Posted September 19, 2024

By Sean Ring

PANIC!

I almost titled this piece “Mea Culpa II” because it’s the second time I’ve had to eat crow this year.

The first time was in June when I thought Jay Powell would act early and decisively by cutting 25 bps during the June FOMC powwow.

I was crushed when he didn’t, as I thought, and still think, it would have been the right move.

But this time, old Jay Pow caught me out by cutting the Federal Funds rate by 50 basis points, or 0.5%. When I found out, you could’ve knocked me over with a feather. I had a face like a beaten favorite.

Only two hours earlier, I told my star student in Frankfurt that Powell wouldn’t cut 50 bps the first time into a cutting cycle.

I told him the CME FedWatch Tool had no predictive value and changed its tune every few minutes.

Boy, was I wrong this time!

I was having dinner with my friends S and J when the news came over the wire. FOMC cuts 50 basis points! “Fifty? WTF? I don’t believe it…” was my reaction. My bewilderment was palpable.

Jay Powell didn’t start the hiking cycle in 2021 like he should have; he started it a year late in 2022.

Then, he hiked too big all throughout 2022.

Now, he’s cutting bigly the first time around in 2024? He should’ve started cutting much sooner, so I guess he’s making up for lost time.

I think Jay Powell is panicking. He watched the economy deteriorate to the point he thought he needed to get out the hacksaw.

Rickards’ Call

I often agree with our macro expert, Jim Rickards, and this time, I thought his logic was flawless.

From yesterday’s Paradigm Pressroom’s Five Bullets (bolds mine):

“We’re sticking with our 0.25% forecast for three reasons,” says Paradigm’s macro expert Jim Rickards.

“The first is that this is the no-drama Fed. They’re definitely cutting rates, but they don’t want to appear panicky or to suggest the economy is worse off than they admit. Far from providing ‘stimulus,’ a 0.50% rate cut may signal recession fears and lead to a stock sell-off.

“The second reason is the election itself,” Jim adds. “Delivering a rate cut just six weeks before the presidential election would appear to favor Harris and work to Trump’s disadvantage.

“Still, the economy is showing signs of slowing,” he says. “A 0.25% cut will give Harris and the economy a boost (so they believe) without being too blatant.

“The third reason is that more rate cuts are on the way. Third-quarter GDP growth looks healthy, at least according to the Atlanta Fed GDPNow tracker, which estimates 3% growth.

“The Fed has two more scheduled meetings this year in November and December and will likely cut rates at both meetings,” says Jim. “A 0.50% rate cut can always be rolled out at some future meeting if needed.

“In effect, the Fed is saying, ‘What’s the hurry?’

“A 0.25% rate cut will have the desired effect, at least in the Fed’s eyes, without appearing too political or too panicked,” Jim concludes.

Honestly, I couldn’t have agreed more. But, of course, it didn’t turn out that way.

So, what are the three things I’m concentrating on?

Inflation and Growth

The Fed's decision shows that it believes inflationary pressures are subsiding enough to justify more accommodative monetary policy. I think this is delusional. We’re nowhere near the 2% target, not that we should have one at all.

A 25 basis point cut is designed to support economic expansion, especially as unemployment has ticked up slightly and wage growth moderates. But a 50 bp cut? That’s plain panic.

I now doubt the economy will achieve a "soft landing" (a gentle slowdown without a recession). By this move, Powell himself has signaled a more severe downturn is the likelier case.

Labor Market

The labor market, although still strong, has shown signs of softening. The Fed’s focus on reducing rates could help prevent further deterioration, ensuring the job market remains stable. But this cut looks like it was made in response to growing economic vulnerabilities.

Market Reactions

While markets initially reacted positively to the cut, concerns about economic weakness caused stocks to close slightly down for the day. Investors are now grappling with mixed signals—on the one hand, the rate cut provides relief from higher borrowing costs, but on the other, it might reflect underlying economic concerns.

Initially, this larger-than-expected cut looked like it would pave the way for further rate reductions later this year. But I’m not sure the Fed is as enthusiastic about that as the market is.

So What’s Next?

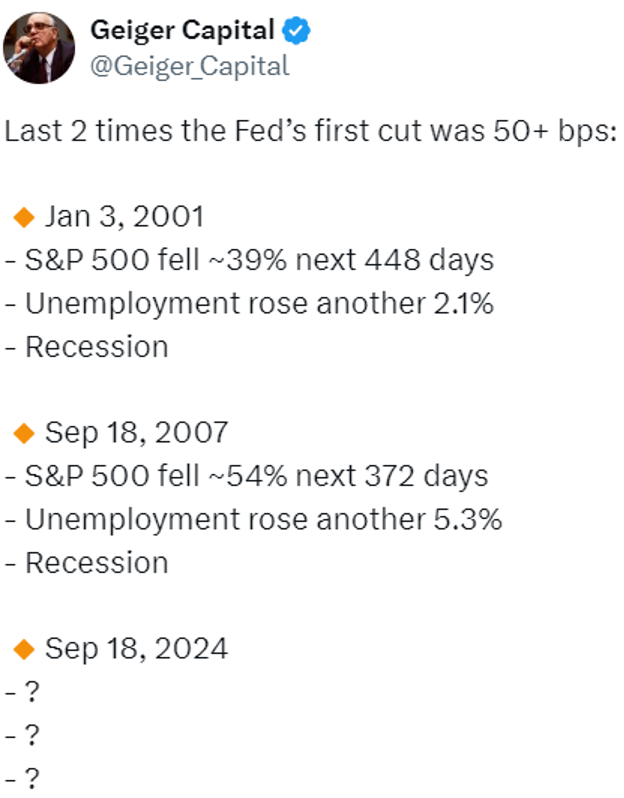

Here’s quite an ominous tweet from Geiger Capital.

Credit: @Geiger_Capital

Shall we see a spike in unemployment presently?

Wrap Up

This move is starting to look like a stealth sell signal. The charts are still fine, but I think this could be the beginning of a correction, at least, or a prolonged sell-off into bear market territory.

Something is wrong with America’s financial plumbing, and I have a funny feeling Powell knows it and that’s why he convinced most, but not all, of the Fed governors to back his move. Only Michelle Bowman dissented, and that’s a first for a Fed governor since 2005.

I’ll be writing more about this in the Morning Reckoning, which will be in your inbox in a few hours.

Buckle your seatbelts.

The Ghost of Louis XVI Warns Trump

Posted September 16, 2025

By Sean Ring

Something like 1980 is about to happen…

Posted September 15, 2025

By Sean Ring

The Curious Incident of the Dog in the Night-Time

Posted September 12, 2025

By Sean Ring

America’s Rubicon: Two Murders That Changed Everything

Posted September 11, 2025

By Sean Ring

Just a Tad… The BLS’s 911k Emergency

Posted September 10, 2025

By Sean Ring