Posted May 03, 2023

By Sean Ring

Today’s the Big Day: Does Powell Hike?

- The Rude’s position has been that Powell and Co. will hike.

- More importantly, what does the Fed signal for the next few meetings?

- Yesterday was ugly for the stock markets, down over 1% each.

Happy Hump Day from a sunny Asti!

Today feels both important and anti-climactic.

What the Fed does matters. Unfortunately. I wish for a return to the days when the Fed’s actions were an afterthought. But we don’t live in that world anymore.

On the other hand, a rate hike of 25 bps is nearly a certainty and is priced into the market. Well, it looks like the market priced it in yesterday.

The SPX and Nasdaq were each down 1.08%, while the Dow fell 1.16%.

The likeliest scenario for the drop is that the markets are incredibly concerned about the regional bank situation. You know, the problem the Federal Reserve, Treasury, and FDIC created themselves.

And that’s the onion.

We know Powell wants to hike more and is not keen on watching stock markets. But he can’t hike to the point that his banks break.

Like we said many times, the Fed has painted itself into a corner by not starting the hiking cycle soon enough, and then hiking too quickly once it belatedly started.

As Vivek Ramaswamy wrote in his Wall Street Journal op-ed piece, “The global market will hang on every word of every FOMC press conference to see what a dozen central planners have to say. That won’t be because these planners have any special insight. Everyone will listen to see what the Fed may destabilize next.”

That’s a swift kick in the gooey bag if I ever read one!

Let’s stick with Mr. Ramaswamy as we open today’s Rude.

An Op-Ed For the Ages

If you haven’t heard of him, Vivek Ramaswamy is an Indian-American entrepreneur running for the Republican nomination in 2024.

He’s the one of whom Don Lemon said, “...whatever ethnicity you are…” which led to Lemon’s firing. On that score alone, we like Ramaswamy.

Though he graduated from Harvard and Yale Law School, Ramaswamy is refreshingly anti-woke. And he seems to lean toward Austrian Economics over Keynesian. How this miracle took place, in spite of his Ivy League education, is a mystery to me.

He is the founder and executive chairman of Roivant Sciences, a biopharmaceutical company that creates and develops innovative medicines. He’s allegedly worth roughly $600 million.

Ramaswamy has been recognized as a Forbes 40 under 40 honoree and a World Economic Forum Young Global Leader. Ok, no one’s perfect.

But what Ramaswamy wrote in the Journal is worth noting. Most presidential candidates have only a passing knowledge of economics. This guy intimately understands how monetary policy works.

He writes (bolds mine):

Attempting to balance low inflation and full unemployment—trying to hit two targets with one arrow—has proved to be disastrous since the Phillips Curve cult gained prominence at the Fed around 2000. If elected president, I will return the Fed to a narrower scope: preserving the U.S. dollar as a stable financial unit to help prevent financial crises and restore robust economic growth.

Beginning in the 1980s and lasting through most of the 1990s, the Fed governors, including Vice Chairman Manley Johnson and Wayne Angell, used a framework first adopted by Paul Volcker in 1982 to stabilize the dollar. The idea was to consider the dollar’s value in terms of commodities, letting it serve as a reference point for other nations’ floating fiat currencies. This provided financial stability for two decades following the stagflation of the 1970s.

Beginning in the late 1990s, the Fed’s scope drifted to include “smoothing out” business cycles.This was a mistake, since business cycles serve a healthy function by transferring the assets and employees of poorly run companies to more capable management. Even worse, the Fed’s actions often exacerbated business cycles by creating transitions that create boom-bust-bailout cycles instead.

Business cycles indeed serve a healthy function. But if you’re an overpaid CEO, you never want the party to end.

And speaking of boom-bust-bailout cycles, let’s look at another Fed-created problem: the regional bank run.

The Regional Bank Headache

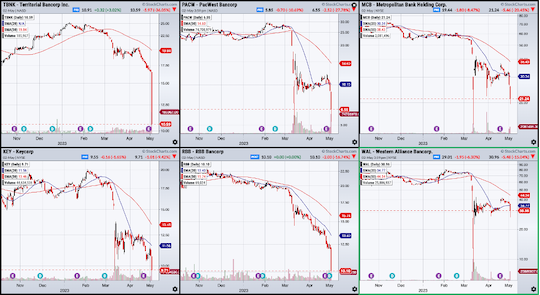

Let’s look at some of the regional bank stocks from yesterday:

That chart may be difficult to see, but Territorial Bancorp (TNBK) was down over 36% yesterday. In the lower right corner, Western Alliance Bancorp (WAL) was down merely 15%.

It was an entirely avoidable bloodbath.

Let’s talk about this Fed-induced problem.

I wrote how upset I was that the Fed, Treasury, and FDIC didn’t just let Silicon Valley Bank (SIVB) go bankrupt.

But with clientele like Oprah, Harry, and Meghan, the Democrats couldn’t let that happen.

And that’s a shame.

Because had the Fed just let SIVB go, this regional bank problem wouldn’t exist.

When the USG said they’d bail out SIVB, initially, they said they’d cover all deposits in the system regardless of size. (That’s absurd on its own merits.)

Useless Yellen later said the Treasury wouldn’t insure all deposits, but would review things on a case-by-case basis.

This signaled to the world that there’s a special club, and you ain’t it (a la George Carlin).

What was a perfect opportunity to take the froth off the top of the market became a blunder that put pressure on the regionals.

Why is that?

The question became, “Why would you stick your money in the regionals when they might not be protected?”

Of course, we still have a commercial real estate problem. But trust and safety are a far bigger problem, especially when you’re dealing with business deposits.

And not only that, the regionals weren’t getting audited worth a good goddamn.

Get a load of this.

An Auditor Goes 3-for-3

I try to avoid The Financial Times, or as it’s commonly called, The Pinko Paper, because it’s such a lefty Eurotrash rag nowadays.

But this article made me sit up.

Credit: ft.com

Can you believe KPMG audited these banks?

Look, it’s tough to predict a bank run. But there wasn’t a sniff of “they’re long US 30-year bonds and are unhedged.” Or “They may have problems with crypto.”

This was another problem from 2008 that was never addressed, let alone solved.

When you pay your auditor to audit you, you’ve had to have done some severe damage for them to raise the flag.

So these banks just kept on trucking without a word of warning to their shareholders and customers.

It’s ludicrous.

Wrap Up

The Fed’s rate decision today is almost an anti-climax.

What will Chairman Pow do next? Continue to raise rates despite the bank run?

Or will the Fed signal a pause to let the US economy and its bank catch its breath?

All will be revealed this afternoon.

Have a great day ahead!

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali

How Options Boss Stocks

Posted February 20, 2026

By Nick Riso