Posted June 19, 2025

By Sean Ring

This Banker Keeps Hitting the Snooze Button

I'm not sure if you've noticed, but “not doing something” is now a monetary policy.

On Wednesday, the Federal Reserve did exactly what everyone expected—and still managed to disappoint almost everyone. They held rates steady, while simultaneously letting everyone know they might cut later this year if the stars align, inflation behaves, and the wind blows in the right direction.

Niki Timiraos (NikiLeaks) over at The Wall Street Journal, in his usual calm tones, framed it like this: “To resume rate cuts that they started last year, Fed officials are likely to need to see either labor markets soften or stronger evidence that price increases due to tariffs will be relatively muted.”

Meanwhile, ZeroHedge quoted The Donald as calling Powell “stupid” for not cutting. "We have a stupid person, frankly, at the Fed; he probably won't cut today," Trump said, hours before the Fed decision urging Powell to cut rates by 2.5 percentage points.

“I call him ‘Too Late Powell’ because he’s always too late.”

“What is wrong with Too Late Powell? Not fair to America, which is ready to blossom? Just let it all happen, it will be a beautiful thing!”

Let’s unpack this.

Powell: The Hamlet of Central Bankers

Jerome Powell has become the Shakespearean character Hamlet, with a Bloomberg terminal.

“To cut, or not to cut? That is the question.” And he dithers.

The Fed is supposed to be “data dependent,” which in Fed-speak means “we won’t anticipate what must be done. Therefore, we’ll always be just a little bit late.” But even Powell couldn’t ignore the fact that May’s CPI came in cooler than expected. Core inflation fell to its slowest pace since 2021. A real signal. A potential pivot point.

So what did Powell do?

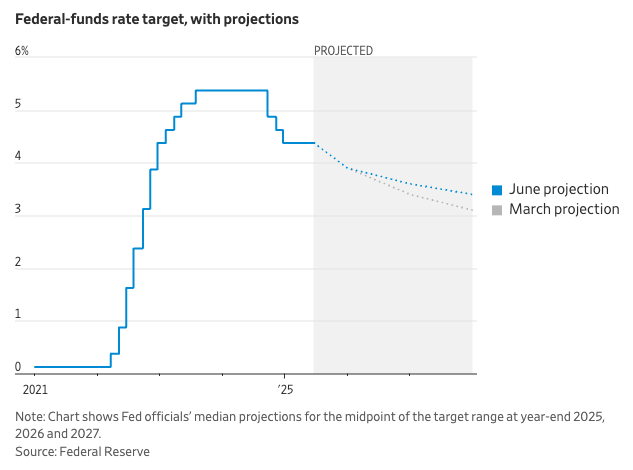

He cut the number of projected rate cuts this year from three to one. That’s right. He lowered the odds of a cut… the same day we got disinflationary data. If that’s not peak institutional gaslighting, I don’t know what is.

Markets Wanted a Pivot—They Got a Stalemate

The S&P 500, which had been pushing toward all-time highs, stuttered. Bonds rallied briefly before fading. Gold sniffed the stupidity and added a few bucks. But the real takeaway?

Markets are losing faith in the Fed's ability to steer the economy.

The forward guidance game is broken. Remember when a few carefully chosen words from Alan Greenspan could calm entire continents? That’s dead. Now, Powell says “one cut,” and the entire Street goes: “Sure, buddy. We’ll price in two anyway.”

Which they did.

Fed funds futures are now pricing in 1.9 cuts by December. In other words, the bond market is already calling Powell’s bluff.

Credit: The Wall Street Journal

Heads You Lose, Tails You Also Lose

The problem, of course, is fiscal dominance. I’ve written about it. Heck, I’ve screamed about it. Now it’s chewing through the walls of the Eccles Building.

With $35 trillion in federal debt, every uptick in rates turns into an exponential increase in debt service. In FY2024, we’ll spend more on interest than on national defense. The USG is the most overleveraged hedge fund in the world—and Powell is its reluctant risk manager.

If he cuts, he’s admitting inflation is dead—and possibly risking a bubble explosion. I think this is a low probability scenario, as long as oil prices don’t surge to the upside.

If he doesn’t cut soon, he risks crushing the Treasury under interest expense. This is a highly probable scenario.

So he splits the difference. A non-cut, with a vague promise of a maybe-cut. It’s like promising to diet tomorrow, after the pizza arrives.

Gold, Silver, and Sanity

So what do we do? The answer isn't more FOMC bingo.

This is the kind of environment where hard money thrives. Because sooner or later, Powell’s going to cut. Powell will be forced to cut, unless the U.S. economy stages a remarkable turnaround.

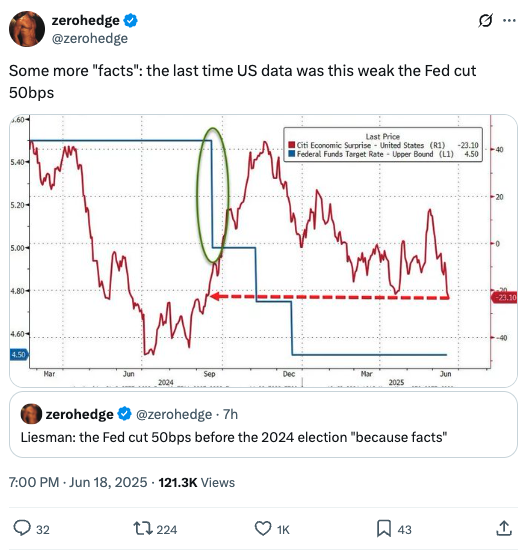

The last time the economy was this slow, the Fed cut by 50 basis points. You know, when the Democrats were in electoral trouble…

Credit: @zerohedge

Gold’s resilience near all-time highs despite rising real yields tells you all you need to know. Silver, the high-beta cousin, has bounced hard and still feels underowned. If Powell does cut before year-end (which I still believe he will), the precious metals trade will ignite again, much like it did in 2010.

The dollar is weak, trading at a 98 handle in the dollar index. Underneath the surface, the faith in fiat is eroding. Not just in the U.S., but everywhere. That’s why gold is up in every major currency, not just the dollar. When rates and the dollar fall further, the metals will explode to the upside.

Wrap Up

This isn’t just about Powell. It’s about the whole central planning paradigm.

The idea that a dozen unelected technocrats can manage a $27 trillion economy with precision-engineered rates and sterile press conferences is laughable. But we’ve played along because it worked—until it didn’t. That, and no one has read “I, Pencil.”

Now the limits are showing. Powell is boxed in. Congress is addicted to spending. So the Fed pretends. The media nods. And the market… prices in a future that probably won’t happen.

That’s your real signal.

When fantasy collides with debt math, it’s not a soft landing—it’s an impact crater.

Time to position accordingly.

“You Better Get A Big Shovel!”

Posted June 26, 2025

By Sean Ring

مرحباً بكم في مدينة نيويورك!

Posted June 25, 2025

By Sean Ring

A Most Cordial War

Posted June 24, 2025

By Sean Ring

“We’ll Be Welcomed As Liberators!” and Other Nonsense

Posted June 18, 2025

By Sean Ring

SHOCK AND OIL!

Posted June 17, 2025

By Jim Rickards