which it doesn’t have) to Oracle, whose stock jumped 36% on the news, making Larry Ellison the richest man in the world again. Since Oracle runs on Nvidia microchips, it’ll buy an estimated $40 billion’s worth of chips from Jensen Huang’s firm.

Bankers would refer to this as “symmetry.” Investors might call this a “scheme.” Regulators will almost certainly ignore it.

But savvy investors should start looking at situations like these (Saylor’s MSTR comes to mind) as a sign of the end of the tech bull market. In this case, you’d rather exit a few months early than be one day late.

Wrap Up

Metals and mining are the game now. Keep your wits about you and you’ll be rewarded. We’ve been on this ride for almost a year now. And it seems like it’s just getting started.

A Minor Miner Correction

Posted October 03, 2025

By Sean Ring

$50 Silver: Ceiling or Floor?

Posted October 02, 2025

By Sean Ring

Equities and Metals Soar in a September to Remember

Posted October 01, 2025

By Sean Ring

Keep These Things In Mind When Riding the Wave

Posted September 30, 2025

By Sean Ring

Pennies and Steamrollers

Posted September 29, 2025

By Sean Ring