Posted June 01, 2023

By Sean Ring

The Most Immoral of All Taxes

- Inheritance tax should be immediately abolished worldwide.

- The Death Tax doesn’t even let you rest in peace…

- …unless you do some judicious tax planning.

Good morning from an overcast Piedmont!

I was scrolling through my Twitter feed, feeling like Michael Douglas wielding his machete in Romancing the Stone, when I happened upon this op-ed in The Daily Telegraph:

Beautiful.

Just beautiful.

Of course, the UK communist trolls - nearly 90% of the total population, by my estimate - castigated Mr. Zahawi for even suggesting the idea.

You know, the people who always have their hands out.

Before I get into why I loathe inheritance tax, let me issue a disclaimer.

Never, ever do anything to piss off the taxman. There’s a line: don’t even approach it, let alone cross it. With most transactions conducted electronically these days, there’s no way you’d get away with any wrongdoing, no matter how morally empowered you may feel.

And besides, there are many legal ways to reduce or avoid inheritance tax altogether.

The other thing is this: make sure you pay an accountant or a lawyer for their professional advice and service and for their signature to appear on your paperwork. That alone will keep the IRS officer at bay.

If you do this on your own, without professional advice, you put a target on your estate.

Now, let’s get into it.

What is Inheritance Tax?

Inheritance tax, also known as estate tax or death tax, is a type of tax imposed on the assets or property passed down from a deceased person to their heirs or beneficiaries. It is a tax levied on the value of inherited assets, such as money, real estate, investments, or valuable possessions.

When someone passes away, their estate (the total value of their assets and property) is assessed. An inheritance tax may be applied if your wealth exceeds the government's threshold. The tax rate and threshold vary by country or region.

The State’s purpose for inheritance tax is to collect a portion of the transferred wealth to ensure that everyone contributes to public funds and to address potential wealth inequality.

You give your money to strangers instead of your children or heirs.

The tax is typically paid by the recipient of the inheritance, not the deceased person. This doesn’t make it any better. It just makes it seem like the person paying the tax is the person who didn’t earn the wealth.

Why Inheritance Tax Is Immoral

Let me list some of the reasons why inheritance tax (IHT) is indeed, as Mr. Zahawi says, “morally wrong.”

- Property rights: Individuals can dispose of their property as they wish, including passing it on to their chosen heirs. Imposing a tax on inherited wealth is a flagrant violation of property rights, as it limits individuals' freedom to distribute their assets according to their wishes.

- Double taxation: IHT is double taxation because the assets being transferred have already been subject to income tax or other forms of taxation during the deceased person's lifetime. Taxing those assets again when passed on to heirs is ridiculously unjust.

- Generational fairness: IHT unfairly targets the wealth accumulated by one generation and transfers it to the government. That disrupts the intergenerational transfer of wealth and undermines the ability to provide for future generations.

- Wealth preservation: IHT discourages wealth accumulation and capital investment. If individuals know that a significant portion of their wealth will be subject to taxation upon death, they’re less motivated to build and preserve wealth, stunting economic growth and investment.

- Complexity and avoidance: IHT is complex, leading to loopholes and opportunities for wealthy individuals to use tax planning strategies to reduce or avoid the tax altogether. Indeed, this creates an unfair advantage for the rich. They can afford sophisticated legal and financial advice to minimize their tax liabilities.

The argument begins and ends with property rights. You ought to be able to give what you want to whom you wish to upon your death without regard to the IRS.

Interestingly, one of the reasons that gay marriage had to happen was that gay persons’ private property rights were perpetually violated. One partner couldn’t leave his assets to another tax-free. A way to solve this problem was via spousal rights.

I’m not reducing gay marriage to a tax dodge. People will always want to get married simply because they love each other.

But just think about this: if The State didn’t violate private property rights, would this have happened to the degree it did?

I don’t know for sure. No one does. But it’s an interesting thought experiment.

US Inheritance Tax

If you’re a US citizen, the threshold is very high. Thankfully. But it still shouldn’t exist at all.

According to CNBC, starting in 2023, individuals can transfer up to $12.92 million to heirs, during life or at death, without triggering a federal estate-tax bill, up from $12.06 million this year.

There’s also a higher annual limit on tax-free gifts in 2023, rising to $17,000 from $16,00, which doesn’t reduce the threshold.

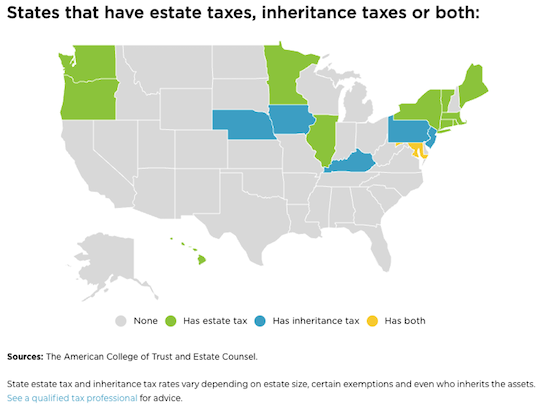

But that’s just the federal bit. But what about states?

Credit: nerdwallet

By the way, there’s a distinction between estate and inheritance taxes. (I usually lump them together, but they are different.)

Inheritance tax is what the beneficiary — the person who inherited the wealth — must pay when they receive it.

The estate tax is the amount taken out of someone’s estate upon their death based on the estate's value.

If you live in any of the above states, be sure of your situation.

UK Inheritance Tax

The UK’s inheritance tax is asinine. It gets so many into trouble and is the reason for the above Telegraph article.

From gov.uk:

Inheritance Tax rates

The standard Inheritance Tax rate is 40%. It’s only charged on the part of your estate that’s above the threshold.

Example

Your estate is worth £500,000, and your tax-free threshold is £325,000. The Inheritance Tax charged will be 40% of £175,000 (£500,000 minus £325,000).

The estate can pay Inheritance Tax at a reduced rate of 36% on some assets if you leave 10% or more of the ‘net value’ to charity in your will. (The net value is the estate’s total value minus any debts.)

If you’re a Brit and don’t see a lawyer or accountant about this, see a psychiatrist.

As a British citizen, I will do everything I can to avoid this tax.

Italian Inheritance Tax

Italy’s is more convoluted but much lower than the UK’s.

This is just if you’re leaving your money to your children. It gets more complicated otherwise.

Relationship to the deceased: Child or spouse

Estate inheritance tax: 4% of the amount exceeding €1 million for each heir

Estate filing tax: 2% of real property value or €200 if the property will be the principal home

Property inheritance tax: 1% of real property value or €200 if the property will be the principal home

In short, in Italy, you can’t lose your house via IHT. But in the UK, it’s a routine thing.

Possible Solutions to This Problem

Again, if you face IHT issues, you must take professional advice from a lawyer or an accountant. I don’t know your personal situation, so please take this only as educational material:

- Tax-free allowances and exemptions: Many jurisdictions provide tax-free allowances or exemptions for specific amounts of inherited wealth. You can minimize or eliminate inheritance tax by structuring your estate and distributing assets within these limits.

- Lifetime gifts: Making gifts during your lifetime can help reduce the value of your estate subject to inheritance tax. Some jurisdictions have specific rules and exemptions regarding gifts.

- Trusts: Setting up trusts can effectively manage and distribute your assets while potentially reducing inheritance tax liabilities. Trusts can provide control over the assets, allowing you to specify how and when they are distributed to beneficiaries.

- Charitable donations: Making philanthropic donations in your will or during your lifetime can have dual benefits. Not only does it support causes you care about, but in many jurisdictions, charitable contributions are tax-deductible or will reduce the taxable value of your estate.

- Life insurance policies: Life insurance proceeds are often paid directly to the beneficiaries and may not be subject to inheritance tax. By designating beneficiaries and structuring life insurance policies appropriately, you can provide liquidity for paying inheritance tax liabilities.

- Business and agricultural relief: Some jurisdictions provide reliefs or exemptions for certain business assets or agricultural property, allowing for reduced or zero inheritance tax liabilities. These reliefs typically support continuity in family businesses or agricultural operations.

If you have seven-figure wealth, definitely find out more about trusts.

Wrap Up

Sorry, that was a longer one than usual!

But nothing gets my goat more than unjust taxes.

And mirror, mirror on the wall, this is the unfairest of them all!

How Options Boss Stocks

Posted February 20, 2026

By Nick Riso

Investing is So Taxing!

Posted February 19, 2026

By Sean Ring

The Most Expensive Way to Go Broke

Posted February 18, 2026

By Sean Ring

The Bears Gather

Posted February 17, 2026

By Sean Ring

Omar Khayyam: Poet, Rebel, Astronomer

Posted February 16, 2026

By Sean Ring