Posted June 13, 2024

By Sean Ring

I Was Wrong: The Fed Holds

Every night, I dream that a crowd will carry me on their shoulders and think of me as a genius.

And then my alarm clock goes off.

Last night, at 8 pm my time (2 pm Eastern Time), Chairman Powell and his FOMC made a significant decision. They chose to maintain the current interest rates, leaving them unchanged.

As you may recall, I had previously predicted a 0.25% interest rate cut from the Fed this month. My reasoning was that with the election five months away, Powell could use this as a politically deniable move.

Alas, he didn’t do that. The Federal Funds Rate range remains between 5.25% and 5.50%.

Why didn’t he bring the inevitable forward?

Let’s get into it.

Yesterday’s CPI

After drinking my coffee and writing yesterday’s Rude, I settled in for lunch. Then, I watched for the highly anticipated CPI number.

Everything came in soft:

|

Indicator |

Time Period |

Actual |

Expected |

Previous |

|

CPI |

May |

0.0% |

0.1% |

0.3% |

|

CPI |

Year Over Year |

3.3% |

3.4% |

3.4% |

|

Core CPI |

May |

0.2% |

0.3% |

0.3% |

|

Core CPI |

Year Over Year |

3.4% |

3.5% |

3.6% |

Even the core CPI came in below what was anticipated. This was a positive outcome for me.

This set the stage for that cheeky cut of 25 basis points, or 0.25%.

My Wrap Up from last month’s CPI column read (bolds mine):

Tomorrow is a big day for domestic asset and mortgage markets and central banks at home and abroad. I suspect inflation will be hot, but that’s not a prediction. No one knows what the BLS statisticians will concoct this month.

But if I’m correct, the Fed will probably hold in June and cut in July, depending on future inflation data. If I’m wrong and inflation is tame, the Fed will surely waste no time to cut.

Remember, Jay Powell doesn’t want to work for The Donald again, but he can’t make it look political. The further he cuts from the election, the better for him.

If I were Powell, I’d pray for a tame number. Or I’d pick up the phone to the BLS and put a thumb on the scale.

I thought The Powers That Be cooked the books.

Well, it looks like Jim Rickards was right about one crucial thing (among many): the Fed wouldn’t do anything until it saw three months of inflation coming in below expectations. This is only the second month that’s happened.

But there’s another problem.

Powell Doesn’t Believe Biden

Wow. Just wow. Edward Snowden made a fine point about Zero Hedge’s tweet from Powell.

Credit: @Snowden

Credit: @Snowden

And here I thought Powell was onside with Biden. However, Powell thinks Biden is cooking the employment books (and Biden or his peeps undoubtedly are), so Powell no longer believes that data.

I mean, we know the employment numbers are horsefeathers.

And Joe Biden knows the employment numbers are horsefeathers.

We know that Joe Biden knows that…

Oh, never mind!

The point is that it’s incredible that Powell doesn’t want to base monetary policy on his president’s employment numbers.

Meeting Highlights

Inflation remains above the Fed's target, with recent data showing almost zero progress toward achieving the desired 2% inflation rate. Core PCE inflation is expected to be slightly higher at 2.7% for 2024. Despite some positive signs, such as solid job gains - which Powell is skeptical of - and resilient economic activity, the overall economic outlook remains uncertain.

The FOMC's latest Summary of Economic Projections (SEP) adjusted the expected GDP growth for 2024 to 2.1%, up from a previous forecast of 1.4%. The unemployment rate is projected to rise slightly to 4.1% by the end of the year.

While the current stance is to maintain the rate, the FOMC's projections include the possibility of one rate cut by the end of 2024. However, this cut is contingent on continued positive inflation data and economic stability. According to Bloomberg, Fed officials see four rate cuts in 2025.

The Fed announced a slowdown in its Quantitative Tightening (QT) program, reducing the monthly cap on U.S. Treasury securities redemptions from $60 billion to $25 billion while maintaining the current caps for agency debt and mortgage-backed securities. In essence, the Fed is slowing down the shrinking of its balance sheet. This is “loosening the tightening” and, hence, inflationary.

Hawkish Message

My friend and colleague Dan Amoss posted this from Bloomberg:

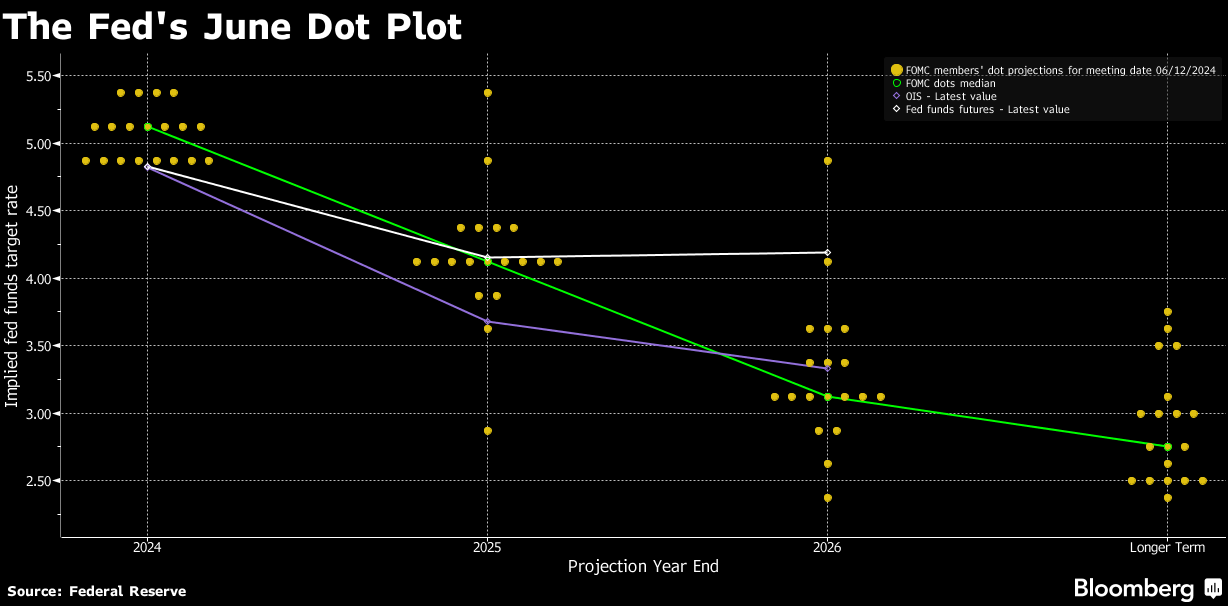

The yellow dots (The Dot Plot) show where members of the FOMC see rates at a given time.

Dan wrote in our Slack channel, “The green line (median dot) over the purple line (OIS, the futures market pricing of fed funds rate) is the hawkish message from the FOMC to the market.”

Like Dan, I’m looking forward to when the central bank will be a minor player in the free market.

Wrap Up

I’m sorry I wasn’t right on the timing of the cut, but the cut is coming.

I wouldn’t be surprised if they cut in July, but now it looks more like an autumn cut than a summer cut. If the cut is inevitable, Powell should get on with it. But that’s not his way.

Powell's cautious approach to monetary policy, prioritizing stable inflation and employment, is a significant factor in the current economic landscape. This careful balance is crucial for the stability of Wall Street and the overall economy.

They say he who hesitates is lost. Let’s hope Powell doesn’t get lost in the weeds of his data.

The Crowd’s Madness Saves Uncle Herschel

Posted August 27, 2025

By Sean Ring

The Fed's Cook is Goosed

Posted August 26, 2025

By Sean Ring

The Ascent of Ag in 5 Tweets

Posted August 25, 2025

By Sean Ring

Rickards on Sovereign Wealth Funds

Posted August 22, 2025

By Jim Rickards

Trump’s Tariff Timebomb

Posted August 21, 2025

By Sean Ring