Posted August 01, 2024

By Sean Ring

I Love You 3,000!

July 2024 Monthly Asset Class Report

If you watched Avengers: Endgame in 2019, you’d remember Tony Stark’s daughter saying to her daddy, “I love you 3,000!”

This line was ad-libbed in the movie as a tribute to Robert Downey Jr.’s real-life children, who say that to him while they get tucked in at night.

Luckily for us, we’ll get to say that to gold in less time than we think.

Jay Powell didn’t cut rates yesterday, but the message was bullish: the Fed will cut rates… soon—maybe not in September or November, but soon.

And that was enough for a vast swath of the market, including gold. Silver, alas, is sluggishly trying to catch up. But that’s fine.

Copper, however, has ended its sharp rally for the time being.

The other bright spots are equities and debt. I get the equities bit. I’m still a massive stock market bull. But bonds? Why, with all this inflation hanging around, are they rallying?

Once you see the charts, you’ll know what I’m talking about. Let’s not waste time, then…

To the charts!

S&P 500

***New Closing High of 5,522.30.***

Ok, we had our pullback. But there’s nothing to indicate a large correction is imminent.

Though Jay Powell and his FOMC didn’t cut rates yesterday, they’ve signaled they’re more willing to do so in the future.

One rate cut this year will suffice, barring an unexpected enormous drop in the stock market. We still target 6,000.

Nasdaq Composite

The Nazzie had a much rougher month, thanks to the whipping of the Mag 7.

NVDA, AMZN, and MSFT all got hammered in July. NVDA has been down nearly 25% since its crowning as the world’s biggest company in terms of market capitalization. It was a short reign.

Still, I think we’ve got a way to go on the upside. Nothing in the chart above screams, “SELL!”

Russell 2000 (Small caps)

I’ll have what Russell’s having!

We’ve had a few huge upthrusts this month that smacks of a new bull market.

It took this year to break out of that 190-210 range, and it’s finally done. Is it a false breakout? Maybe, but I doubt it.

For now, this confirms the thesis that equities are one of the places to be.

The US 10-Year Yield

I was right about the direction but wrong about the reason.

Powell didn’t cut yesterday, as I thought he would when I wrote June’s MACR. However, the 10-year yield is down over 40 basis points (0.4%).

As the 10-year yield is the discount rate (with adjustments) by which we value most long-term assets like stocks, bonds, and real estate, asset prices should continue to rise.

3.80%, here we come!

Dollar Index

The dollar index was slightly down this month.

How? The euro and sterling had a solid start to the month but faded.

The yen, however, rallied hard because the Bank of Japan raised rates for the second time this year. Japanese rates are the highest they’ve been since 2008.

I’m not sure where we go from here, to be honest.

USG Bonds

Again, right on the direction. Despite what common sense may tell you, you’ve got to watch the charts.

Investment Grade Bonds

From last month:

If we clear 109, we can retest the 132 level. Scary, but possible.

That still stands. Up, up, and away.

High Yield Bonds

Again, from last month:

Junk continues its ascent. I’m looking at 79 as the next upside target.

That still stands, too, but our new upside target is 85.

Real Estate

Well, there’s our pop after a dull prior month.

If you didn’t bet on the downside, I’d now target 113 to the upside.

Energy: West Texas Intermediate (Oil)

Oil had the rough month I was expecting last month.

Still, if the dollar weakens, we’ll probably see a rally here.

The targets are 84, 88, 92, and finally 106.

Base Metals: Copper

Copper had one good week this month, then got beaten like a rented mule.

The big downside price target is $2.25. The world economy can’t be that healthy.

Precious Metals: Gold

***HIGHEST MONTHLY CLOSE OF 2,473***

Finally, we broke out of the 2,300-2,450 range that’s lasted for a long while.

$2,609 is still the next target. But beyond that, we’re now looking at $2,759.

With the Fed set to cut rates before inflation has been slain, I think we’re still nearer the beginning of a bull market than at an end.

Precious Metals: Silver

Silver recovered somewhat from its selloff in the last two weeks.

We need to get above $33 to get excited.

Cryptos: Bitcoin

Bitcoin gained another $3,000 this month.

I’m still massively bullish and reiterate my $100,000 target for January 2026.

Cryptos: Ether

Ether has had a rough time of late, but I still think $6,000 is a good target over the next 18 months, mirroring Bitcoin’s ascent.

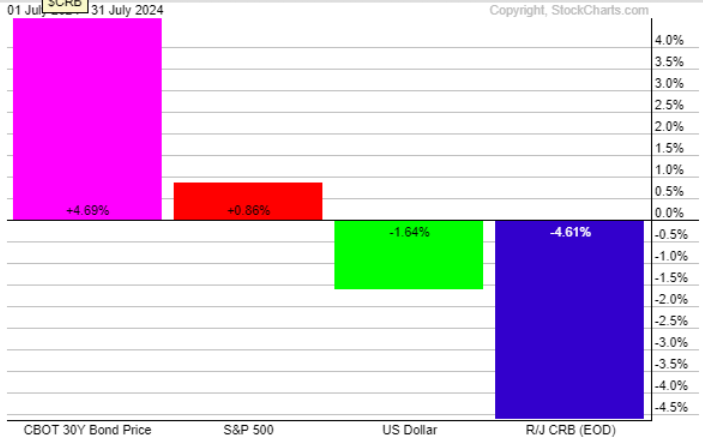

Trad Asset Class Summary

I think this month is one of the most anomalous I’ve seen.

In these inflationary times, bonds won the month, gaining 4.69%.

The SPX finished slightly positive, up 0.86%.

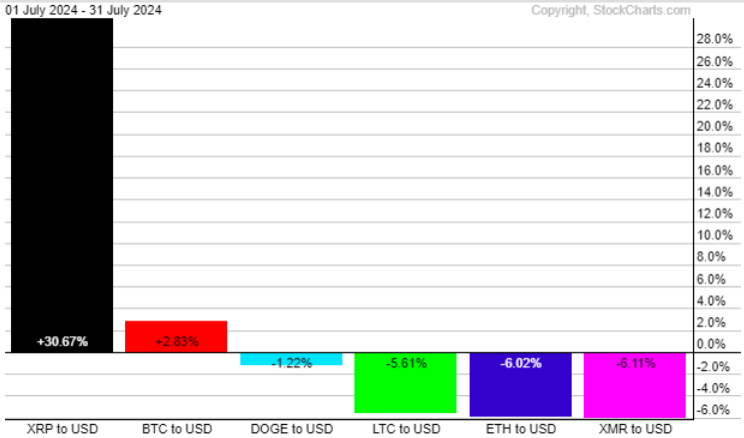

Crypto Class Summary

We had another lackluster month from Bitcoin and Ether, but Ripple ripped north of 30%.

I think crypto will rally hard, thanks to the expected Fed cut in either September or November, though I’d be surprised if Jay Powell were willing to get into the political much before the election. (The November FOMC meeting is after Election Day.)

Wrap Up

Gold will continue upward after its breakout.

Bonds look great, as do stocks. And I stand by my $100,000 BTC prediction as well.

Get out there and stack some paper!

Finally, let’s take a moment, courtesy of the Twitterverse:

Have a wonderful day!

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali