Posted July 31, 2024

By Sean Ring

The Long and Short of It

One of the reasons I’m happy to be back in Italy is that I’ve regained my six-hour headstart to the day.

You see, while you’re counting sheep, I’m reading the morning edition. It gives me time to reflect and decide on what’s important and what’s not.

Another reason is that overnight action in the U.S. is early morning action for me. So, I can see what Asia was doing before their markets closed and how U.S. stocks traded internationally.

Two overnight stories have implications for American investors. The first is the short-term one: Microsoft’s earnings beat, but subsequent sell-off. The second, more long-term story is the Bank of Japan hiking rates for only the second time this year.

Let me explain.

MSFT’s “Miss”

I don’t usually write about single stocks, as this is more of a macro-oriented newsletter. However, since MSFT is the second largest company in the world in terms of market capitalization and a part of the famed “Mag 7” stocks that make up nearly one-third of the S&P 500, I’ll make an exception.

Microsoft beat earnings expectations yesterday, but the stock still tanked overnight.

Zero Hedge nicely summarized MSFT’s results:

- EPS $2.95, up 11% YoY and beating the estimate of $2.93

- Revenue $64.73 billion, up1% YoY. and beating estimate $64.52 billion

- Intelligent Cloud revenue $28.52 billion, missing estimate $28.72 billion

- Azure and other cloud services revenue Ex-FX +30%, in line with estimates of +30.3%

- Productivity and Business Processes revenue $20.32 billion, beating the estimate $20.21 billion

- More Personal Computing revenue of $15.90 billion, beating the estimate $15.54 billion

- Revenue at constant currency +16%, beating estimate +14.7%

- Operating income of $27.93 billion, beating the estimate $27.63 billion

- Capital expenditures were $13.87 billion, beating the estimate of $13.27 billion, which normally would have been sufficient to send the stock higher, but not this time.

If you’re wondering why investors shaved $250 billion off the stock’s value, look at that third bulletpoint. That “Intelligent Cloud Revenue” line is code for “artificial intelligence.”

Zero Hedge continues:

While the results were generally strong, investors focused on the AI-heavy cloud segment: here, Azure [SR: Microsoft’s cloud service] posted a 29% revenue gain in the quarter, decelerating from the 31% growth in the previous period, with revenues just missing estimates.

Commenting on the quarter, CEO Satya Nadella said, “Our strong performance this fiscal year speaks both to our innovation and to the trust customers continue to place in Microsoft. As a platform company, we are focused on meeting the mission-critical needs of our customers across our at-scale platforms today while also ensuring we lead the AI era.”

Nadella has been infusing Microsoft’s product line with AI technology from partner OpenAI, including digital assistants called Copilots that can summarize documents and generate computer code, emails, and other content. The company also is selling Azure cloud subscriptions featuring OpenAI products. However, judging by the disappointing cloud numbers, chatbots, pardon AI, are rapidly emerging as the next "3D TV" mega dud.

And this is where I disagree.

Now that AI is available to the masses, it’ll take a while to trickle down to the point where they use it daily. This isn’t Bitcoin, which is challenging to use, maximalists be damned. Also, I look at AI as a cost-saving measure rather than a revenue-generating one for large companies. For solopreneurs, AI allows them to do things they’d only be able to do by hiring teams. It enables companies not to employ vast swathes of workers and consultants to do heaps of work.

Normally, I’d dismiss this sell-off as a temporary move, and I hope it is. If so, it’s a nice buying opportunity to load up on MSFT before the Fed. If not, this may be the first real wobble – last week notwithstanding – of a prolonged correction. To be sure, we need to see what Meta (Facebook) and Amazon report this week.

Now, let’s turn to Asia and the longer-term issue.

The Bank of Japan Approaching Normal

Oh, I can tell you some stories about Japan's lack of normalcy. But since this is a morning publication, we’ll leave that for another time.

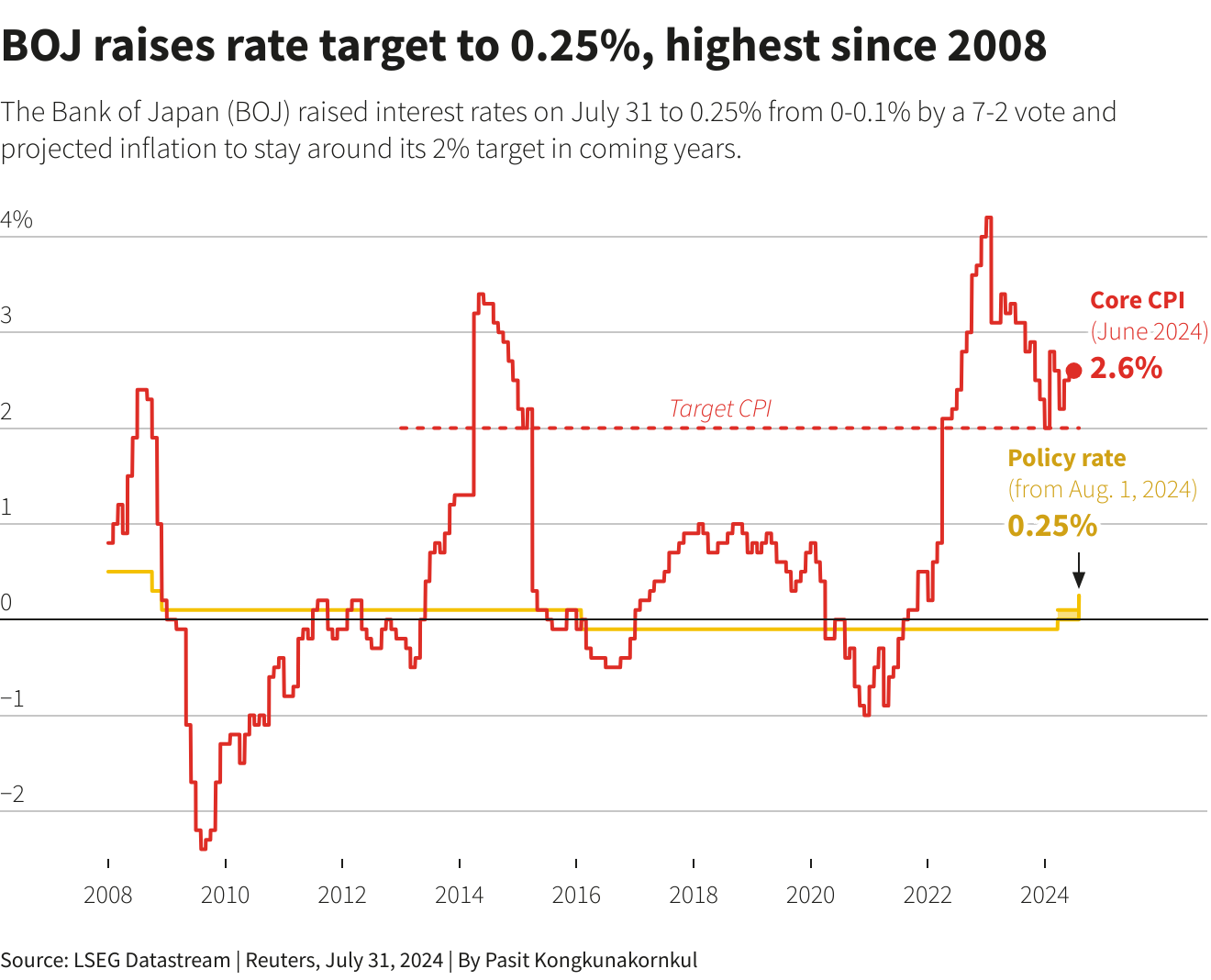

The Bank of Japan, Japan’s central bank, surprised everyone by raising interest rates for the second time this year.

Credit: Reuters

Credit: Reuters

Macro Alf had this to say:

If Japan really follows up with more 25 bps hikes going forward, it will matter for global markets - here is why.

Japanese investors are gigantic exporters of capital, owning over $1 trillion of Treasuries and almost $0.5 trillion in EUR government bonds.

Make their domestic government bonds more attractive, and the constant flow of Japanese investors into foreign bond markets might be affected.

And that’s the onion. Japan’s low interest rates encourage investors to borrow yen at very low rates, convert that borrowed yen into another currency, and buy assets with that other currency. This is called the carry trade.

If Japanese interest rates keep increasing, the flow may reverse. Japan may start importing capital from other countries.

If that happens, US Treasury bonds would have to offer more of a return to keep investors interested. That means increasing US interest rates and falling US treasury bond prices.

But this will take a lot of time to bleed into the markets.

In the meantime, this will temporarily halt the yen’s weakness versus the dollar.

Wrap Up

A lot is going on for a hot summer.

First, there is the Fed, which we talked about yesterday. Next, there are the tech earnings. Finally, the Bank of Japan has re-entered the chat, trying to normalize itself after thirty-five years of failed policy.

Amidst all this, we can look forward to potential opportunities in the market.

The Rude will have its Monthly Asset Class Report tomorrow, so we’ll talk more then.

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali