Posted September 20, 2024

By Sean Ring

Why I Sold All My Stocks Yesterday

It’s been a helluva run.

From May 2023 until Wednesday, my portfolio went on an insane tear, and I’m thrilled with the results. Wednesday, which, in time, may be remembered as the day Jay Powell panicked the markets into a tailspin, made me reconsider my position to stay long stocks.

Even after yesterday’s rally, I’m unsure if this run has much more to give now. But don’t be surprised if I write that I’m long the market next week.

Let me explain.

Captain Kirk Backs Off

One of my favorite movies is Star Trek VI: The Undiscovered Country.

During the climactic space battle, Captain Kirk and the crew of the Enterprise face General Chang, played by the legendary Christopher Plummer, who is attacking them from a cloaked Klingon Bird-of-Prey that can fire while invisible. Chang taunts Kirk and continuously fires on the Enterprise, putting the ship in a dire situation.

Knowing they can't pinpoint Chang's location for a counterattack, Kirk decides to change tactics. He orders the Enterprise to stop evasive maneuvers and back off, slowing down the ship.

[Enterprise-A bridge]

CHANG (on intercom): I can see you, Kirk.

KIRK: Chang!

CHANG (on intercom): Can you see me?

[Bird-of-Prey bridge]

CHANG: Oh, now, be honest, Captain. Warrior to warrior...

[Enterprise-A bridge]

CHANG (on intercom): You do prefer it this way, don't you? As it was meant to be. ...No peace in our time. 'Once more unto the breach, dear friends.'

[Bird-of-Prey bridge]

CHANG (OC): (in Klingonese) Fire!

[Enterprise-A bridge]

McCOY: This is fun.

KIRK: Reverse engines! All astern! One-half impulse power. Back off! Back off!

[Bird-of-Prey bridge]

CHANG: (in Klingonese) What's she doing?

[Enterprise-A bridge]

KIRK: What's she waiting for?

SPOCK: Probably trying to ascertain why we are reversing, wondering whether we detect her.

The unorthodox strategy momentarily confuses Chang, who expects Kirk to keep fighting and dodging.

This moment of tactical restraint from Kirk helps to level the playing field, ultimately leading to the successful targeting and destruction of Chang's ship.

I’m hoping getting out and taking a breath will give me the clarity I need to either happily stay out… or quickly jump back in.

But before I get into the “why,” let me show you what listening to my fellow friends and colleagues at Paradigm Press has done to my portfolio over the past year or so:

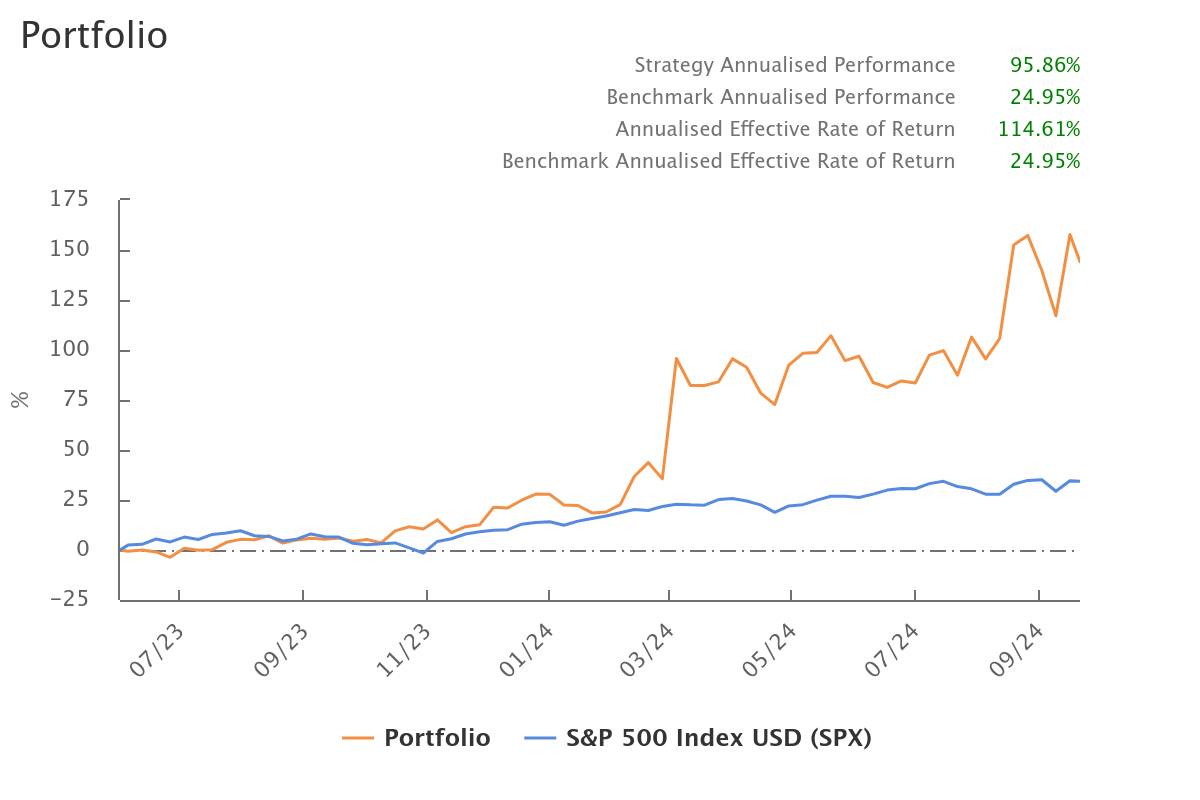

Source: Sean Ring

Since the trough of my portfolio in May 2023, I’ve achieved a cumulative return of nearly 175%. That annualizes to 114.61%, as per the chart. I started making changes in November 2023, and you can see the separation from the S&P 500’s performance almost immediately.

I must thank my Retirement Lord and Savior Ray Blanco, Options Optimist Alan Knuckman, and Ace Rock Kicker Byron King and the rest of the Rickards franchise (Jim, Dan, and Zach), along with the rest of our team, for this amazing bounty. I’m grateful beyond measure.

So what spooked me?

After the Cut, Yields Rise?

If you’re new to the Rude, you may not know I cut my teeth on Wall Street and in the City of London in fixed income. I wasn’t an equity trader. Fixed income is an umbrella term that covers any sort of debt. In fact, it’s a synonym for debt and bonds. If you see “FICC,” that stands for “Fixed Income, Currencies, and Commodities” because Wall Street groups them together for their macroeconomic importance and relationship with interest rates.

Fixed income people are much more concerned with the macroeconomic outlook and getting their money back than with outsized gains on lucky stock picks. (Ray Blanco, you stay lucky, pal!)

Bond traders are miserable people compated to their compadres that trade stock.

Stock traders get lucky. Often. Bond traders almost never do.

Something really scared the bejesus out of me when Jay Powell cut the other day. And it wasn’t just the size of the cut, which indicated to me that he’s seeing something I, and the most of the rest of the market, isn’t seeing.

Yields actually rose.

For context, any interest rate (or yield) can be broken down into the risk-free rate plus a risk premium. In our case, the risk-free rate is the US Treasury yield. The risk premium includes things like credit risk, liquidity risk, and maturity risk, among others.

In theory, when the central bank cuts rates, the treasury yield comes down, and, hence, interest rates come down. But it times of market stress, central banks can cut rates, but the overall yield rises.

That’s because the risk premium increases.

When’s the last time yields rose as the Fed cut rates?

October 2008.

Lehman.

But The Charts are Still Bullish

The S&P 500 closed at an all-time high yesterday.

It’s not the most convincing candle, but it’s an all-time high. That’s not indicative of a bear market.

But here’s the thing:

Market dislocations start in the fixed income markets and end in the equity markets.

I may be well out in front of the curve; I accept that. But Jay Powell himself alerted me to something that’s wrong with his 50 basis point cut. Otherwise, I might not have seen it.

Rebalancing My Portfolio

Also, one of the blessings of a Ray Blanco runner is that it takes up a lot of your portfolio. ASTS, and VKTX before it, went on such tears that at different points they made up nearly 50% of my portfolio.

So taking profit on those positions while thinking of rebalancing my portfolio might do me some good.

I even sold PLTR!

It’s not that it’s not performing; quite the opposite. But if the market risk is getting large enough to overwhelm even the most loved stocks, it’s silly to stay in. Get out. You can always buy them back later.

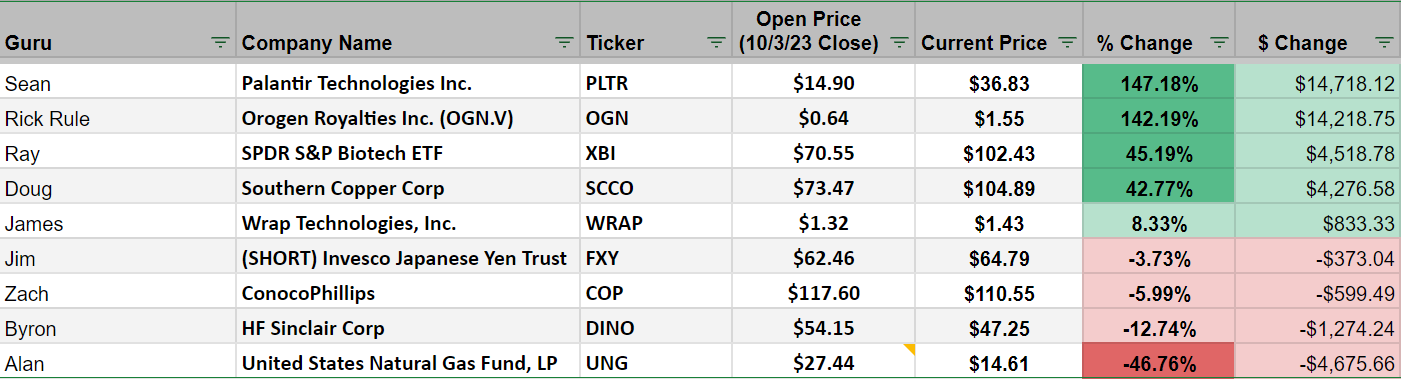

Also, I’m still bullish on PLTR even though I sold it. You can see below, PLTR is the best performing pick of the Vegas Whisk(e)y Bar.

Source: Chris Harris

Wrap Up

For now, I’m out. The fixed income markets are telling me something’s wrong. The equity markets are, as yet, unaware of any dislocation.

That’s fine.

I just need a break. It’s been an amazing 17 months.

I’ll see how I feel next week.

Have a wonderful weekend.

Why Bitcoin Isn't a Short-Term Safe Haven

Posted October 03, 2024

By Sean Ring

“I’ve Become Friends With School Shooters.”

Posted October 02, 2024

By Sean Ring

Gold Glitters as Silver and the SPX Soar

Posted October 01, 2024

By Sean Ring

The South Is Rising Again!

Posted September 30, 2024

By Sean Ring