Posted April 04, 2023

By Sean Ring

The Tsunami Running Up a Canyon

- It’s not just Russia and China moving on from the USD.

- The Indian rupee has become the surprise currency of choice.

- The Global South doesn’t want sanctions and unpayable interest.

It’s another gorgeous morning here in Il Piemonte.

I hope the sun shines on you and yours and the coffee is fresh and aromatic.

Following on from yesterday’s monthly asset class report, where we brought good tidings for gold, silver, and bitcoin, I want to follow up with more information.

I saw some cracking videos and tweets this weekend that corroborate the theory that the USD will weaken substantially over time and that gold and silver will hit all-time highs.

Much to my shock, Bitcoin may do the same because that chart went from “broken” to “maybe we’ll hit $48,000” quickly.

I will put what I saw in a logical and easily digestible order, so that you can see what I see.

The upshot is this: because the dollar’s demand abroad is falling rather fast, those dollars will flood the US domestic market, driving inflation far higher than even Jay Powell suspects.

That inflation will drive the prices of gold, silver, and Bitcoin much higher than they are right now.

So even if you haven’t bought any of those yet, you have time.

Let’s begin.

The News

The fact that countries want to escape sanctions and high interest is not really news. But what is new is that there’s an alternative to the US dollar taking shape.

Most Western economists agree that unseating the USD is a near-impossible task. But none of these countries are listening to these economists.

In fact, it seems like the Global South will do anything short of madness to escape the grip of the USD… and USG.

It certainly helps when Russia forgives your debt, as they have in Africa… to the tune of $20 billion. When was the last time the Western world did that?

And don’t give me the appropriately named Band-Aid stuff. As in a “Band-Aid” on a broken leg.

The BRICS (Brazil, Russia, India, China, and South Africa) are working on a currency to displace the dollar.

ASEAN (Association of Southeast Asian Nations) comprises Indonesia, Malaysia, Philippines, Singapore, Thailand, Brunei, Laos, Myanmar, Cambodia, and Vietnam. The association is discussing reducing dependence on the US Dollar, Euro, Yen, and British Pound from financial transactions and moving to settlements in local currencies.

From the ASEAN Briefing:

Indonesian President Joko Widodo has urged regional administrations to start using credit cards issued by local banks and gradually stop using foreign payment systems. He argued that Indonesia needed to shield itself from geopolitical disruptions, citing the sanctions targeting Russia’s financial sector from the US, EU, and their allies over the conflict in Ukraine.

Moving away from Western payment systems is necessary to protect transactions from “possible geopolitical repercussions,” Widodo said.

Of the ASEAN nations, just Singapore has enforced sanctions on Russia, while all other ASEAN nations continue to trade with the country. There has been alarm at being caught up in US-led secondary sanctions, as are short to impact Central and South Asia countries involved in cotton manufacturing, a major industry in the region employing millions of people.

Before you dismiss these two economic blocs, have a look at their populations:

BRICS Nations:

- Brazil: 213.8 million

- Russia: 144.5 million

- India: 1.366 billion

- China: 1.394 billion

- South Africa: 59.6 million

- Total BRICS population: 3.178 billion

ASEAN Nations:

- Indonesia: 276.6 million

- Vietnam: 98.3 million

- Thailand: 69.8 million

- Philippines: 108.1 million

- Malaysia: 32.8 million

- Singapore: 5.7 million

- Brunei: 0.4 million

- Cambodia: 16.7 million

- Laos: 7.2 million

- Myanmar: 54.0 million

- Total ASEAN population: 669.6 million

Therefore, the combined population of BRICS and ASEAN nations is 3.178 billion + 669.6 million = 3.847 billion.

So, just under half the world’s population resides in these two blocs. They’re worth watching, aren’t they?

Even Senator Marco Rubio seems to have finally caught on:

Credit and watch the clip here: @Glenn_Diesen

The Explanation

Simple - but not oversimplified - explanations are always the best.

Peter St. Onge, Mises Fellow and Austrian economist, performs the impossible. He makes understanding reserve currency, the dollar system, and inflation easy.

Credit and watch the video here: @profstonge

I’ll paraphrase the professor’s video.

Professor St. Onge correctly states that though the USD is the world’s reserve currency, that status doesn’t benefit dollar holders. It benefits those who print the dollars. Those beneficiaries are the US Treasury (via the Fed) and the commercial banks (who get to make more loans because of higher dollar demand).

He asks us to think of it like this:

The Fed prints a “river” of ever-increasing dollars which flows into the “money-supplied reservoir” where domestic USD holders float. Another river flowing out of that reservoir matches foreigners' (formerly ever-increasing) demand for USD.

The dollars move through the domestic economy (the reservoir) out into the world economy without benefitting domestic USD holders.

Now imagine if those same foreigners now don’t want those dollars anymore. That could be because the Fed created too much inflation or countries pay for things with their currencies.

Those dollars would come flooding back up the river to the “money-supplied reservoir” of US holders.

The USD holders be inundated with dollars, driving up inflation and the prices of goods and services in the domestic economy. USD holders - especially US citizens that must deal in USD - would get their purchasing power wrecked.

Peter calls this the “Tsunami Running Up a Canyon,” from which this piece gets its title.

This doesn’t mean this will happen tomorrow. But it’s increasingly likely that it will happen.

Please watch the video if you have a chance. It’s well worth 4 minutes of your time.

The Charts

Before I get to the charts, good friend and ace Austrian economist Thorsten Polleit posted this video about the banking collapse and why it’s wise to hold gold and silver.

Credit and click here to watch: Thorsten Polleit

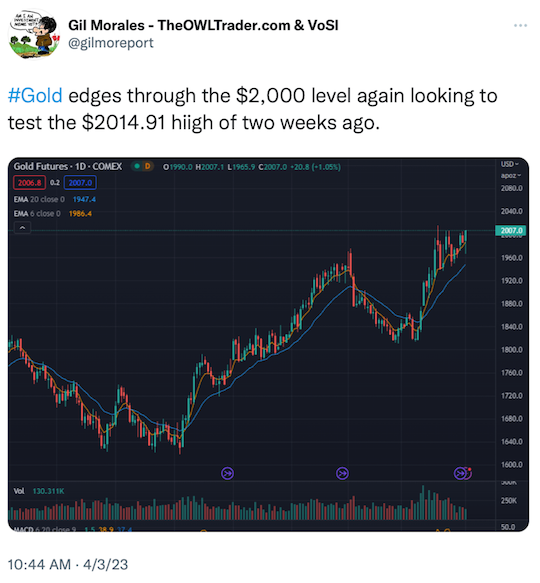

Here’s a great chart of Gold:

Credit: @gilmoreport via The Daily Chart Report

Up and to the right. We suffered through a dip.

It won’t be smooth sailing. But we’ll get up there. I’m still looking for $3,000.

Here’s Silver:

Credit: @TaviCosta

Yes, we can hit $48 when all is said and done. If we breach $50, the sky’s the limit.

As for Bitcoin:

We certainly can hit $48,000 from here. It’s not sure, but things are looking up.

Wrap Up

Things are in motion we can’t possibly stop.

But we can protect ourselves and minimize the harmful effects on our wealth. In fact, we can prosper during these turbulent times by buying metals that have withstood the test of time.

And maybe even the electronic version of it will shield us from the inevitable, imminent pain our brainless leaders have foisted upon us.

Have a great day ahead.