Posted February 12, 2025

By Byron King

Where Are the Streets of Gold?

“Before I came to America,” said my long-deceased grandfather, “I heard stories about how the streets were paved with gold. This was a fairytale among the working class in Europe. But I was young and believed those stories.”

“When I arrived,” he added, “the streets were not paved with gold. In fact, where I lived in the early years, the streets weren’t even paved. We all walked to work in the mud. And if people wanted paved streets, we had to do it ourselves.”

In 1913, my grandfather – my mother’s dad – sailed to the U.S. from Italy. He disembarked in New York and boarded a train to Westmoreland County, Pennsylvania, about 30 miles east of Pittsburgh. There, he found a job mining coal for $1.00 per day. (Yes, you read that right: one dollar per day.)

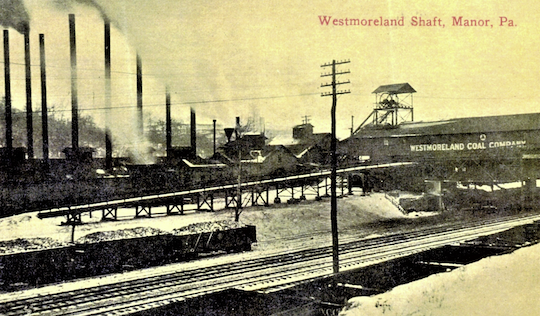

A coal mine in Westmoreland County, in the 1910s. Courtesy MinDat.

A coal mine in Westmoreland County, in the 1910s. Courtesy MinDat.

For my granddad, in 1913, there was no gold. No paved streets. He worked in a coal mine for 10 cents an hour. Hold that thought…

Gold Price is Rising

If you haven’t been paying attention, gold is now well over $2,900 per ounce. That’s up from $2,740 on January 20 when Donald Trump was sworn in as U.S. President, a gain of 6.7% in just over three weeks. What’s happening?

Well, let’s be clear about the price of gold; it was heading up in any event, Trump or not. Indeed, I can only imagine how much higher the price of gold might be if that other candidate had won the election. You remember her. Yeah, what’s-her-name.

Lately, some news accounts have pinned the rising price of gold on the threat of Trump’s tariffs. The idea is that when Trump places tariffs on imports, the imposts will apply to gold as well as everything else. Indeed, Trump just slapped steel and aluminum imports with a 25% tariff, regardless of the foreign source.

Trump signs tariff order for steel and aluminum. Courtesy Money.CNN.

Trump signs tariff order for steel and aluminum. Courtesy Money.CNN.

According to this thought process, people are importing gold into the U.S. just in case Trump follows through with even more tariffs on more items, including the yellow metal.

Well, Trump’s going to do whatever he does. He’s on a roll, early in his second term. But when you boil it down, tariffs or not, the price of gold is controlled by events far beyond the powers of even the Mighty Orange Man.

Central Banks Now Drive Gold Prices

Supposedly, the price of gold is set by supply and demand, just like pretty much everything else in the world. Although yes, some argue that gold prices are manipulated, and the point is not entirely off-base. But for our purposes today, let’s just deal with the generally accepted world market system for gold, which shows a nominal price.

As for what’s available, the supply of physical gold is what it is, meaning metal above ground plus whatever new metal gets mined and refined each year.

Meanwhile, demand for gold reflects the growth of money supply, an economic term of art for the amount of currency issued by central banks worldwide, led by the U.S. Federal Reserve and similar banks in many other nations.

In general, a rising gold price parallels inflation caused by central banks. And in this macro-environment, people and institutions buy gold to preserve wealth and defend against the loss of purchasing power over time.

Plus, there’s another, more recent spin on gold demand: central banks are buying metal for their own vaults and accounts. No, the U.S. Fed isn’t buying, and it's sad to say the institution still disdains monetary gold. But other central banks are buying big time, including banks in countries ranging from Russia and China to India, Turkey, Indonesia, the Philippines, and many more.

In the words of the World Gold Council, in 2024, “central banks continued to vacuum up gold at an eye-watering pace.”

According to Forbes Magazine, “central banks and private investors dominated the gold market last year (2024), seeing the metal as a defense against inflation and as an asset class separate from government-controlled currencies.”

Kitco News explains that “central banks look to diversify away from the U.S. dollar.” Particular bones of contention with the dollar include a lack of confidence in interest rate impacts, continuing inflation that appears to be structural and embedded, and overall geopolitical instability in the face of apparently declining U.S. power across the globe.

Central banks are increasingly moving into gold as a long-term store of value and inflation hedge, relying on gold’s historical performance during times of crisis. In addition, gold is an effective portfolio diversifier with no default risk to physical holdings.

And consider what else this represents; namely, recent global scale moves in gold indicate how something seismic is going on with the world alignment of political and economic power:

- Foreign-owned gold is being repatriated. Despite the inflow of privately held gold to the U.S. (perhaps for Trump-related reasons, as noted above), many foreign central banks have removed gold from the Federal Reserve in New York and the Bank of England in London and returned it to foreign capitals. Apparently, many foreign political powers don’t trust the U.S. or British governments as custodians of their gold.

- Another way to describe this retro movement of gold is that large stocks of metal arebeing regionalized. While the U.S., for example, seldom trumpets its (alleged) gold in Fort Knox, etc., other nations are proud to announce their own domestic build; we see it from national capitals across the Middle East, Central Asia, South Asia, certainly China, and even South America.

- There’s a strong national trend toward governments asserting physical control over their gold rather than allowing other nations – especially the U.S. and U.K. – to continue to hold this valuable state asset. It’s almost as if people don’t trust Uncle Sam or the King of England.

How’s Your Gold Stash Doing?

Let’s bring this closer to home, meaning your personal investment approach. Yes, it’s fascinating to watch price moves for gold, perhaps, but these big trends are entirely out of your hands. In other words, if even Donald Trump can’t control the price of gold, neither can you.

At the same time, individual investors can definitely ride this wave. At the very least, you should own gold in different forms: physical metal, tradable plays, royalty companies, and essential gold miners.

Physical speaks for itself. Buy and hold. Store it where you can find a safe site. This is a multi-decade program of building generational wealth, where you don’t trade in and out. You just hang on and smile as the metal price rises.

For trading, and because there are good days and bad ones in the gold pits, you use an ETF like GLD or the Sprott Physical Gold Trust (PHYS). There are these and many others; do your due diligence.

As for royalty and mining plays, you know the big names: Franco Nevada (FNV), BarrickGold (GOLD), and Newmont (NEM), plus many other intermediates and small caps. The large names appear moving, but the many others are still dramatically underpriced.

Less than 1% of the market cap is now focused on precious metal plays. This is because too much money is arguably chasing the usual suspects in tech, biotech, etc. But if just a tiny amount of that market cap decided to reallocate to metal and mining ideas, we’d see massive upswings in share prices. In other words, it’s not too late to get into gold and related plays.

Back to Granddad

Well, God works in mysterious ways. My grandfather's coming to America and working in that coal mine was advantageous because he was in the U.S. rather than Italy. Thus, he avoided being drafted into the Italian army during World War I.

And no, before sailing west, my grandfather didn’t know or suspect that war was coming. But in a different universe, and if he had remained in the Alpine foothills where he was born, my grandfather likely would have wound up near the Isonzo River, in what is now Slovenia. And he could have died along with several of his brothers, who were killed fighting Austrians in the Battle of the Caporetto.

As for that $1.00 a day my grandfather made working in the mines? That was back when gold was $20 per ounce.

U.S. $20 gold coin, St. Gaudens. Courtesy U.S. Treasury Dept.

U.S. $20 gold coin, St. Gaudens. Courtesy U.S. Treasury Dept.

By comparison with today’s price of over $2,900, that’s a factor of 145x. In other words, my grandfather earned the equivalent of $145 per day in the coal pits or $14.50 per hour.

No, that’s not a great wage by many standards, but more than the minimum in many states today. And it wasn’t forever because he had other ideas.

Meanwhile, as for America (and really, it’s something that’s true everywhere), over time, we all must pave our own streets.

That’s it for now. Thank you for subscribing and reading.