Posted May 18, 2023

By Sean Ring

What If Powell Hikes Again in June?

- The market is looking for a pivot.

- But what if it gets something completely contrary?

- Let’s think out loud for a few minutes.

Good morning from glorious Jekyll Island!

I’m about to hop on the shuttle back to JAX for a short flight to Atlanta. Then, I fly directly to Milan on the redeye from here, landing at 09:30 Friday morning.

It was wonderful getting back Stateside to meet and greet the Paradigm team. You really have excellent people who genuinely care about your future, writing for you.

As I sat around with Jim Rickards’s Managing Editor, Frank DeVechio, and The Banker, Zach Scheidt, we were chinwagging about Jay Powell’s next move.

We don’t know, and we haven’t placed any bets yet.

But what if Jay Powell hikes again at the June meeting?

The Thesis

Jay Powell has never said he was going to pause. He’s a man on a mission.

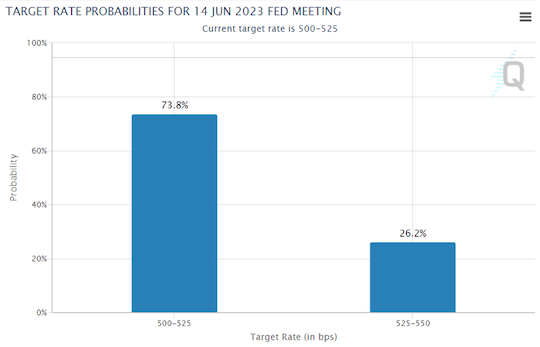

Even the market is starting to come around to that. Here’s the latest on the CME FedWatch Tool:

The market thinks there’s a 26.2% chance the Fed will hike in June.

If you remember, most market participants are looking for a pause and a quick pivot. The Rude has never thought this is the case because Jay Powell never said so. Also, the last time we had a huge hiking cycle under Ben Bernanke, he left rates at 5.25% for over a year.

Why Wouldn’t You Hike?

The issues are plenty, unfortunately.

The Stock Market

Everyone’s 401(k) plans may go “poof!” all at once.

As you can see, the SPX just can’t seem to get above 4,200.

With another hike, Powell may put the index down quite a bit. And there lies the opportunity.

I think some cheap puts are out there to take advantage of the current positioning.

The Bond Market

The Banker, Zach Scheidt, and I were looking at the TLT chart yesterday.

Like the SPX, it had a nice recovery last autumn but stalled at 107.5.

Another hike, and we will probably head down to 90.

The Banks

The regional banks especially are crying, “Uncle!” after the latest hike. Silly Valley, Signature, First Republic, and Credit Suisse have all bitten the dust.

Many regional banks have one foot in the grave and another on a banana peel. Another hike, and they may slip into the coffin of bankruptcy.

And who really knows what’s going on at the “too big to fail” banks? Sure, the US-based ones are fine. The Fed will print whatever it takes to save them.

But Europe’s banks don’t give me any hope. The banks over there are not in good hands.

Christine Lagarde, the head of the European Central Bank, can’t even define inflation, let alone fight it.

Why Do It?

Well, Mr. Powell, that’s your job, for one.

The Federal Reserve, such as it is, is tasked with price stability and growing the economy.

It has failed utterly at its first, most important, function.

Let’s be frank. The Fed was never really all that good at it. And the world would be better if money, like any other commodity, were subject to the free market.

The great Austrian economist Murray Rothbard didn’t think the Fed should exist, let alone be charged with such an important task.

By manipulating the money supply and interest rates, Rothbard believed that the Federal Reserve interfered with the market's natural ability to price goods and services, consequently contributing to boom-bust cycles.

Over time, Rothbard has been proven logically sound and empirically correct.

He wrote in What Has Government Done To Our Money?:

I believe that banking is a fundamentally fraudulent activity, and hence that any government guarantees or regulation is bound to fail to stem the tide of bank failures and bank runs.

He went on:

Like other goods on the market, it [money] is not subject to any 'optimum' supply...The money relation expresses the extent and depth of the influence of money on the economy. An increase in the quantity of money any amount will not confer a social benefit. It will merely dilute the effectiveness of each gold ounce; on the other hand, a fall in the supply of money will intensify the effectiveness of each gold ounce. Therefore, money, the nerve center of the economic system, should be kept as far away as possible from governmental manipulation.

The only problem is this: we don’t live in this world.

The Federal Reserve’s world mandates it must control the money supply, interest rates, and inflation.

So with that in mind, the most significant reason for Powell to hike is this inflation is not only not “transient,” it seems sticky as hell.

This is the US Core Inflation rate change, year-on-year:

Have a great day!

This is still too hot for my taste, and for many in the Eccles Building, as well.

By removing the volatile food and energy components, core inflation attempts to measure the long-term, sustained price movements that affect the cost of living. Central banks often use this measurement to help set monetary policy.

And I think Jay Powell is looking at this and thinking he may hike again.

Also, it’ll make Treasury Secretary Yellen’s job much harder. And that’s bound to make Powell happy.

Wrap Up

We’re not ready to place bets yet.

There’s too much data coming out between now and then that’ll dictate the next move.

But it’s worth considering the market isn’t positioned for a hike and may be an opportunity to make an outsized profit.

The EU Has No Credibility

Posted July 19, 2024

By Sean Ring

Training Shiny Young Things

Posted July 18, 2024

By Sean Ring

These Stocks Made So Much Money!

Posted July 17, 2024

By Sean Ring

The Trump adVance Continues

Posted July 16, 2024

By Sean Ring