Posted November 18, 2025

By Sean Ring

The Next Leg of the Rally

If you’ve ever wondered what actually keeps the global financial system humming — and no, it’s not Powell’s eyebrows, AI hype, or whatever half-baked TikTok macro guru is peddling today — the answer is something much duller: repurchase agreements.

Yes, the mighty “repo.” The plumbing behind the plumbing. The caffeine drip of Wall Street’s overnight addiction. The thing every journalist pretends to understand but absolutely doesn’t.

But here’s the twist: Wall Street’s repo desk nerds — the folks who speak in collateral haircuts, duration buckets, and other languages unknown to man — are now saying the reopening of the U.S. government could be the spark for the next stock market rally.

When the back room quants start talking like they’re on CNBC, it’s time to pay attention.

Let’s get to it.

First, What in Sam Hill Is a Repo?

For 99% of the population — and 70% of Congress — a “repo” sounds like the guy who shows up at 3 am to take your car.

In reality, repos are short-term, collateralized loans, usually backed by U.S. Treasury securities.

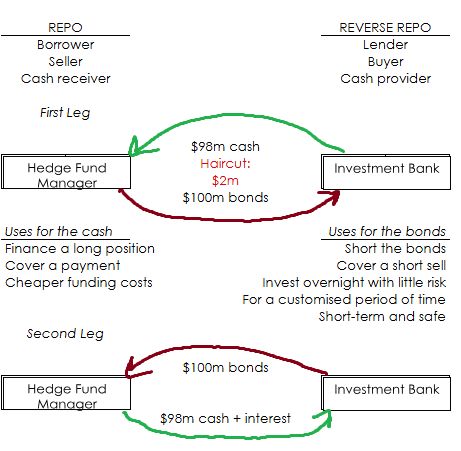

Because the loans are collateralized, they carry practically no risk. That’s why repo rates are usually very low. I’ll walk you through the diagram below, which I’ve used in class.

If I’m a hedge fund manager, having bonds on my books generally makes me little to no money unless I can leverage the trade to the hilt.

While those bonds sit there, I find a better use for them. I can loan them out to my favorite prime broker (banker), and in return, that banker will give me the cash equivalent. (The “haircut” for high-quality clients may be as low as 0%; for lower quality clients, it could range from 2-5%.) In this example, the hedge fund gives the bank $100 million in treasury bonds, while the bank provides the fund with $98 million, a 2% haircut. This is the first leg of the repo.

The hedge fund can now finance another long asset position or cover a pending payment. Using bonds as loan collateral lowers the funding costs of any trade the hedge fund wants to execute next.

Credit: Sean Ring

Credit: Sean Ring

Why would a bank provide this service for the hedge fund manager?

For client facilitation, which is when a bank (prime broker) makes it easier for a fund to trade.

Additionally, the bank can use the bonds to short them or cover an existing short sale, earning a return overnight with minimal risk.

At the second leg of the trade, which may be overnight or longer, the two parties re-exchange the cash and the bonds, with the hedge fund manager paying the small interest on the loan, as well. That small return is referred to as the repo rate.

It’s the safest, most boring loan imaginable. Wall Street hates safe and boring — unless it’s paying them.

Repos are how banks meet overnight funding needs, broker-dealers finance their trading books, leverage junkies magnify tiny arbitrages into beach houses, and the Fed transmits monetary policy without admitting they’re panicking.

If the repo market cracks, everything cracks. Stocks. Bonds. Futures. Options. Powell’s voice. The whole circus.

Why Repos Matter More Than Powell’s Pressers

The repo market is basically the cardiology wing of finance. For liquidity, repos are how trillions move smoothly each night. Repo rates anchor the entire short-term interest rate complex. If repo rates spike, everyone screams, vomits, and sells everything not nailed down.

Whenever you hear “funding stress,” “liquidity squeeze,” or “conditions tightening”… that’s repo-speak for: “We’re running low on financial oxygen.”

That brings us to the recent chaos.

The Shutdown That Froze the Plumbing

Now, normally, we treat government shutdowns like meteorologists treat “storm of the century” headlines — all noise, little consequence.

But this one actually mattered. Because when Uncle Sam shuts down, several ugly things happen:

First, the Treasury General Account (TGA) drains. Treasury can’t issue debt, so it starts spending down its checking account at the Fed. That drains liquidity out of the banking system.

That leads to the repo collateral supply shrinking. Fewer new Treasury bills means less collateral to lend. Less collateral means higher repo rates. And higher repo rates mean hedge fund leverage shrinks like George Costanza’s tallywacker in cold water.

Finally, volatility explodes. When funding costs spike, leveraged players tend to unwind their positions. That unwinding means forced selling in every asset under the sun.

According to Zero Hedge, JPMorgan’s macro futures & options desk confirmed what anyone with a Bloomberg already knew:

Repo stress was a major reason equities lost their momentum.

Everyone was suddenly short liquidity. When the oxygen tank runs empty, even a marathon runner can collapse.

The Reopening: Why It Matters More Than Any Speech From Powell

Last week’s government reopening wasn’t just lawmakers returning to the cafeteria buffet. It was the moment the Treasury turned the money hose back on.

And that changes everything.

According to JPMorgan, the end of the shutdown means repo markets are about to normalize, and that could trigger the next leg higher in stocks.

1. Treasury Issuance Returns!

You can almost hear the singing of Hallelujah breaking out on Wall Street (Mandel’s uplifting chorus, not Leonard Cohen’s mournful song, in this case).

When Treasury starts selling bonds again, new collateral floods the system, repo desks breathe again, dealers can lever up, hedge funds stop selling, and systematic funds stop panicking.

In short, the financial pipes get unclogged.

More Treasuries in circulation means more repo supply, which in turn means lower repo rates, resulting in more leverage available, and ultimately, higher equity prices.

It’s a beautiful, corrupt, circular, self-referential miracle.

2. The TGA Gets Refilled — and That’s Actually Good News

Now, the Treasury rebuilding its checking account does drain some liquidity from banks. But because it comes with a wave of new bond supply, the repo market suddenly has what it desperately lacked: collateral.

Everyone who de-risked because repo markets were freezing? They’re now looking at their screens thinking, “Ah, hell, now I need to get back in.”

3. A Liquidity Wave That Could Fuel a Rally

Here’s the key point JPMorgan makes — and Zero Hedge amplified:

Repo normalization creates a wave of liquidity that investors will ride straight into risk assets.

Investors who were forced to trim exposure can now re-lever. Systematic funds follow volatility lower, and volatility is finally falling. Short sellers begin covering. Dip-buyers get ballsy again. And dealers hedge flows in ways that reinforce momentum higher.

This is how rallies start.

Not from earnings. Not from geopolitics. Not from Powell’s “I’m cautiously optimistic but deeply concerned” tap-dance.

From plumbing.

Repos: The Financial System’s Hidden God

Let’s zoom out, because this stuff isn’t just about one shutdown.

The repo market is the quiet deity behind modern finance. It’s how the Fed injects and withdraws liquidity, where crises typically emerge first (2008, 2019, 2020), that determines how leveraged the system can become and dictates how smoothly markets flow.

If you want to know where the market’s going, watch repos. If repo rates fall, stocks tend to rise. If repo rates spike, grab your bug-out bag.

Of Course, There Are Risks! It’s Washington, after all.

Here are three big ones:

First, there could be another shutdown. Who knows? Congress could screw this up again. They always do. And if they do, repo stress returns instantly.

Second, if the Treasury rebuilds its account too quickly, it sucks liquidity out of banks. I doubt this will happen, though.

Third, the Fed thinks it “manages” liquidity. Market participants are aware that the Fed typically responds to liquidity crises after the fact. If Powell gets cute with his operations, repo markets will let him know quickly — and violently.

Wrap Up

The government reopening wasn’t just political theater. It was the moment the repo market inhaled deeply for the first time in weeks.

That matters because when the repo market normalizes, liquidity returns, increasing leverage, which drives equities higher.

I’m not bullish because Washington got its act together. Spare me.

I’m bullish because the people who actually run the financial system — the repo desks — suddenly can work again.

If that continues, expect the S&P to stop sulking and start marching higher, along with other risk assets, like our mining stocks.

The heart of the system is beating again.

And when the heart pumps healthily, asset prices tend to rise.

Silver Screams While Gold Whistles in the Wind

Posted November 17, 2025

By Sean Ring

This Edition Belongs to You

Posted November 14, 2025

By Sean Ring

An Open Letter to President Trump

Posted November 13, 2025

By Sean Ring

Charlie Munger’s Wit and Wisdom

Posted November 12, 2025

By Sean Ring

The Good, The Bad, and The Ugly

Posted November 11, 2025

By Sean Ring