Posted September 08, 2025

By Sean Ring

The Market Has Caught Up With Us!

After foregoing a 100% gain on gold and silver, and the first $100,000 on Bitcoin, bankers are finally waking up to these assets. I hope you’ve bought already, because the banking and institutional floodgates are opening. It’s only a matter of time until Mom and Pop of retail repute wake up.

Perhaps this is a humble brag, but we here at Paradigm have been beating this drum for well over a year. And some, like Jim Rickards, have been shouting from the rooftops for well over a decade or two.

When I interviewed billionaire resource investor Rick Rule last year, he said he owned gold for insurance. He also expressed concern about an $8,000 gold price because of the circumstances we would have to endure for gold to trade at that price. Like Rick Rule, Bank of America’s ace analyst Michael Hartnett believes we’re at the beginning of a 1970s throwback. I’ll get to Hartnett’s comments later.

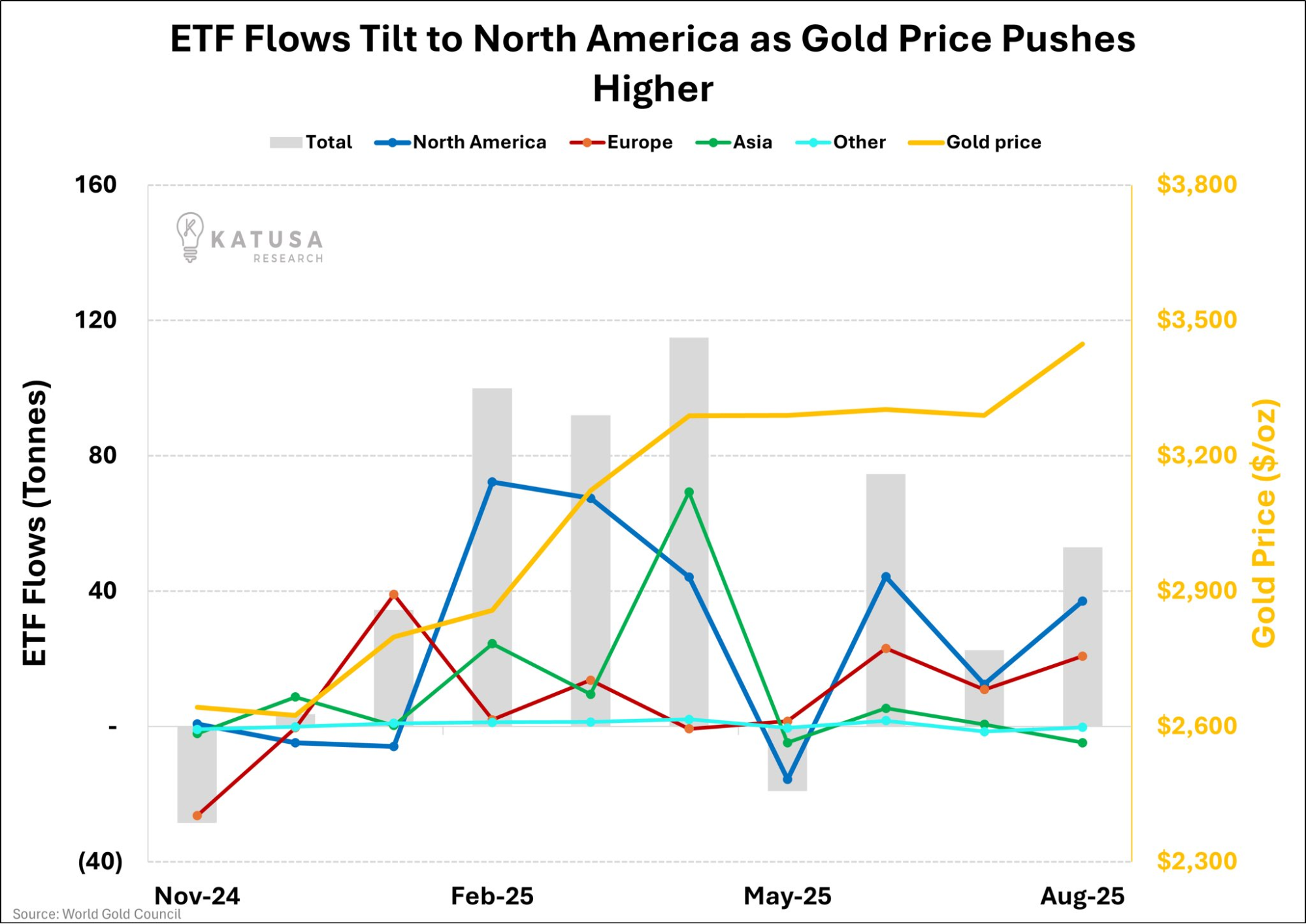

But first, Katusa Research just posted this chart on X:

Credit: Katusa Research

Credit: Katusa Research

Interestingly, someone commented on Katusa’s chart above, countering that not enough people had yet invested in gold.

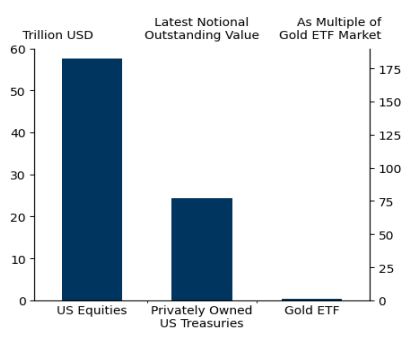

Credit: @DaglioDavid

Credit: @DaglioDavid

The above chart shows just how coiled the gold price is. Once retail starts to pile in, there’s no telling just how high the price will go.

Now, let’s get to Hartnett’s comments on the situation.

The 1970s Redux

Sometimes the markets feel like a badly written sequel: the same plot, the same mistakes, just with new actors. Like Gladiator II.

Bank of America’s Michael Hartnett thinks we’re about to replay one of the most infamous decades in modern financial history—the 1970s.

Back then, Trickie Dickie Nixon ditched the gold standard; inflation took off, Arthur Burns’ Fed was chocolate-teapot-useless, and investors who didn’t own hard assets got wiped out. Hartnett’s thesis is that we’re heading straight back to that disco-ball decade, only with Spotify, DJs on Apple MacBooks, and a mountain of debt that makes the ‘70s look like an example of fiscal rectitude.

Hartnett’s solution? Go long gold and crypto, short the U.S. dollar, and prepare for the Fed to unleash yield curve control—the nuclear option of debt management. Sound familiar?

Let’s unpack what this going mainstream means for us, and why you should probably start dusting off your bell-bottoms and hair picks.

Déjà Vu, All Over Again

The 1970s were marked by what economists politely refer to as “stagflation.” For ordinary people, that meant rising prices, sluggish growth, gas lines, and presidents appearing on TV to lecture the public about turning down their thermostats. Meanwhile, gold went on a historic tear, rising 2,300% from its $35 peg to over $850 an ounce by 1980.

Fast-forward fifty years. The U.S. is now sitting on more than $37 trillion in federal debt. Interest costs alone are devouring the budget, like Pac-Man chewing Tic Tacs. Every uptick in bond yields threatens to blow a hole in Washington’s fiscal hull.

That’s why Hartnett thinks the Fed will eventually have no choice but to step in—not just with rate cuts or QE, but with something bigger: yield curve control.

What Is Yield Curve Control?

Yield curve control (YCC) is precisely what it sounds like: the Fed pins interest rates at specific levels for each maturity of USTs. If the market tries to push Treasury yields above the Fed’s target, the Fed just prints money and buys the bonds until yields fall back in line.

We have historical precedent for this. From 1942 to 1951, the Fed capped short- and long-term yields to finance World War II and manage post-war stability. Since 2016, the Bank of Japan has used YCC to maintain 10-year JGB yields at around 0%, to combat deflation and stimulate economic growth.

In 2020, the Reserve Bank of Australia employed YCC during the COVID-19 crisis, targeting three-year government bond yields.

YCC works… sort of. You suppress volatility, but at the cost of destroying honest price discovery in the bond market. Investors know the game is rigged, but as long as they can front-run the central bank, they play along.

For the U.S., YCC would be an act of desperation—an admission that Uncle Sam’s debt is so bloated, the only way to manage it is to fake the bond market. But once it happens, it sets off a predictable chain reaction. First, we’d have USD weakness: Why would you hold greenbacks if yields are artificial? That would lead to a surge in the gold price because real money thrives when paper money is forcibly devalued. And, of course, we’d have a crypto boom because digital assets benefit from capital flight and distrust of fiat.

In other words, Hartnett’s playbook.

Hartnett’s “Triple Crown” Trade

He’s not shy about it: his bet is long gold, long crypto, short dollar until YCC arrives.

Gold is the ultimate inflation hedge, the asset that thrives when confidence in paper evaporates. As Jim Grant once said, “The price of gold is one divided by t, where t equals the trust in government.” Central banks are already loading up on gold at a record pace. They know what’s coming.

Crypto is millennial gold. Bitcoin doesn’t have an army, a navy, or a central bank. That’s precisely the point. In a world of currency debasement, its appeal is obvious. Sure, it’s volatile. However, when the Fed starts capping yields and stealth-devaluing the dollar, capital will look for ways out. Crypto will be one of them.

Finally, the USD is the sacrificial lamb. The dollar has been the global reserve currency for decades, but debt and deficits are eroding its credibility. Add in BRICS countries actively building alternatives, and you’ve got the makings of a slow-motion dethroning. Hartnett sees the dollar sliding as YCC becomes official policy.

The Bull Market Mirage

Are you ready for this? If history repeats itself, Hartnett thinks the S&P 500 can run all the way to 9,914 (not a typo) by 2027.

It sounds bullish and fanciful, right? But don’t confuse a nominal melt-up with real wealth creation. If stocks are “rallying” because the Fed is quietly destroying the currency, your portfolio may look fat on paper while your grocery bill doubles or worse.

This is the cruel joke of inflationary booms: people feel rich, until they realize their riches don’t buy much. That’s why gold and crypto matter. They’re not about chasing returns; they’re about preserving purchasing power when the system tilts into full-blown currency debasement.

Why This Isn’t Just Nostalgia

Some will say, “Sure, Sean, but the 1970s were unique—oil shocks, Cold War, bad haircuts, worse blue jeans. We’re different now.” Really? Let’s check the list:

- Energy chaos? Check. Oil and gas geopolitics are messier than ever.

- Runaway debt? Check. $37,000,000,000,000 isn’t a debt. It’s a telephone number.

- Social unrest and political chaos? Check.

- Central banks improvising like jazz musicians on meth? Check and double-check.

The script is familiar. The only question is how long the Fed can maintain the illusion of control before pulling the YCC lever.

Nominal Gains, Real Losses?

So what do we do with all this?

First, don’t be lulled by the shiny stock market numbers. The S&P may scream higher into 2027 - if we don’t get a major correction before then - but it may be fool’s gold—a nominal gain masking a real loss.

Second, recognize the setup for real assets. If Hartnett’s right, gold isn’t just an inflation hedge; it’s a monetary necessity. And don’t forget about silver, either. Crypto, whether loved or hated, plays a similar role for a younger, tech-savvy investor base.

Third, expect volatility. The transition from a “normal” bond market to outright YCC won’t be smooth. There will be shocks, panics, and sudden lurches. That’s when most investors will panic and sell. That’s when you’ll want to be already holding the assets that survive the storm.

Wrap Up

Hartnett’s message isn’t original. It’s about seeing a debt-soaked system suffocating under its own interest costs. The Treasury can’t keep rolling over trillions at higher yields. Something’s got to give. It’s a story we've been telling you at Paradigm for quite some time.

When the system does give, the blueprint is available. Nixon showed us in the ‘70s what happens when debt, inflation, and political weakness collide: currencies get debased, gold soars, and investors who don’t adapt get destroyed.

History doesn’t repeat exactly, but it rhymes with a disco beat. The ‘70s are back. The only question is whether you’ll dance or not.

Have a great week.

The First Cut is the Shallowest

Posted September 18, 2025

By Sean Ring

The Safety is in The System

Posted September 17, 2025

By Sean Ring

The Ghost of Louis XVI Warns Trump

Posted September 16, 2025

By Sean Ring

Something like 1980 is about to happen…

Posted September 15, 2025

By Sean Ring

The Curious Incident of the Dog in the Night-Time

Posted September 12, 2025

By Sean Ring