Posted February 07, 2025

By Dan Amoss

The Prick Who Pops NVDA’s Bubble

America's economic miracle wasn't built on steel and steam alone.

Behind the gleaming factories and thundering locomotives of the Gilded Age lay a quieter but equally revolutionary force: the art of cost accounting.

Wait! Come back! Accounting isn’t as dull as you think. I promise. If you give Dan a few more paragraphs, you’ll find out who the “villain” of this story is! - Seanie

As I was saying… we face today's technological revolution. This forgotten story is surprisingly relevant for investors watching the AI boom.

President Trump highlights McKinley-era tariffs and entrepreneurial zeal as driving this growth.

The late 1800s transformed America from an agricultural startup into an industrial powerhouse. While protective tariffs and entrepreneurial spirit played their parts, another hero worked behind the scenes: systematic cost accountants.

Stay with us… lax accountants allowed the USAID waste to go undetected for decades! Good accountants fix the problem. Read on. - Seanie

Systematic cost accountants turned chaos into order, allowing the industrial giants of the era to scale their operations with unprecedented efficiency.

Thomas King's 2006 book More Than a Numbers Game reveals a crucial truth: the massive enterprises of the McKinley era couldn't have succeeded without rigorous accounting systems tracking every penny spent and earned.

The most successful companies often maintained multiple sets of books, not to deceive, but to understand their businesses from every angle.

Consider Andrew Carnegie, whose mastery of steel production and cost control built an empire. His wisdom still resonates:

“Watch the costs, and the profits will take care of themselves.” – Carnegie emphasized that controlling costs was the key to sustained profitability.

“The true road to preeminent success in any line is to make yourself master of that line.” – By mastering steel production and cost control, Carnegie outcompeted his rivals.

Carnegie's philosophy wasn't unique. The railroad giants of the era developed equally sophisticated systems. Albert Fink, a pioneering railroad financial expert, captured this mindset perfectly:

“The first duty of railroad management is to ascertain the cost of transportation in all its details, and to adjust the business to the results.”

Fink's innovations in standardized cost accounting revolutionized how railroads calculated expenses per ton-mile and optimized pricing. His methods laid the groundwork for modern corporate financial planning, influencing future industrial titans and management theorists like Frederick Taylor.

The AI Revolution: A New Accounting Dilemma

Today's tech giants face a similar challenge: accounting for massive investments in artificial intelligence. The recent DeepSeek breakthrough in AI training efficiency highlights how quickly technological assumptions – and their associated costs – can change.

As King notes in his analysis of modern accounting challenges, the field always involves estimates and uncertainties. His provocative statement that “There's no such thing as an accounting mistake” takes on new meaning in the age of AI, where the value of digital assets can evaporate overnight.

Consider the billions of dollars major tech companies spend on Nvidia GPUs. These purchases are treated as capital expenditures, depreciated over several years. But if DeepSeek's low-cost training methods prove viable, these expensive chips may become obsolete sooner than their depreciation schedules suggest. By early 2026, tech giants may face significant write-downs of their AI infrastructure investments.

The “GAAP” Between Reality and Reporting

GAAP stands for Generally Accepted Accounting Principles. GAAP earnings for the S&P 500 always lag behind “operating” earnings.

At their worst, operating earnings are the accounting equivalent of walking toward a mirage in the desert.

The more capital-intensive a business, the more misleading operating earnings can be.

Consider the oil business. Capital spending is a high percentage of revenues, and drilling is a necessary part of the capital program. Without constant drilling, oil companies' revenue would eventually disappear. So, capital spending is a very real, vital process.

Ten years ago, the operating earnings numbers published by many in the oil industry did not reflect the amount of cash they could safely distribute to shareholders. To avoid being misled by a mirage, you must subtract the annual amount spent on drilling to maintain revenue.

At the trough of the oil shale drilling bust around 2015, shareholders plodded into the future, funding frenetic drilling campaigns with equity raises. They slowly discovered that EBITDA was not real liquidity. It was just dry sand, with the promise of liquidity always on the horizon. It was the ultimate tease for shareholders. Cash from shale oil companies went right back into the ground—into projects with overhyped returns.

Fortunately for oil and gas company shareholders, capital discipline improved dramatically by the late 2010s. Since then, returns have been better. Operating earnings have more closely matched free cash flow. Executives started being incentivized by metrics like return on invested capital (ROIC) rather than production growth.

King provides a clear framework for understanding these dynamics:

Financial accounting’s second major deliverable is the income statement. Revenue and expense accounts represent temporary extensions of the retained earnings section of shareholders’ equity. Revenue shows increases and expenses show decreases in retained earnings within an accounting period. Revenues arise from transactions that increase a company’s assets. Expenses represent [the] consumption of assets to bring in revenue. Any excess of revenues over expenses plus distributions to owners adds to retained earnings.

Just as historical cost represents the bedrock of asset valuation, matching is the foundation of the income statement. Instead of comparing inflows and outflows of cash, accountants use accruals to align efforts and accomplishments over an accounting period. Management estimates used to match revenues and expenses (e.g., provisions for bad debt, obsolete inventory, or future income taxes) convey information valuable to investors and creditors.

Perhaps the most important accounting decision a bookkeeper can make is determining whether resources consumed today will generate revenue in future accounting periods. If the answer is yes, then the charge should be capitalized and classified on the balance sheet as an asset. If not, then the balance should be expensed, flow through the income statement, and accumulate as a reduction in retained earnings.

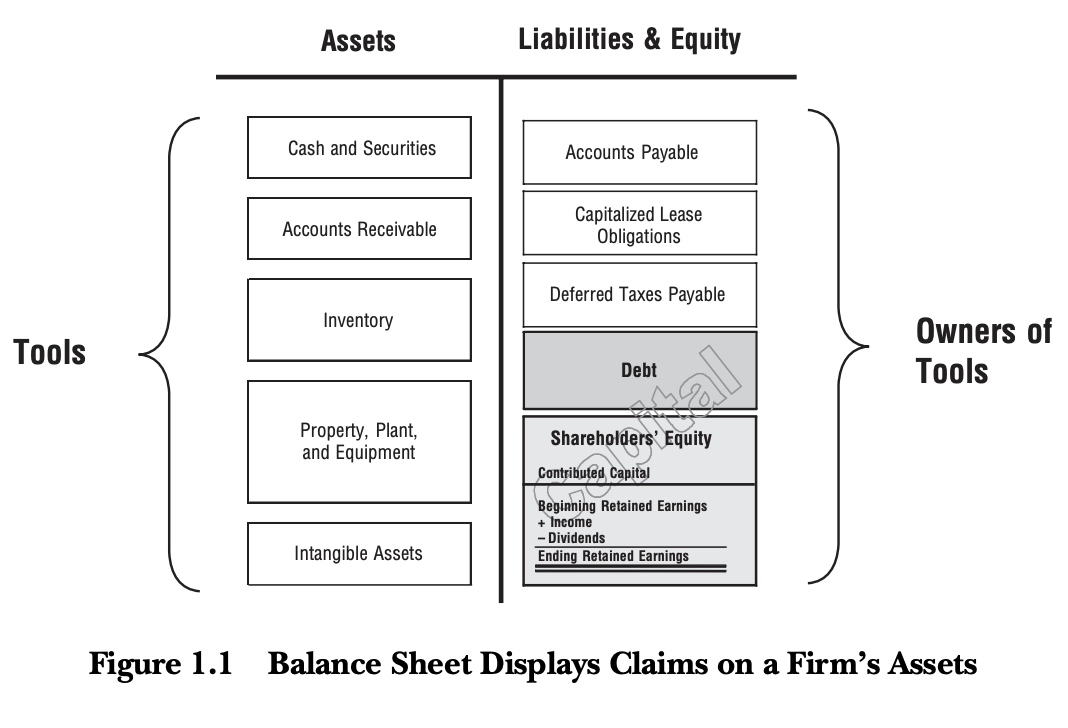

If you are unfamiliar with these accounting terms, King’s book includes the handy diagram below. Big Tech companies have been adding Nvidia GPUs to the property, plant, and equipment (PP&E).

Capital expenditures (from the cash flow statement) boost PP&E, while depreciation (and expense from the income statement) reduces PP&E. As King writes, these depreciation expenses “represent consumption of assets to bring in revenue.”

Big Tech companies expect to earn operating profits by using GPUs to build useful models that perform valuable services for their customers.

The size and scope of software services sold by big tech companies look unimpressive so far. After all, we’re more than two years after the launch of ChatGPT. If revenues were going to be enormous, they’d probably be pretty formidable by now. Still, hopes are high that a big wave of revenue is on the horizon.

The Coming Tech Reckoning

Microsoft's transformation illustrates the challenges ahead. Once primarily a software company with minimal capital requirements, it now pours billions into data centers and AI hardware.

MSFT traded around 3 times sales when risk-free interest rates were near zero percent in 2016, and ahead of a rapid growth spurt.

Now, it trades at 13 times sales as it spends tens of billions on Nvidia graphics chips to train its artificial intelligence (“AI”) models.

Microsoft hopes to earn a good return on these investments, but nothing is guaranteed. Since 2016, Microsoft’s capital spending (or “capex”) budget has more than quadrupled as it competes with Amazon Web Services and Google Cloud for customers.

Chris Wood from Jefferies recently mentioned the rising capital intensity of Big Tech companies.

Unless revenue growth accelerates for all hyperscale competitors, a rising capex-to-sales ratio will eventually lower operating margins. Flat revenue and higher depreciation expenses in the income statement result in lower operating earnings.

How You Can Profit from Less NVDA Dominance in AI Computing

Intel (NASDAQ: INTC) has been left behind in the worldwide rush to own the popular graphics processing unit (GPU) stock Nvidia.

While GPUs are powerful for specific workloads, they are unlikely to replace Intel’s CPUs. GPUs are powerful for their tasks but less energy-efficient and more costly than CPUs for general-purpose computing.

We’ll likely see a new wave of tariffs in the second Trump administration. If so, Intel’s competitive advantage of manufacturing chips primarily in the U.S. would strengthen.

Intel could become a relative winner in 2025 as investors look past the end of the current CPU recession. They may recognize that Intel’s earnings could surprise on the upside by the late 2020s.

The DeepSeek revelation could cause Big Tech companies to rethink their GPU-intensive approach to developing AI models. That could, in turn, open up opportunities for Nvidia’s rivals, including AMD and Intel. They are pursuing a more open-source software approach to AI model training. Ultimately, a balanced mix between CPUs and GPUs in data centers could drive a significant reassessment of Intel’s long-term profit potential.

Even if DeepSeek’s model is overhyped, its software engineering breakthroughs are spreading worldwide to coders. More efficient coding could drastically cut the demand for pricey Nvidia GPUs. Perhaps once the price of GPU processing falls, demand will reaccelerate. In the meantime, Nvidia’s super-normal profit margins and the associated investments on Big Tech balance sheets might deflate in 2025.

History shows that respect for accounting principles ebbs and flows.

As a recipient of investors’ attention, accounting has been in a bear market.

However, the cost accountant may be the prick who pops NVDA’s bubble.

Have a great weekend!