Posted May 15, 2024

By Sean Ring

Why Today’s CPI Number Matters So Much

Today at 08:29 Eastern Time, traders will be staring at their screens, hand on mouse, like they’re ready to draw at the OK Corral.

At 08:30, we’ll know if the Fed will cut rates this summer or not.

Why is this?

Because the April CPI number will come out and tell us whether or not the Fed has inflation under control. It’s no matter that the way the Bureau of Labor Statistics (BLS) calculates the CPI is complete bullshit. It doesn’t matter that a cup of coffee has gotten so expensive; the statistics guys removed it from the calculation. That number will tell the Fed to cut or not to cut.

To ensure we’re on the same page, the CPI is the Consumer Price Index. Though its methodology is entirely flawed, Fed Chairman Powell relies on it to determine whether he’s cooled the fires of inflation.

Simply put, we take a basket of goods in March, measure its price, and then take the same basket in April and calculate the price difference between the two monthly baskets. In our stupid Keynesian world, the price rarely goes down.

The problems started when the BLS statisticians added cheap goods and removed expensive goods. As I mentioned above, the stat guys removed coffee from the basket. I know exactly two people who’ve never drunk coffee. It’s people's fuel. That it’s no longer in the basket is absurd.

The BLS stats guys call it “hedonic adjustments.” Most other people call it “lying.”

The CPI’s expected month-on-month increase was 0.3% for the last three months. The CPI missed its target each time, recording a 0.4% gain.

The trouble is that the PPI, or Producer Price Index, came in yesterday above expectations. (The PPI is like the CPI but measures price changes for wholesalers, not retail folk.) So, the likelihood of the CPI coming in below expectations is low. It’s not impossible, but it’s low. Quite frankly, no amount of book-cooking coming from the government’s economists would surprise me.

Let’s get into why this potential Fed move is so important.

Asset Markets

I just re-watched my presentation (with prediction) in the Paradigm Press Seven Predictions on YouTube. I predicted an SPX of 5,000 and a gold price of $2,500 by the election because of all the goodies the Democrats will hand out to try to win the election.

The SPX has already reached 5,000, so I was too conservative with this prediction. I still stand by my gold prediction, but I was wrong that gold and the miners needed a pivot to rally. They obviously didn’t.

I’m still bullish. But the likeliest scenario tomorrow is that the CPI comes in hot. That means it’ll overshoot the consensus again. If that happens, the market will know Powell doesn’t have the green light to cut rates yet. The market will sell off, and it may be a terrible day indeed.

But if the CPI falls below expectations, Powell is getting the punch bowl back out.

I also said, and stand by, that Jay Powell doesn’t want to work for or be fired by The Donald. So Powell has a vested interest in letting his dovish colleagues win and cutting rates.

If not at this next June meeting, we’ll wait for two months more for data before he moves at the late July meeting.

The Mortgage Market

This doesn't matter much to folks who were smart enough to lock in low mortgage rates in 2021.

But for everyone else, this is utterly crucial.

When the Fed changes the federal funds rate (FFR), it directly affects short-term interest rates, such as those for adjustable-rate mortgages (ARMs) and home equity lines of credit (HELOCs).

ARMs often adjust based on short-term interest rates, which the FFR influences. If the FFR falls, the interest rate on ARMs usually decreases, leading to lower mortgage payments.

So you can see why our less savvy brethren are waiting with bated breath for Chairman Pow to cut.

Europe Needs a Lifeline

Most economists thought the Fed would lead central banks in cutting interest rates. I, myself, thought that would be the case. We were wrong.

The Swiss National Bank cut interest rates in March, and Sweden’s Riksbank cut in May.

From Capital Economics:

In Switzerland’s case, core inflation has dropped to only 1.1%, which is consistent with the SNB’s “below 2%” target and much lower than elsewhere. Swedish core inflation has also been relatively subdued. Moreover, Sweden’s economic performance has lent itself to earlier loosening as the economy contracted for a fourth successive quarter in Q1 as mortgages responded quickly to higher interest rates.

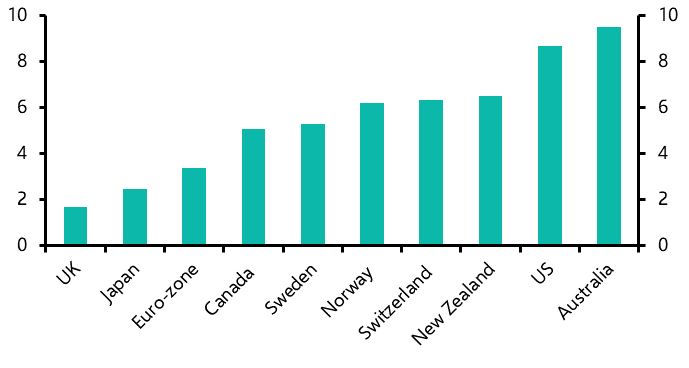

The Eurozone needs help, fast. Its GDP has only grown by 3.4% since Q4 2019 (or just 2.5% if we exclude Ireland).

This is the Real GDP change since December 2019 among major economies:

Credit: Capital Economics

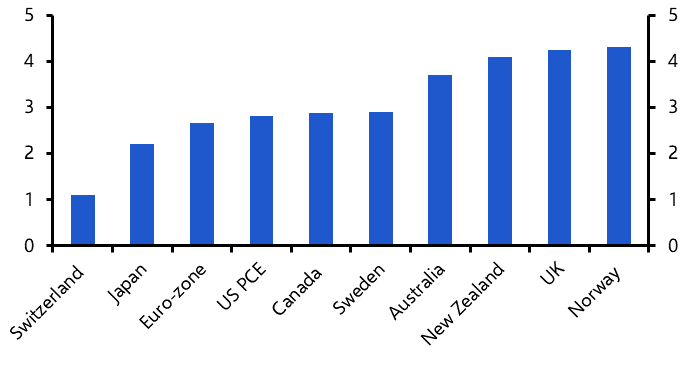

Credit: Capital Economics

Since the Eurozone’s inflation rate isn’t out of control, they have room to cut. The UK, however, has an inflation problem (below) and terrible GDP growth (above).

The UK’s inflation rate is second only to Norway.

So Europe will probably cut first, followed by the Fed. Then, the Bank of England will cut rates in late summer or early autumn.

Wrap Up

Today is a big day for domestic asset and mortgage markets and central banks at home and abroad. I suspect inflation will be hot, but that’s not a prediction. No one knows what the BLS statisticians will concoct this month.

But if I’m correct, the Fed will probably hold in June and cut in July, depending on future inflation data. If I’m wrong and inflation is tame, the Fed will surely waste no time to cut.

Remember, Jay Powell doesn’t want to work for The Donald again, but he can’t make it look political. The further he cuts from the election, the better for him.

If I were Powell, I’d pray for a tame number. Or I’d pick up the phone to the BLS and put a thumb on the scale.

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali