Posted August 31, 2023

By Sean Ring

Why We Don’t Feel Fed Hike Pain Yet

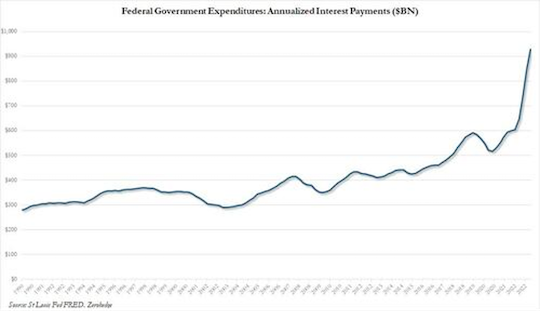

- USG interest expense is approaching $1 trillion.

- That’s more than the USG spends on the military.

- How come the pain hasn’t trickled down yet?

Good morning from a bright, shiny Northern Italy!

One more day to go… I needed a vacation from my vacation, but this weekend should do it.

In the meantime, the USG has far bigger problems.

Besides Cadaver McConnell freezing again, the interest expense on USG debt is rapidly approaching $1 trillion.

We’re in telephone number territory now.

$1 trillion. That’s far more than you need to clean up Maui or East Palestine. And yet, that’s money sent to the US’s creditors for money the USG has already pissed up a wall.

That’s even more than we’ve wasted in Ukraine.

History won’t be kind to the Congresses and citizens of this era. Future generations, who’ll still be paying off this debt, will wonder how previous generations felt fit to pass on the cost of its frippery to them.

And yet, where’s the pain? Sure, lower-income households feel the pain. But they always feel pain. Where’s the middle-class and upper-class pain? It’s not here yet.

Zero Hedge published a corker yesterday on this. But it’s on their premium service, so I’ll walk you through it.

But before I do, let me tell you I’ll be on Rickards Uncensored with Matt Insley tomorrow. We will discuss China and its Schrödinger’s Cat-like economy, US investor sentiment, Tucker and Orbán, and US credit card debt.

I hope you join us. Just click here to sign up!

The USG Interest Expense

It’s just ludicrous when you think about it.

The US is supposed to be the wealthiest country in the world. But this generation of politicians has squandered it.

“Deficits don’t matter,” said the appropriately named Dick Cheney.

Credit: Zero Hedge

Welp, the national debt is nothing more than accumulated unpaid deficits.

They sure look like they matter, Dick.

But Corporate Interest Payments Fall

Now, here’s where it gets cheeky.

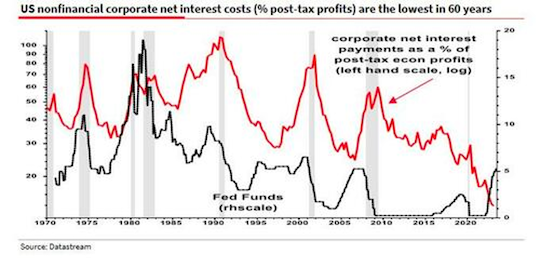

Albert Edwards, the famous permabear of Societe Generale, a French bank, noticed that corporate interest payments kept falling as the Fed was hiking rates.

That’s not supposed to happen.

Here’s the chart:

Credit: Zero Hedge

Edwards explained the above chart thusly:

We can see clearly from the Fed’s Z1 (table L103) that the US corporate sector is a massive net borrower. Normally when interest rates rise, so too do net debt payments, squeezing profit margins and slowing the economy. BUT NOT THIS TIME. Corporate net interest payments have instead collapsed (H/T my derivatives colleague, Jitesh Kumar). What on earth is going on?

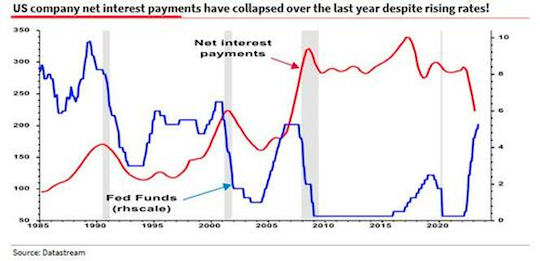

Edwards said he was “so surprised when I saw Jitesh’s chart (above), I assumed it was a mistake and emailed the SG macro-network for help. No, the chart is correct. The data comes from the BEA GDP press release (Table 11, line 9). Raw net interest payments in $bn are shown as the red line below."

Credit: Zero Hedge

On the right-hand side of the chart, corporate net interest payments (red line) sharply declined when the Fed Funds rate went up (blue line).

What new financial devilry is this?

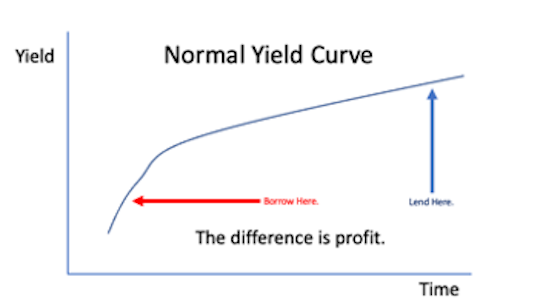

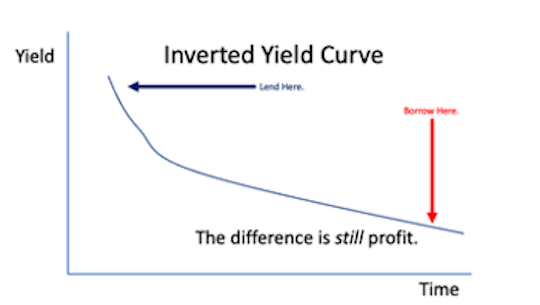

Companies Played the Yield Curve in Reverse

A few things have happened recently that have delayed (even more than usual) the effect of Fed rate hikes.

First, in the mortgage market, everyone with a house and a brain refinanced a few years ago when mortgage rates were under 3%.

So, if you’ve got a 30-year fixed mortgage at 2.75%, you’re set for life and relatively immune to rate hikes.

But what big companies did and are doing is positively sublime.

Usually, big companies and banks (mainly) will borrow short and lend long. This makes sense with a normal yield curve.

If the curve inverts, you’d expect the difference to be a loss, as the borrowing rate would be higher than the lending rate.

But companies wised up to this and simply reversed their strategy.

Since the curve was inverted, they’d borrow long and lend short.

My goodness. That gives me morning wood in the early afternoon.

Succinctly, big companies with access to the debt capital markets took Chairman Pow’s rate hikes and used them to their advantage.

They’ve told Jay Powell, as Annette Benning told Warren Beatty in Bugsy, “Why don’t you run outside and jerk yourself a soda.”

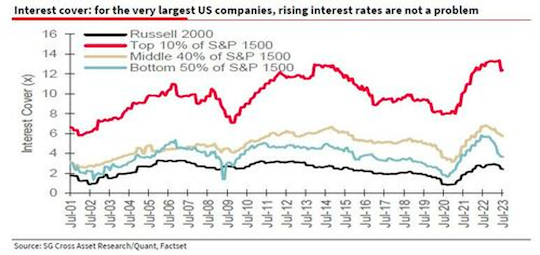

Large US Companies Are Safe

With that said, the big US companies are inoculated from rate hikes. That is, their net interest expense won’t be the cause of their demise.

Credit: Zero Hedge

To be clear, we’re talking about the top 150 of the SPX 1,500.

However, companies that don’t have access to the deep reservoir of the debt capital markets may be in trouble. That’s the rest of the SPX 1,500.

Large companies' interest cover (earnings before interest and taxes divided by interest expense) is fine. Better than fine, actually. Exquisite.

Credit: Zero Hedge

For the overall Russell 2,000 companies, it’s far worse. Usually, a 1.5x interest cover is the minimal acceptable level, though that varies by industry.

In short, many small and unquoted companies are in trouble.

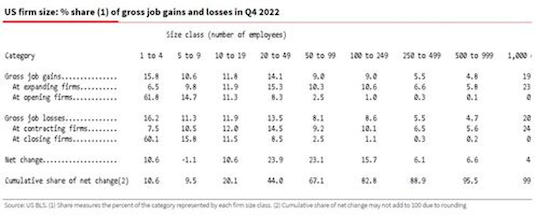

Watch the Small Companies

From Zero Hedge:

The real issue, Edwards writes, is that although large- and mega-caps may have come to increasingly dominate indices such as the S&P 500, smaller companies (say with less than 100 employees) are still the lifeblood of the US economy, accounting for some two-thirds of recent jobs growth – see BLS table below and link (and not just recent jobs growth but for the last 25 years – link)

In fact, contrary to what the mega-cap valuations suggest, smaller companies remain the beating heart of the US economy – maybe, the SocGen bear notes snarkily if correctly, "the mega-caps are more like vampires sucking the lifeblood out of other companies."

To summarize, while the top 10% of companies are benefiting from higher rates in the form of cash interest income greater than debt interest expense, at the same time, the lights are going out all over the US smaller-cap corporate sector. Unlike their far bigger peers, "they weren’t able to lock into long-term loans at almost zero interest rates and pile it high in the money markets at variable rates."

Ultimately, Edwards concludes, "the pain for US small- and mid-cap companies will trigger the recession most economists are now giving up on, and hey, guess what? I think we’ll soon find out that even the large- and mega-cap stocks might not be immune to the indirect recessionary impact of higher interest rates after all."

So watch the IWM ETF (Russell 2,000) to see early signs of trouble.

As of yet, it looks fine. I’ll follow up on that in tomorrow’s monthly asset class report.

![]() Wrap Up

Wrap Up

The SPX 150 biggest companies have performed a jiu-jitsu-like move on the Fed, playing the yield curve in reverse.

This, along with homeowners smartly refinancing their houses in the past few years, has staved off the worst effects of the quick Fed rate hikes.

The key now is to see when the IWM and other unquoted companies start to get near bankruptcy because of their excessive debt payments.

Have a great day!

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali