Posted February 02, 2026

By Sean Ring

The Massacre of the Innocents

I remember viewing Peter Paul Rubens’ masterpiece, The Massacre of the Innocents, at the National Gallery in London in the early naughties. Rubens is a favorite of mine, and his room in the Louvre, where they display the enormous canvases he painted for Catherine de' Medici, is the best part of that museum. (Forgive me, Leonardo, but Mona Lisa is totally overrated.)

But what’s so stunning about Massacre is the sheer violence Rubens is able to convey to the viewer.

If you’re unfamiliar with the story, it appears in the New Testament in Matthew 2:16-18. Threatened by news that a “king of the Jews” had been born, King Herod ordered his soldiers to kill all boys two years old and under in Bethlehem and its surroundings. Joseph, having been warned in a dream, had already taken Mary and Jesus and fled to Egypt, so Jesus escaped the slaughter.

Violence. Ugly violence.

The move on Friday and now into Monday in the metals is unprecedented in my three decades in the markets. And many of the old hands who’ve been around far longer than I have say the same. It’s a violence I suspect has taken out many traders, investors, and retail folk. It’s those moms and pops for whom I feel the most. They were just trying to stay ahead of inflation, and Wall Street nuked their positions. We’ll see why further on in the report.

But first, to the charts.

S&P 500

***New Monthly Closing Price Record of 6,939.03***

We’re up another 100 points or so from last month. This is a healthy chart.

The next target is 7,613. Stay bullish.

Nasdaq Composite

***New Monthly Closing Price Record of 23,461.82***

Again, the chart is rounding, but there are no sell signals yet.

We still have a 26,890 upside target. Although the recent highs are lower, the recent lows are higher. In short, I’m not calling a top here.

Russell 2000 (Small caps)

***New Monthly Closing Price Record of 269.65***

The Russell rebounded and is leading the major markets. This is very bullish.

It still has an upside target of 323.94.

The US 10-Year Yield

We’ve ticked UP another 7 basis points in the 10-year after the Fed held rates steady in January—nothing to see here, just yet.

Dollar Index

The dollar looked like it was about to fall out of bed, but rebounded slightly. This may have been a false breakdown, but we won’t know for a while yet. If not, the first downside target remains the 88.50/89.50 area. After that, 79.75.

USG Bonds

TLT barely moved in January. As you know, I’m not a fan of bonds in this environment, and even less so now. The first downside target is 83.85, a few points away. The big one, though, is 74.75, which would be painful for any holders. Avoid.

Investment Grade Bonds

From last month:

Admittedly, this chart looks excellent. From here, the next target is a whopping 140.85. But I don’t buy the story in the long term.

High Yield Bonds

From five months ago:

I don't know if HYG can go much higher. Stalled at these nosebleed levels, a turnaround may be in order soon.

Same as it’s been for a while, but it keeps creeping up a point every month.

Real Estate

We ticked up a bit in real estate, but the next big target remains 70.75.

Energy: West Texas Intermediate (Oil)

Last month, we finally got the rally many observers were calling for. However, this Monday morning, oil is down with everything else, trading at $62 as I write this. With that said, we’ve got mixed signals on the targets. We have a new upside target of $70.75, in addition to our downside targets of $55.15 and $50.50. The next few days will be important to determine which path oil will take.

Base Metals: Copper

Copper had a great month until Friday, like the rest of the metals complex. This morning, it’s still getting whooped, down another 2.21%. However, there are no new downside targets, with the upside target remaining $6.93.

Precious Metals: Gold

***New Monthly High of 4,886.71***

Everything was going so well… and then Friday happened. The laughable part of this is that gold still achieved a new month-end high. With that said, I wouldn’t be surprised with a few months of sideways and down action before we get liftoff.

This morning, we’re down again to $4,680.

And it’s even worse for…

Precious Metals: Silver

***New Monthly high of $84.63.***

This is where the largest dislocation in market history has occurred. And we’re down again, nearly 6% this morning. Don’t let the record fool you. I think we’re going to have a few months, or maybe even a year, of sideways action before a recovery.

Paradigm options expert Nick Riso put it this way:

The crash of January 30 was a classic Liquidity Cascade. It was a mechanical unwind of leverage. The catalyst (Warsh/Margins) was secondary to the structural positioning. Once the $96.50 gamma threshold was breached, the market became a derivative of its own hedging requirements. We view the $73.61 low as a "clearing price" where forced liquidations finally exhausted, not necessarily a fundamental value floor.

However, he added this:

We expect IV to remain elevated (>80%) for the next 2-3 weeks. The "V-Shape" recovery is unlikely as the $90-$100 zone is now a massive "Gamma Wall" of resistance where trapped longs will look to exit.

If this is the case, and I suspect it is, we won’t have a feverish rally no matter what Shanghai does. So it’s time to look at the portfolio.

The Unofficial Rude Portfolio

Below is a list of the Unofficial Rude Portfolio. It lists my buy price, where it closed on Friday, the highest close this cycle (a few days ago for most of them), the trailing stop (25% away from the highest daily close), whether I get stopped out, and the distance to the stop if that stop hasn’t been triggered.

Following Matt Badiali’s 25% trailing stop (I calculated it from the highest daily closing price), there’s only one stock I’m selling today, and that’s Viszla (VZLA). I won’t sell on the open, so you can get in there and sell first.

Has the fundamental silver story changed? No.

Is the silver market in a pickle and will remain so for a while? Yes.

And Viszla had a bad down day before this began because some of their workers were kidnapped in Mexico, and it’s my worst-performing holding. It’s time to go.

You can see the prices I’ll use to stop out my other holdings. Some will likely get triggered today, and I’ll update you tomorrow about that. Or, you can, with my blessing, front-run me if you want to get out early.

For Wednesday’s Rude, I’ll try to decipher and simplify (but not oversimplify) Nick’s great report.

Cryptos: Bitcoin

From last month:

If we break below $84,500, we’ll be looking at a disastrous $55,500.

Bitcoin is broken for now. I’m not sure when or if it’ll recover.

Cryptos: Ether

From last month:

If ETH breaks below $2,800, the target is $2,400.

Now, the target is $2,010.

Cryptoworld is in the same pickle as the metals, it seems.

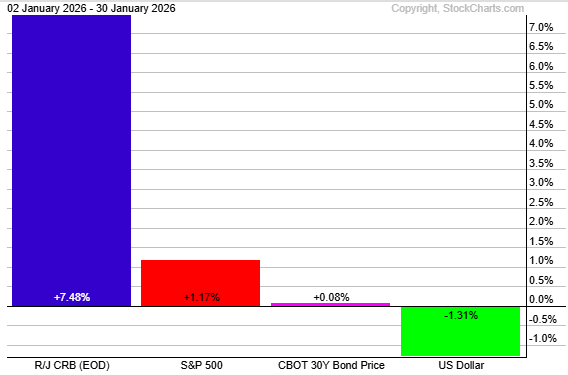

Trad Asset Class Summary

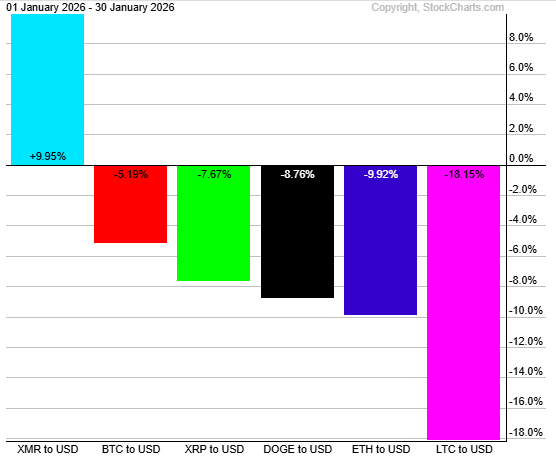

Crypto Class Summary

Monero was up nearly 10%, with the rest getting hosed. The biggest loser was Litecoin, which was down 18.15%. (Keep in mind, BTC and ETH are down further over the weekend.)

Wrap Up

The equity markets look ok, but everything else is hurting. I don’t know how long it will last, but it will be a while for sure. Two months, maybe three; maybe longer.

The metals and crypto need time to heal.

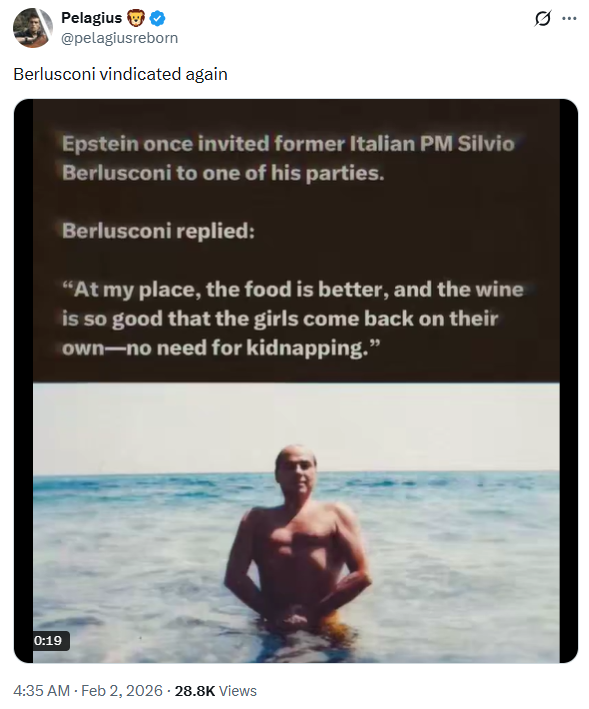

Finally, let us laugh, courtesy of the X-verse:

Forza Italia!

Vicious Patriotism

Posted March 05, 2026

By Sean Ring

Don’t Overprice Risk with Mining Companies

Posted March 04, 2026

By Matt Badiali

America First!

Posted March 03, 2026

By Sean Ring

WAR! What’s It Good For?

Posted March 02, 2026

By Sean Ring

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring