Posted May 06, 2025

By Sean Ring

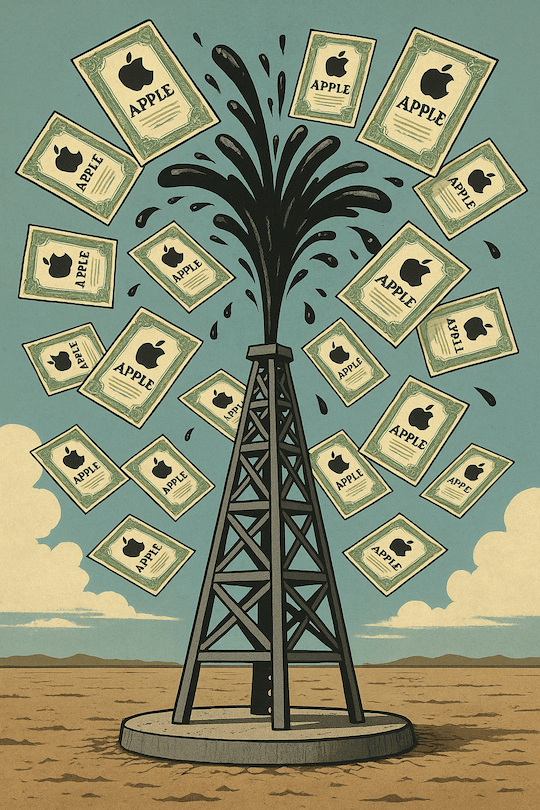

Turning Oil Into Apple

I walked outside the Abu Dhabi Investment Authority (ADIA) office on a hot day in the Emirates in 2019. I had just taught a graduate class on macroeconomics for traders and thought the day went well.

ADIA’s building is across Corniche St. from the beach, so I strolled through the pedestrian tunnel under the highway until I reached the boardwalk. From there, it was only an hour’s walk into the sunset to my hotel in Etihad Towers.

As I had already changed into sneakers, I put on my sunglasses and tightened my backpack. As I walked, I thought, “A sovereign wealth fund is a fantastic thing.” You can take the income you make from what you’re good at and use it to diversify into investments that can secure your country’s future.

ADIA was turning oil into AAPL shares… prime real estate in major cities… U.S. Treasury bonds… investments in hedge funds… and more.

“These Arabs know what they’re doing,” I thought to myself.

But does that apply to all countries? And would it apply to the United States? Let’s examine.

What’s a Sovereign Wealth Fund?

You may have heard whispers. Now it’s official: the U.S. is gearing up to launch its sovereign wealth fund (SWF). If that term sounds like something out of a global finance textbook, it is. But it’s also a concept that could dramatically reshape not just America’s role in markets… but your portfolio, too.

So, what is a sovereign wealth fund?

At its core, an SWF is like a national investment account — a pot of money set aside by governments to be invested in assets like stocks, bonds, real estate, private equity, or even cryptocurrencies. The aim? To grow national wealth, diversify away from core revenue streams (like oil), and secure financial stability for future generations.

As good friend and colleague Jim Rickards puts it:

Some reserves would be kept in liquid, safe investments at central banks, but other reserves could be placed in a separate entity that would invest in riskier but higher-yielding assets.

Think of it as a national side hustle… with trillions at stake.

A Short History of Big Money

SWFs aren’t new. Kuwait launched the first in 1953, wisely realizing their oil money wouldn’t last forever. From there, the concept spread slowly until it caught fire in the early 2000s. Between 2006 and 2012, over 30 new SWFs came online.

Today, there are 99 SWFs on six continents, with $9.1 trillion in assets under management. Most of that wealth — over 78% — is controlled by just 10 of the biggest players. The global asset mix? About 30% equities, 28% bonds, and 23% in private equity and hedge funds. Surprisingly, most SWFs hold very little gold — that remains the central banks’ domain.

SWFs invest similarly to pension funds and endowment funds. Their time horizon is limitless for all intents and purposes, which means they can take risks most investors can’t.

Oil Rich, Asset Smart

Let’s discuss examples. You may have heard of Norway’s famous Government Pension Fund Global. At $1.7 trillion, it’s the largest SWF on the planet. Funded by oil revenues, it invests in over 9,000 companies across 70 countries. The logic is clear: don’t rely on fossil fuel profits forever. Make your wealth work harder—and more sustainably—in global markets.

The same goes for Saudi Arabia’s Public Investment Fund ($925 billion) and Abu Dhabi’s ADIA ($1.1 trillion). These Gulf states understand that black gold is a finite blessing that can become a curse if not managed carefully. Diversification isn’t just smart; it’s existential.

Jim points out:

Over 57% of all SWF assets are funded by natural resources such as oil, natural gas, hydroelectric, strategic metals, and grain.

Even China gets in on the game, with two giant SWFs — the China Investment Corporation (CIC) and SAFE — managing a combined $2.4 trillion.

And lest you think it’s all passive investing, Rickards reminds us of the geopolitical stakes:

The line between legitimate SWFs and weaponized SWFs is not always clear.

Enter Trump: A Made-in-America SWF?

So what happens when a country with no trade surplus — and a massive debt problem — decides to launch a sovereign wealth fund?

Jim flags this as the trillion-dollar question:

Almost all SWFs are funded with trade surpluses. The U.S. has a trade deficit. How would a U.S. SWF be funded?

Trump has a few ideas. One is to borrow and issue bonds and fund the SWF with debt. That’s one way to do it… But it’s hardly conservative.

Another option is to use tariff revenue, especially as Trump escalates the trade war with China. Rickards estimates tariffs could generate $10 billion annually—a decent starting capital for a U.S. SWF.

But the most intriguing — and controversial — option is funding the SWF with seized crypto assets. Trump’s March 6th executive order created the “Strategic Bitcoin Reserve and United States Digital Asset Stockpile.” This could eventually merge with the broader SWF to form a dual-asset juggernaut of Bitcoin and financial instruments.

All this raises a final — and critical — question for Jim:

Will the fund be managed strictly for high risk-adjusted returns or weaponized to pursue geopolitical goals through financial manipulation?

Because let’s be real: the U.S. isn’t Norway. If we build a sovereign wealth fund, it’s likely not just for national retirement savings. It might be another arrow in the financial warfare quiver — a tool to flex American power in boardrooms and stock exchanges worldwide.

Wrap Up

A U.S. sovereign wealth fund will have enormous market-moving potential. Whether it buys AI stocks, shores up domestic infrastructure, or hoards Bitcoin… it will shift the financial landscape.

That means new tailwinds for some assets — and sudden headwinds for others.

As always, the key is to stay informed, agile, and skeptical of official narratives. You don’t want to be caught on the wrong side of the trade when Uncle Sam becomes a market whale.

We’ll be watching this closely — and I’ll be here to break it down for you, every step of the way.

How to Retire Without Running Out—or Running Scared

Posted May 16, 2025

By Sean Ring

Beware the Ides of May

Posted May 15, 2025

By Sean Ring

Trump’s Riyadh Revival: Peace Through Power—and Profit

Posted May 14, 2025

By Sean Ring

Oil, Guns, and Freedom: Alberta’s American Dream

Posted May 13, 2025

By Sean Ring

GREEN NEW SCAM: Biden’s $93 Billion Crony Climate Heist

Posted May 12, 2025

By Sean Ring