Posted October 02, 2025

By Sean Ring

$50 Silver: Ceiling or Floor?

Every time I mention silver at $50, I hear the same old refrain: “Yeah, but it’ll never stay there. Silver always spikes and crashes. Back to $30 in no time, mate.”

Fair enough. History does show silver to be the drama queen of commodities. It shoots higher like a bottle rocket, then fizzles into the dirt. 1980. 2011. The chartists keep those scars fresh in their memory.

But here’s the thing: the skeptics may be wrong this time.

Silver at $50 doesn’t have to be a blowoff top. It could be the beginning of a new normal—a permanent repricing of the devil’s metal.

Let’s dig into the three big reasons why…

1. Tech to Trash, Investment in Materials and Metals

For the last decade, money’s been crowding into tech like frat boys around a keg. FAANGs, cloud, AI—take your pick. It made sense. These companies printed money, and the Nasdaq became the only growth story in town.

But trees don’t grow to the sky. Valuations have gone full nosebleed, and everyone knows it. Just like in the early 2000s, when the dot-com bubble burst, investors will eventually rotate out. And when they do, where’s the cash headed?

Into hard assets.

Commodities. Materials. And yes—silver.

The metal is tiny compared to trillion-dollar tech behemoths. This means that even a modest capital rotation can ignite a fire under the price. If you think $50 is a ceiling, it may be more like a magnet.

2. Goodbye Treasuries, Hello Gold (and Silver)

The U.S. Treasury market used to be the safest game in town. Uncle Sam’s IOUs were gospel. Not anymore.

Deficits, rising debt service, endless new issuance—confidence in Treasuries is cracking. Central banks see it too, which is why they’ve been dumping Treasuries and piling into gold.

And where gold goes, silver usually follows.

Silver is the “poor man’s gold,” the sidekick that rides shotgun. Retail loves it, ETFs hoover it up, and institutions treat it as a leveraged play on the same theme. If Treasuries are losing their mojo, gold will get the capital, and silver will hitch a ride.

That’s not cyclical froth—it’s a structural shift in central banks’ asset allocation.

3. A New Paradigm of Demand Beating Supply

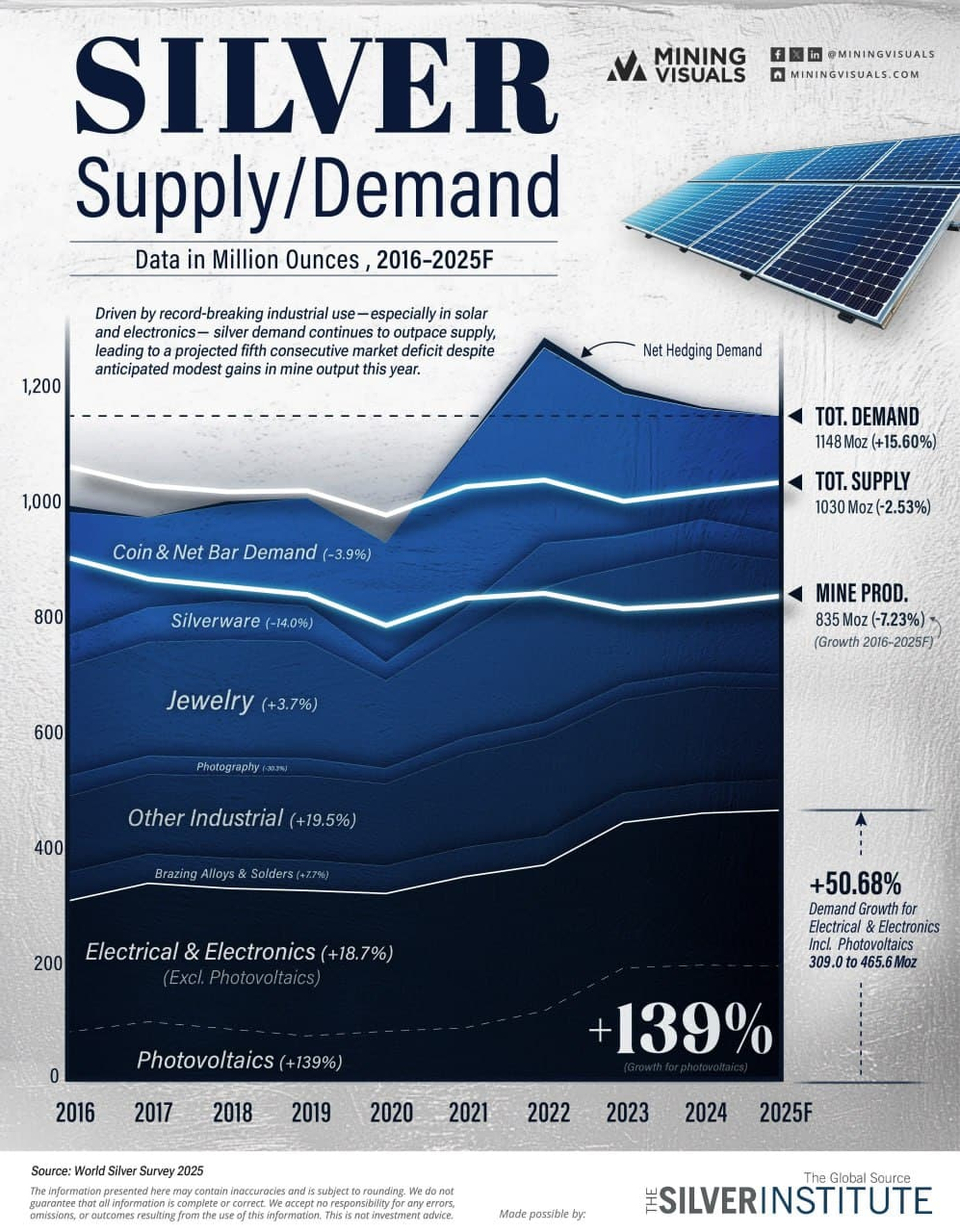

Here is where silver’s story breaks from its own past. Check out this visual from the Silver Institute:

Total demand of 1,148 million ounces (Moz) outstrips the total silver supply of 1,030 Moz.

Since 2016, silver has experienced a 50.68% increase in demand for electrical, electronics, and photovoltaic applications.

And get this: we only mine 835 Moz per year.

The math simply doesn’t work.

Silver isn’t just a hedge anymore. It’s the irreplaceable ingredient for 21st-century tech. Solar panels devour it. EVs need more of it than your old gas guzzler ever did. Every phone, laptop, and 5G tower runs better with silver inside.

Meanwhile, supply isn’t keeping up. Silver is primarily a byproduct of other mining operations, and its output is stagnating. You can’t just snap your fingers and bring a new supply online—it takes years.

Result? A structural shortage. Not a temporary kink. Not a one-off squeeze. A real imbalance that keeps a floor under the market.

Why This Isn’t 1980 or 2011

Every silver skeptic has the same two bullets loaded in their chamber: 1980 and 2011. They pull the trigger on those dates like they’re gospel: “See? Silver always spikes to $50 and then crashes back into the mud.”

Let’s set the record straight.

In 1980, silver’s moonshot had a name: the Hunt brothers. Nelson Bunker and William Herbert Hunt attempted to corner the silver market, purchasing physical bullion and futures contracts in large quantities. At one point, they controlled a third of the world’s deliverable supply.

The price soared to $50, but it wasn’t natural market forces driving it. It was a speculative attempt at a monopoly. Then came the smackdown: the COMEX changed the rules mid-game, raising margin requirements and banning new long positions. The bubble imploded, the Hunts went broke, and silver cratered.

That episode tells us more about regulatory overreach and concentrated speculation than it does about silver’s actual value. It was a corner, not a secular repricing.

Fast forward to 2011. Silver’s spike back toward $50 wasn’t about monopolists but about fear. Europe was in the midst of a full-blown sovereign debt crisis, the U.S. had just suffered its first-ever credit downgrade, and investors were in a state of panic.

Gold and silver both ran hot as traders piled in. But notice what was missing: industrial demand. Solar was still niche. EVs weren’t mainstream. Electronics used silver, sure, but not at the scale they do today. The 2011 rally was a classic “fear trade.” Once the panic subsided, so did the price of silver. Back to the mid-teens it went.

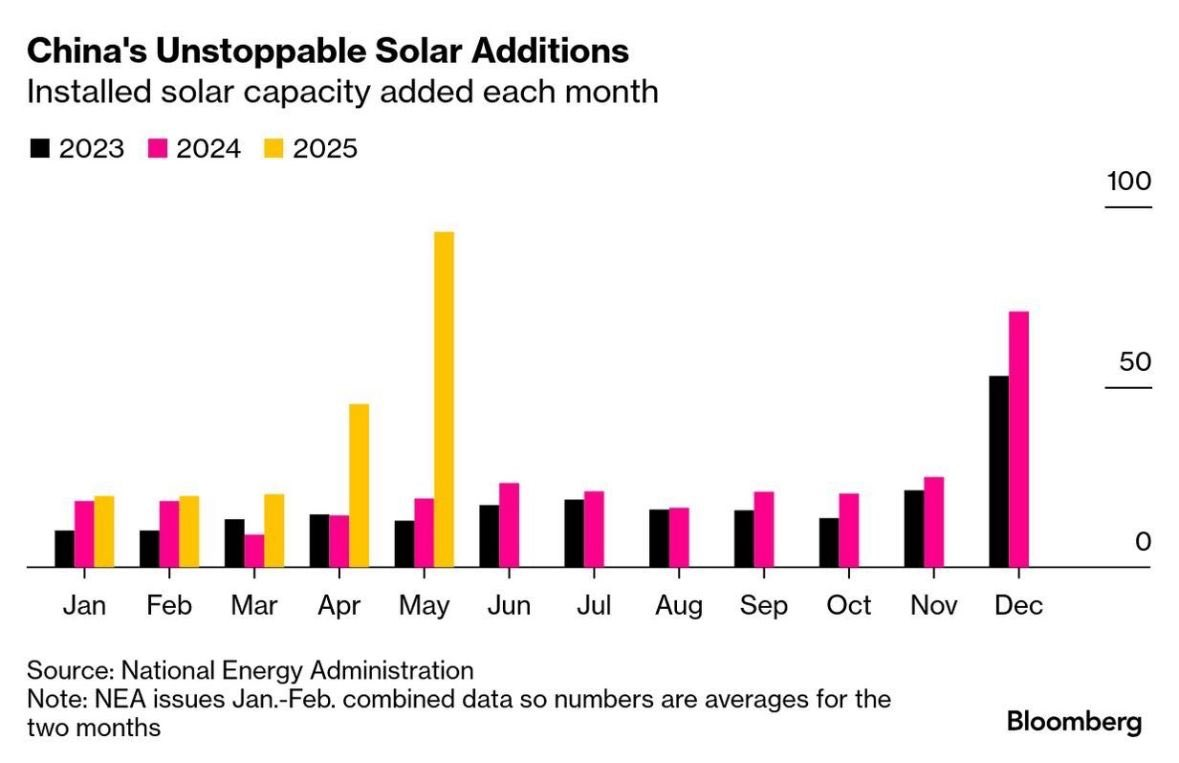

Finally, my friend and colleague Adam Sharp posted this in Paradigm’s editorial chatroom:

We didn’t have to worry about China in 1980 or 2011.

Don’t Forget Psychology

Markets aren’t just math and fundamentals—they’re also mania and mood swings. Psychology is the accelerant that takes an orderly rally and turns it into a stampede.

Silver is a perfect candidate for this kind of hysteria. Why? Because it’s been the “forgotten metal” for so long. Investors dismiss it as too small, too volatile, too messy. But once it crosses that magical $50 line, the narrative flips overnight: silver becomes the one asset nobody can afford to ignore.

And here’s the kicker: psychology doesn’t just respond to fundamentals—it creates them. Once silver gets the label of “new all-time high asset,” that badge of honor generates its own capital flows. Momentum becomes self-fulfilling.

We’ve seen this movie before. Tech in 1999. Housing in 2006. Crypto in 2021. The difference is silver isn’t some synthetic asset or vaporware—it’s a scarce, industrially essential metal. So when the crowd pours in, it’s piling on top of a story that already makes sense.

In other words, don’t underestimate the herd. Once $50 silver hits the headlines, the mob will show up, and they won’t be asking whether it’s sustainable. They’ll be asking how much higher it can go.

Wrap Up

Will silver, currently at $47.50, collapse back to $30 in a few months?

Not likely.

Between capital rotation out of bloated tech, the shift out of Treasuries into gold, and silver’s industrial demand outstripping supply, we’re looking at something much stickier.

Sure, silver will stay volatile—it’s in its DNA. However, this time, $50 won't be a significant increase. It might be the new baseline.

In other words, silver won’t just fly to $50—it’ll pitch a tent, plant a flag, and start charging rent.

Have a great day!

Equities and Metals Soar in a September to Remember

Posted October 01, 2025

By Sean Ring

Keep These Things In Mind When Riding the Wave

Posted September 30, 2025

By Sean Ring

Pennies and Steamrollers

Posted September 29, 2025

By Sean Ring

Blue Orca Hates Aya Gold & Silver

Posted September 26, 2025

By Sean Ring

The Duke, the King, and the Great Auto Loan Con, Part II

Posted September 25, 2025

By Dan Amoss