Posted July 20, 2023

By Sean Ring

Throwing BRICS Through Wall Street’s Windows

- Jim Rickards awaits the dollar implosion.

- The new BRICS currency will muscle in on the USD’s territory.

- What should be your move?

Good morning on this sweaty Thursday in NYC!

An everything bagel with cream cheese and a cup of coffee off the cart. For some reason, I hear the great sportscaster Bill Mazer’s dulcet tones as I chomp away.

There are fewer things more New York than that. I must admit, I still love the old ways.

I think of when I entered banking and how the world seemed so stable then.

America won the Cold War and was the world's undisputed leader. Russia was “finished.” China wasn’t a concern. We went on vacation.

The only money you wanted was the dollar.

Everything else was lesser.

As I look at these new, young bankers, I see they’ll have to contend with things I’d have never dreamed of.

Imagine having to wake up early to check the price of gold in Shanghai.

Imagine wondering what some far-off country like India is doing with its economy.

Imagine considering what countries to put their clients’ savings in because the dollar has fallen out of favor.

It’s incredible to me.

But it will be their future and their duty to their clients.

Let’s delve into the new, purported BRICS currency.

Rickards on the BRICS

Here’s what Jim had to say in the Daily Reckoning:

The bigger-picture reality is that after 79 years under the Bretton Woods arrangements, 52 years since Nixon closed the gold window and 49 years since the petrodollar agreement with Saudi Arabia, the reign of King Dollar as the world’s leading payment currency is rapidly coming to an end.

This should come as no surprise since global monetary arrangements usually change every 40 years or so.

Nonetheless, the world is unprepared for this geopolitical shock wave. Western elites appear to have been asleep at the switch for the past several years as the BRICS rose in prominence. They’re still asleep.

When I met Jim in Jekyll Island, we spoke about this very thing at the Whisky (No “e”) Bar.

Jim patiently explained payment currencies versus reserve currencies and how he thought the dollar could be replaced.

Nothing that’s happened since then has proven him wrong.

How It Will Work

Jim continues:

What will happen is that the value of one Bric will be determined by reference to the weight of gold.

This plays to the strengths of BRICS members Russia and China, who are the two largest gold producers in the world and are ranked sixth and seventh respectively among the 100 nations with gold reserves.

We don’t know the weight yet, but 8 grams seems a reasonable estimate. That would make one Bric = 8 grams = $485 at today’s market. That’s just my estimate; other weights are possible.

So what you’ll notice from this calculation is that 1 Bric = $485. Still, that is not a fixed exchange rate between the Bric and the U.S. dollar. If the dollar price of gold goes to $2,500 per ounce, then 1 Bric = 8 grams = $643.

In this case, the Bric is unchanged in terms of gold (by weight) but has gained 32% against the dollar. What has really happened is that the Bric is constant (in gold), but the dollar has collapsed.

No one knows how it’ll work, but Jim’s estimate seems reasonable. At this point, near enough is good enough.

So… what does this mean for you?

What Do You Do?

It’s not unreasonable to think the market is wary of the USD. Here’s a chart of the Dollar Index:

I don’t have to tell you that chart is uglier than a drunk carpenter’s thumb.

Let me put it plainly. Chairman Pow has hiked ten times in the last year and a bit, and the dollar is falling.

What new financial devilry is this?

May I remind the court that the euro - toilet paper par excellence - is 57% of the dollar index basket?

For what reason could this be happening? Is the market readily acknowledging King Dollar’s days are done?

Kaput. Finito. End of.

If that’s the case, then what on earth do you do?

I’ll answer it like this: if the dollar is falling in value, then things priced in dollars will rise.

Here’s the Nasdaq:

It’s up 4,000 points since January, and there are no signs it’s stopping. It’s still a screaming buy at the moment.

Ok, gold hasn’t been as hot as tech. But if you think gold will have to be revalued to a few thousand dollars per ounce in the new world, you should back up the truck and load up right now.

Bitcoin has nearly doubled this year.

$42,000 is within reach of here.

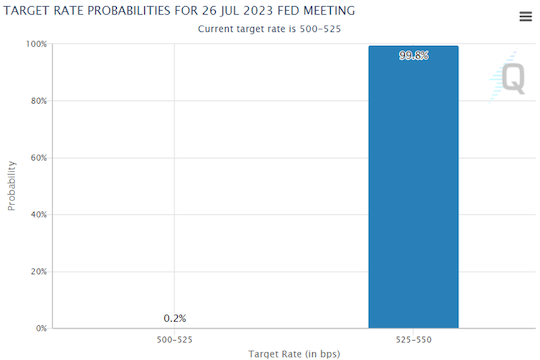

All this, with the markets pricing in an almost certain rate hike next week:

Credit: CME FedWatch Tool

This is the time to take advantage of the market working your money for you.

Wrap Up

This may be the beginning of another time… another epoch… another age.

The Age of the BRICS.

I’m reminded of Francis Urquhart in the second series of the UK’s version of House of Cards named To Play the King:

A new king. A new age, of hope and peace and spiritual growth, et cetera. And I'm still here… for my sins.

Aren’t we all?

Have a great day!

The Pentagon Pays the Piper

Posted March 06, 2026

By Byron King

Vicious Patriotism

Posted March 05, 2026

By Sean Ring

Don’t Overprice Risk with Mining Companies

Posted March 04, 2026

By Matt Badiali

America First!

Posted March 03, 2026

By Sean Ring

WAR! What’s It Good For?

Posted March 02, 2026

By Sean Ring