Posted December 04, 2024

By Sean Ring

Trump Throws BRICS

“If he paid me what he’s paying them to get me to stop robbing him, I’d stop robbing him!” Paul Newman’s Butch Cassidy shouted incredulously in the 1969 classic Butch Cassidy and The Sundance Kid.

I thought of Newman’s great line not because the parallel is exact, but because Trump knows America will fall off a cliff economically if the dollar loses its reserve status.

Funnily enough, the only thing Trump has to do to get those countries from stop leaving the dollar is to stop the sanctions and tariffs.

The thing is, though, that those countries wanting to leave the dollar system aren’t robbing the United States. They’re merely protecting themselves from America’s aggressive sanctions policy. Not everyone is practically immune to sanctions, like Russia. Heck, sanctions seem to improve Russia’s economic performance. (Canada is a different story entirely.)

For those pointing to recent ruble weakness, look at how the dollar has trounced all comers. In short, that’s a strong dollar thing, not a weak ruble thing.

Look, I want to be optimistic and think 2025 will be a great year. But I don’t think The Donald has considered some of his policies—or pronouncements—thoroughly enough.

I recently wrote about how Trump is a libertarian domestically while he’s mercantilist regarding foreign policy. The more I listen to my colleagues at Paradigm Press, the more skeptical I become about this two-pronged approach.

Let me explain.

Tariffs

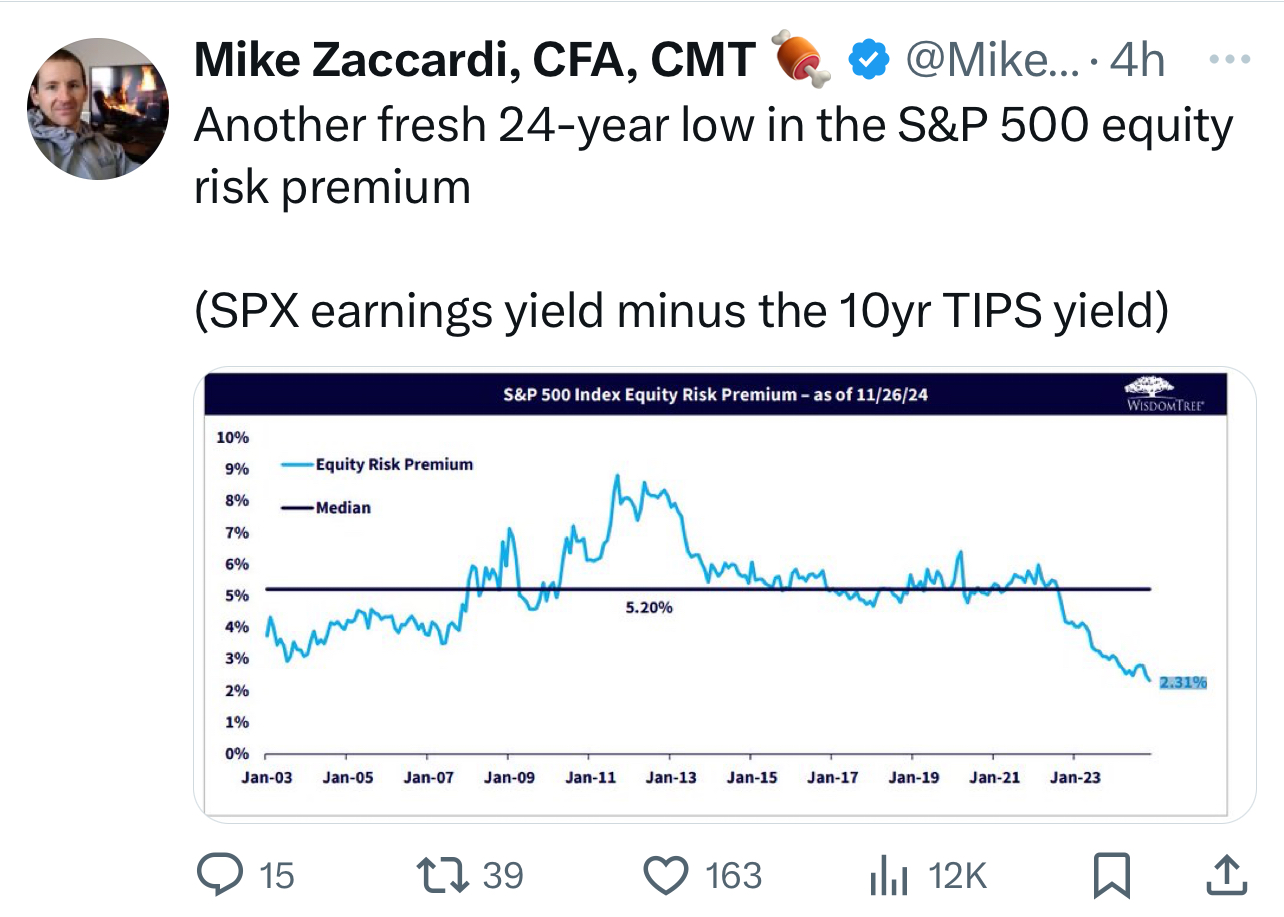

Big-time investor and Paradigm contributor Bob Byrne brought up the idea of tariffs in our last editorial meeting. How on earth will The Donald make that work with countries like China? According to Bob, an across-the-board tariff would almost certainly hurt the S&P 500.

Why?

Let’s hash it out:

A 20% across-the-board tariff, say, would likely hurt stocks because it would increase costs for businesses and consumers while slowing economic growth.

Companies that rely on imported goods would face significantly higher costs, directly through tariffs on raw materials and finished products or indirectly through increased supplier costs. Many firms, particularly multinationals, wouldn’t be able to pass these costs to consumers, reducing earnings and squeezing profit margins. This would hurt sectors like industrials, consumer discretionary, and technology, which rely heavily on global supply chains.

Higher prices on imported goods would erode consumers' purchasing power and reduce demand for goods and services, hurting revenue for many businesses.

Retaliatory tariffs imposed by other countries would further harm U.S. exporters, including manufacturers and farmers, adding to the economic slowdown. Combined, these effects would drag down GDP, raising concerns about weaker corporate earnings growth and increasing the risk of a recession. Our friend and colleague Enrique Abeyta often emphasizes how significant earnings growth is to stock price increases.

In financial markets, the announcement of such tariffs would likely trigger a sharp sell-off in equities as investors react to increased uncertainty and repricing of risk. The SPX could see a decline of 5-10% or more in the short term as investors digest the potential for reduced corporate profitability and slower economic growth.

While some domestic-focused sectors, like utilities and healthcare, might be more insulated, the broad impact of such tariffs would weigh heavily on investor sentiment and market performance. Historical examples, like the recent U.S.-China trade war in 2018/2019, show that protectionist measures lead to significant market volatility, and across-the-board tariffs would likely exacerbate this effect.

Next is the trade balance.

The Trade Balance

Dan Amoss, the hardest-working man in the newsletter business, brought up an excellent point about the trade balance.

To set the scene, right now, when Americans buy goods from abroad, they pay in dollars. Those exporters recycle those dollars into the U.S. stock, bond, and real estate markets. If Trump is serious about reinvigorating the manufacturing sector, and he is, he’ll be asking those exporters to buy American goods and services with the money they currently use to prop up our stock, bond, and real estate markets.

This is a huge problem, as those exporting countries must economize. Will Trump follow through with this policy if the SPX falls off a cliff because of a lack of foreign inflows? It's a big question with an unknowable answer.

And what about Russian missiles?

Hypersonics

@rickhagerbaumer3985 wrote, “Best, most informative, video I have seen since we got involved with Ukraine!! Ty Ty Ty.”

@kathygiddens7089 commented, “I'm amazed, Byron, at your weapon description. Very interesting! You have widened my mind re: Russia. Please post on the Paradigm site a list of books you recommend--your choices of whatever you think intelligent Americans should feast on.”

@kylecollins7079 wrote, “Great analysis. It is such a slap in the face to Americans to escalate this war.”

Click the link here or above to watch it. Be sure to watch it at 1.5x speed: you’ll get all the information faster without missing anything.

But the part about the hypersonics is worth writing here:

On Thursday late in the evening, two days later, the Russians fired one missile back. Now, not just any old missile; it was an intermediate-range ballistic missile, an IRBM, not an intercontinental missile, not like one of these big things that you fire from Russia, and it can hit Washington or Texas or Los Angeles.

It's on a mobile system. It's on a truck. They raise it, and 30 minutes before the launch, the Russians get on the phone and call Washington D. C. and say, per the various treaties —I'm paraphrasing—we're going to launch a missile in 30 minutes.

Okay, the rocket does its thing. It gets up into orbit. What they call the bus flies through the sky, turns around, and has six warheads: multiple independently targeted reentry vehicles, MIRVs.

Now, this is where it really gets interesting. This is where Russian math, physics, and chemistry show their stuff. So all these six vehicles separate from the bus. Now, on a US MIRV, the warheads fall ballistically. That means gravity hauls them down. [But on this Russian MIRV], each one of these things was its own rocket.

It starts shooting them down: 1, 2, 3, 4, 5, 6. Now, each of these warheads breaks into another six pieces. We'll call them submunitions.

They hit the target in Ukraine. Each one of these things hit the ground in a very, very rapid sequence, putting all this energy into the ground, basically causing a giant earthquake, you might say, and the target was completely destroyed.

There were a couple of accounts that came out of Ukraine that, you know, people went to, but there's nothing there anymore. It's all dust. It's all rubble. It destroyed everything. Now, this is not a nuclear weapon. And it's barely a conventional weapon, in the sense that there's no high explosive to it.

The U.S., UK, and NATO have no answer to hypersonic weaponry. Talking tough isn’t going to help.

The BRICS Wall

Returning to what I started with, Trump’s negotiating style is now well-known. He’ll threaten all sorts of stuff, but the U.S. can’t live without China’s current exports. Maybe in the future, but not right now.

Just as you can’t tax yourself into prosperity, you can’t tariff yourself there, either.

I agree.

The only answer is unpalatable to many Americans, especially in The Swamp. Trump must immediately drop all sanctions and promise not to use the dollar or SWIFT punitively again.

Then he must graciously exit the Russia-Ukraine war by accepting Russia back into the international fold while rebuilding Ukraine for Ukrainians, not for BlackRock.

But that isn’t happening right now.

And yet:

The markets are just moving along, which is what scares me.

Wrap Up

Sanctions, tariffs, trade, and missiles are all on the docket and must be addressed. How will President Trump deal with these critical areas once he realizes America’s hand isn’t as strong as it was during his first administration?

A well-running economy and world peace depends on his response.

Isn’t Mining Dangerous Enough?

Posted February 11, 2026

By Sean Ring

A Tale of Two Italys

Posted February 10, 2026

By Sean Ring

Take The Money and Rotate

Posted February 09, 2026

By Sean Ring

The Metal That Powers AI

Posted February 06, 2026

By Matt Badiali

ANNIHILATION!

Posted February 05, 2026

By Sean Ring