Posted February 11, 2025

By Sean Ring

The Penny’s in Heaven

Ilsa: “A franc for your thoughts.”

Rick: “In America, they'd bring only a penny. And, huh, I guess that's about all they're worth.”

Long-time readers of the Rude know that Casablanca is my favorite movie. When I heard President Donald Trump asked newly minted Treasury Secretary Scott Bessant to stop making pennies, I immediately thought of this exchange between Bogie and Bergman.

Trump’s reason was simple: it costs 2.69 cents to mint and distribute a penny.

I get it. It’s plain stupid to keep minting pennies from an economic perspective. And I’m not all sentimental about it, either. I haven’t so much as seen a penny in years. But what gets my goat is that inflation is so damn out of control that there’s a verifiable reason to stop making them.

It’s as if the new USG is saying, “We’re never going to get prices back down to the level you wanted them at (deflation), but we’ll do our best to keep them from rising too quickly (disinflation).”

As a citizen of the world, I didn't want to hear this. After all, where the Fed goes, world economic policy goes. But as gold investors, should we be upset about this move?

Not even a little bit.

The Zim Dollar

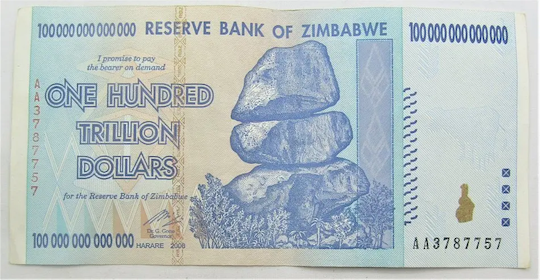

Let’s review a bit of history you may not know. First, look at this:

I wish I could tell you it’s fake, that a one hundred trillion dollar bill didn’t exist. I wish I could tell you it’s a fabrication of the West against Africa, but that would be a lie.

If you look closely at the note, under “for the Reserve Bank of Zimbabwe,” you’ll see a signature. Underneath that signature is “Dr. G. Gono, Governor.” Gideon Gono, a man so incompetent he couldn’t find his bare ass with either hand, ran Zimbabwe’s central bank, currency, and economy into the ground.

Gono’s PhD was, like much else of his, a fake from a degree mill in the United States. And boy, did it show!

Gono was the Governor of the Reserve Bank of Zimbabwe from 2003 to 2013, overseeing perhaps the worst episodes of hyperinflation in history—no, I’m not exaggerating—all of history.

During his tenure, the Zimbabwe central bank printed ungodly amounts of money to finance budget deficits, leading to hyperinflation that peaked at an estimated 89.7 sextillion percent in late 2008.

That statistic is longer than an international telephone number: 89,700,000,000,000,000,000,000%

This rendered the Zimbabwean dollar worthless, forcing the country to abandon its currency in 2009 in favor of foreign currencies like the USD.

Gono defended his policies as necessary to keep the government functioning, but he was rightly blamed for murdering Zimbabwe’s economy. His godforsaken tenure is cited as the textbook example of what happens when you print idiotic amounts of money.

When I was teaching in Singapore in 2009, a student in class had been backpacking in Harare, Zimbabwe’s capital, and had that Z$100 trillion bill in his pocket. I remember converting it into USD at the time. It came to about $30, barely enough for lunch for two in the Lion City.

I tell you this story not to scare you into thinking the USG will do the same thing—it won’t. However, I did want to relate Zimbabwe’s tale to show you the limits of money printing.

Far from wanting to wreck its currency, the USG wants to create just enough inflation to monetize its $36 trillion debt burden without destroying the dollar. In fact, The Donald has said, loudly as usual, the dollar’s reserve currency status isn’t up for debate.

How can this work?

Monetizing Debt

A government monetizes its debt through inflation by effectively reducing the real value of what it owes over time. Here’s how it works in five easy steps:

- Government Borrows Money: The government issues bonds (IOUs) to raise money for spending, which investors (banks, the public, or the central bank) buy.

- Central Bank Prints Money: Instead of letting the market absorb all the debt - often, the market can’t - the central bank (like the Federal Reserve or ECB) buys these bonds, creating new money.

- More Money, Same Goods: This increases the money supply, but if the economy doesn’t produce more goods and services at the same rate, prices rise, causing inflation.

- Inflation Erodes Debt Value: As prices rise, the government's debt's real (inflation-adjusted) value falls. The money the government borrowed years ago is now worth less than when it was issued.

- Government Pays Debt with Cheaper Dollars: The government collects more in nominal terms since tax revenues typically rise with inflation (because wages and prices go up). It repays its debt with money that’s worth less than when it was borrowed.

Inflation is a tax a central bank levies instead of a legislature. It reduces the burden of past borrowing at the expense of those holding cash or fixed-income assets like bonds.

This is why Bessant emphasizes economic growth rather than paying back the debt. It’s also why he’s trying to get The Donald to consider bringing down the 10-year yield a sign of economic success rather than a soaring stock market.

As is every plan, it’s risky. Where do investors usually turn when they see risk in government policy or no longer trust their government? To gold.

Our Greatest Ally?

It’s no secret that the US retail investor still hasn’t piled into gold despite US inflation lingering. Foreign central banks have been buyers for years, especially those concerned about the USG locking them out of the dollar system. Primary among these have been the People’s Bank of China.

If you’ve been watching this gold rally, you know it’s primarily thanks to these central banks. But China has gone two steps further. First, the PBoC resumed buying gold after an alleged six-month hiatus. There’s no way to prove the PBoC stopped buying. And just because it says it did, doesn’t mean it did.

Second, the Chinese government has launched a pilot program permitting insurers to buy gold for the first time. This is fueling the fiery gold rally, which hit nearly $2,940 last night before settling down to around $2,920 this morning.

From Zero Hedge:

As Bloomberg reports, ten insurance firms - including PICC Property & Casualty Co. and China Life Insurance Co., two of China’s biggest - will be able to invest as much as 1% of their assets in bullion, in a program that became effective last Friday.

That would translate into a potential 200 billion yuan ($27.4 billion) of funds, Minsheng Securities Co. said in a note.

The shift in policy in China could be a signal that authorities recognize the dearth of investment options in Asia’s largest economy, and the need for alternatives amid a property downturn and an economic slump.

“Insurance companies lack options for mid- and long-term assets with stable yields,” Guotai Junan Securities analysts led by Liu Xinqi said in a note, even though bullion typically doesn’t offer that.

Wrap Up

The Donald is targeting China long-term for “ripping off” America. Yet, the Chinese are a gold investor’s best friend—well, until the investment power of the American retail investor awakens.

When will that be? When the stock market dumps? Or will Americans realize they’re missing out on the rally soon?

Even if you haven’t been involved in the gold trade yet, there’s silver. It hasn’t started its big run yet. That’s another attractive option right now.

Invest accordingly.