Posted January 06, 2025

By Sean Ring

Why High Rates May Tank The Market

I was scrolling through X when I found this great thread from @MacroAlf. He wrote, “The bond market is on fire.”

If you’ve been reading the Rude lately, you know I’ve written that the bond market warns the equities market when things are going wrong, but the equities market ignores the bond market. I knew something was wrong since Jay Powell cut rates by 50 bps in September.

I was thrilled that Alf would provide concrete evidence to support my intuition. I’ll share his findings with you, but first, a little background is needed.

The era of ultra-low interest rates seems to be over, and the consequences of a new monetary paradigm are rippling across the global economy. I’m thrilled about that, by the way, as I think artificially low interest rates wreck the pricing mechanism of the economy, creating distortions. But to think we won’t experience pain as we transition out of it is silly. The year 2022 is proof things go wrong when rates rise quickly.

While central banks, particularly the Federal Reserve, emphasize their commitment to stabilizing inflation and maintaining credibility, the elevated interest rate environment has sparked profound challenges beyond U.S. borders. Let’s break it down into five critical issues.

The 4% "New Normal" Base Rate

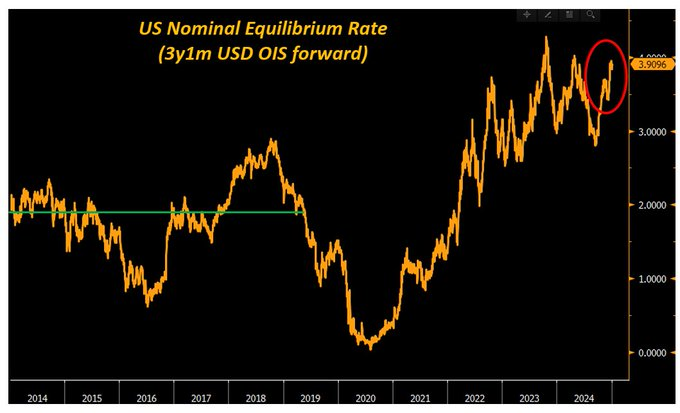

@MacroAlf writes, “Bond investors are pricing an environment in which a very hawkish Fed won't affect the economy down the road.

Basically, Fed Funds around ~4% are priced to be the ''new normal'' - this used to be 2-2.50% before the pandemic:”

Credit: @MacroAlf

Credit: @MacroAlf

The Federal Reserve’s base rate hovered near or below 2% for decades, enabling cheap credit and economic growth. However, the post-pandemic world has ushered in what many Fed officials consider the “new normal” — a 4% federal funds rate. While this level may seem prudent in a higher-inflation environment, it creates a systemic drag on the economy.

Higher base rates translate into elevated borrowing costs for everything from mortgages to corporate bonds. For households, this means higher monthly loan payments and less disposable income. For businesses, it means smaller profit margins as the cost of capital rises. Globally, emerging markets that rely on dollar-denominated debt are squeezed even harder as their effective borrowing costs soar.

The real danger is that a 4% base rate could inhibit long-term investment and innovation. Infrastructure projects, research and development, and other high-capital initiatives may no longer be feasible, ultimately stifling economic growth. And let’s face it: Silicon Valley hasn’t proven it can function when the cost of capital is above zero, at least in the 21st century.

The Higher Term Premium

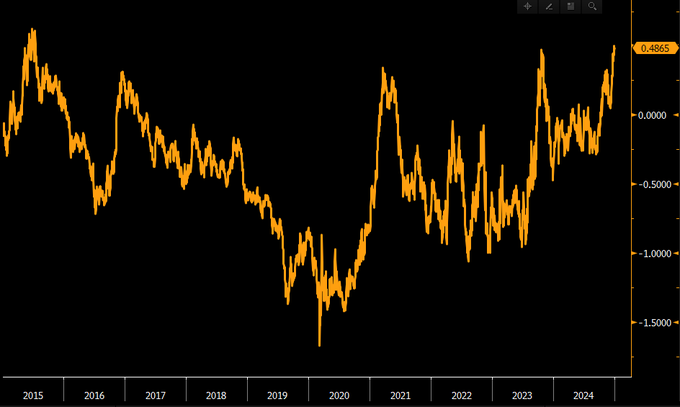

From @MacroAlf: “On top of it, the long-end has underperformed because of an injection of Term Premium.

Term Premium is the compensation investors require to warehouse duration risk in long-end bonds: the more volatile the expected macro environment, the higher the term premium:”

In plain English, the term premium is the excess yield (return) investors demand for holding longer-term bonds over shorter-term bonds. It’s a key indicator of market sentiment. The term premium has recently been rising due to uncertainty over fiscal deficits, inflation expectations, and Federal Reserve policy.

An elevated term premium forces up yields on long-term government debt, which has knock-on effects across the financial system. It increases the cost of issuing new debt for governments, pushing national deficits higher. For private-sector borrowers, elevated long-term yields mean financing for large-scale investments becomes more expensive.

This trend also has implications for pension funds, insurance companies, and their investors, who rely on bond portfolios. As bond prices fall with rising yields, these institutions face significant mark-to-market losses, weakening their financial stability.

Short-Term Rates are Up Because of Expected Future Fed Hikes

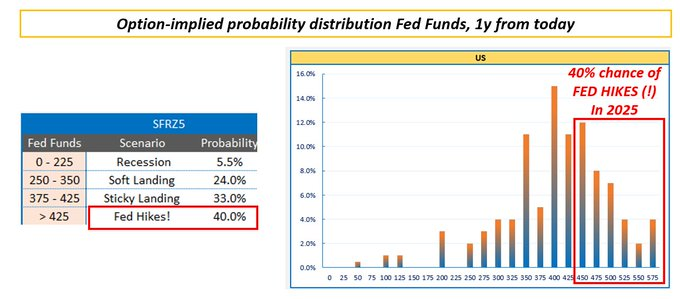

@MacroAlf writes, “In the front-end, things are super interesting too.

Our option-implied probability monitor shows investors are pricing meaningful odds of Fed hikes (?!) in 2025.”

Credit: @MacroAlf

Credit: @MacroAlf

While long-term rates price long-term assets like stocks and housing, short-term rates are just as crucial to the global financial ecosystem. The Fed’s forward guidance and rate hikes directly influence the short end of the yield curve. When short-term rates rise rapidly, like in 2022, it shocks money markets.

The immediate impact is higher borrowing costs for working capital. Companies that rely on short-term loans to finance day-to-day operations face tighter liquidity. The rising short end squeezes banks' net interest margins, especially if long-term lending doesn’t keep pace.

In emerging markets, short-term rate hikes amplify vulnerabilities. Governments and businesses that need to roll over short-term debt face escalating costs, often leading to fiscal and financial crises. The higher rates also act as a magnet for capital, pulling money out of riskier markets and into U.S. dollar-denominated assets.

Bond Drawdowns Have Been Terrible Recently

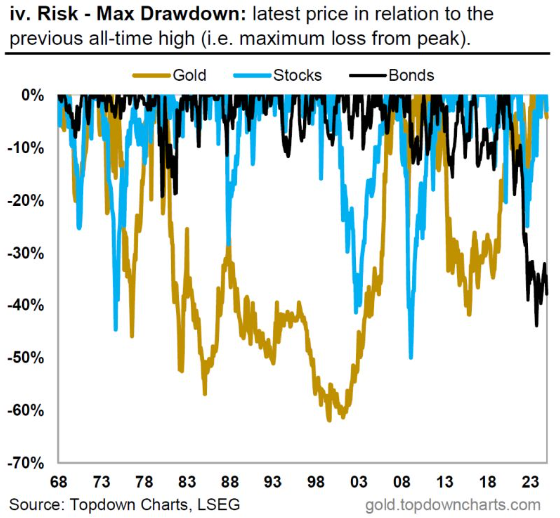

@MacroAlf writes, “The drawdown in bonds now matches some of the historically worse drawdowns for stocks.

And investors don't seem to price in an imminent counter-rally.

But for how long can the economy and the housing market handle high interest rates without any damage?”

Credit: @MacroAlf

Credit: @MacroAlf

A “drawdown” is the peak-to-trough decline in the value of an asset or portfolio. In the bond market, drawdowns are traditionally rare and shallow because bonds are generally viewed as safe-haven assets.

But if you look to the far right of this chart, you can see a 40% drawdown in bonds. It’s a historic move.

These drawdowns have eroded the wealth of retirees, pension funds, and other conservative investors. The losses also wreck the traditional 60/40 portfolio strategy, in which bonds are supposed to provide stability during equity market downturns. With bonds no longer serving their historic role, investors try different alternatives, adding volatility to global markets.

Rising Yield, Rising Dollar: Harder to Pay Back Dollar Debt

One of the worst effects of higher U.S. yields is the strengthening of the dollar. A rising dollar creates a vicious cycle for countries and companies with dollar-denominated debt. As the dollar rises, the local currency cost of servicing this debt balloons, pushing borrowers to default.

Emerging markets remain vulnerable. These economies depend on dollar-denominated bonds to fund infrastructure, healthcare, and education. When the dollar strengthens, debt burdens become unsustainable. And the rising cost of imports, particularly commodities priced in dollars, exacerbates inflation, forcing central banks in these countries to hike rates even further.

Wrap Up

High rates are necessary to combat inflation, but investors will feel their ripple effects on the global economy. The fallout is widespread and severe, from elevated borrowing costs to bond market turmoil and a strengthening dollar.

Usually, this would mean a falling gold price. But will inflation be so bad that gold rises with the dollar? It’s more a probability than a possibility.

Meanwhile, the equities markets fiddle.

WAR! What’s It Good For?

Posted March 02, 2026

By Sean Ring

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring