Posted October 11, 2022

By Sean Ring

The Latest Participation Trophy

Good morning on this fine Tuesday from a foggy Asti.

If you’re into wine, “Nebbiolo” comes from the Italian “Nebbia,” meaning fog.

Wines from the nebbiolo grape include Barolo and Barbaresco, the king and queen of wines.

But the fog has greater significance today.

You might want to sit down for this.

The man who ushered in an economic crisis and was given unjust kudos for “solving” it just won a Nobel Prize.

Yes, Ben “Helicopter Money” Bernanke, the man who was “100% certain” he could control inflation and once said the subprime crisis “will not affect the economy overall,” is the newest Nobel laureate.

It’s about as bad as Barack O’Bomber, the European Union, Yassir Arafat, or Henry Kissinger winning the Nobel Peace prize.

Oops. Never mind.

Let’s have some fun today.

What The Committee Said

Straight from the horse’s mouth (bolds mine):

Ben Bernanke analyzed the Great Depression of the 1930s, the worst economic crisis in modern history. Among other things, he showed how bank runs were a decisive factor in the crisis becoming so deep and prolonged. When the banks collapsed, valuable information about borrowers was lost and could not be recreated quickly. Society’s ability to channel savings to productive investments was thus severely diminished.

“The laureates’ insights have improved our ability to avoid both serious crises and expensive bailouts,” says Tore Ellingsen, Chair of the Committee for the Prize in Economic Sciences.

Is this guy serious?

Bernanke authored his prize-winning paper in 1983. The crisis, which he helped engineer, was from 2006-2008.

Currently, the Fed’s balance sheet stands at $8.7 trillion.

I question this: What constitutes “serious” and “expensive” for this gentleman?

To be fair, the Financial Times was more rounded in their report:

Bernanke, who led the Fed for two terms from 2006 to 2014, was criticized in some quarters for failing to foresee the 2008 crisis and failing to tackle the problems building in property markets, and for then deploying vast sums of public money to rescue some Wall Street companies from the consequences of their bets on subprime mortgages.

He also pioneered the use of unconventional monetary policy, launching the Fed’s quantitative easing program to boost the economy when interest rates were already at zero. Some economists believe the loose monetary policy was instrumental in restoring the US economy to growth, but others say it fueled inequality, artificially inflated asset prices, and ushered in a period of cheap money that sowed the seeds of the current inflation crisis.

Let’s look at some other reactions.

Krugman Weeps

Former Princeton professor turned full-time blogger Paul Krugman had one up on his old department head: he was a Nobel laureate.

In case you didn’t know. Credit: @paulkrugman

Yes, in one of the more embarrassing awards ever given, the Nobel Economics committee gave The New York Times blogger the big prize in 2008.

It was a soothing elixir for being passed over for the Federal Reserve Chairman role in favor of his old “buddy.”

No more.

Now “The Bernank” also has a shiny medal, so Krugman can go weep in his morning coffee.

Believe me, he hates this more than you or I do.

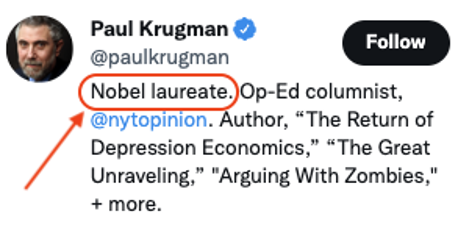

And it’s not like he offered congratulations. Here is his tweet:

Credit: @paulkrugman

Ok, let’s call his tweet “lukewarm.” He gives credit where it’s due (at least in his mind) but falls short of offering a public “congratulations.”

Taleb is Aflame

If you think Krugman is upset over this, just wait until you see Nassim Taleb:

Credit: @nntaleb

Priceless.

As for the other one, I’m not sure. Maybe it’s Krugman. He’s also had spats with Myron Scholes, Harry Markowitz, and Joe Stiglitz. Or someone else.

Hilariously, the first reply under Taleb’s tweet was this:

I’ve written about Nassim Taleb a few times before. But this piece has my thoughts on his books.

Unquestionably, Taleb, who had written Fooled By Randomness and The Black Swan by the financial crisis, was Bernanke’s most prominent and famous critic.

But Taleb didn’t just oppose Bernanke. He opposed the prize itself.

In this fantastic FT opinion piece, Taleb railed against it:

MPT [Modern Portfolio Theory] is the foundation of works in economics and finance that several times received the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. The prize was created (and funded) by the Swedish central bank and has been progressively confused with the regular Nobel set up by Alfred Nobel; it is now mislabelled the “Nobel Prize for economics.”

So, it’s not even a real Nobel.

But knowing that is a weak consolation prize.

I encourage you to read Taleb’s entire piece in the FT, but let me reprint his conclusion here:

Every time I have questioned these methods, I have been abruptly countered with: “they have the Nobel,” which I have found impossible to argue with. There are even practitioner associations, such as the International Association of Financial Engineers, partaking of the cover-up and promoting this pseudo-science among financial institutions. The knowledge and risk awareness we are accumulating from the current subprime crisis and its aftermath will most certainly not make it to business schools. The previous dozen crises and experiences did not do so. It will be dying with us, unless we discredit that absurd Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, commonly called the “Nobel Prize.”

Taleb pulls no punches with the economics prize itself.

But he’s as indignant specifically with this year’s winner as he is with the prize.

In this YouTube clip, you can see how passionately he argued against the status quo that brought us the crisis.

In this clip, Taleb hilariously explains that Bernanke and Krugman are “his nightmares.”

But the most scathing of his criticisms came when he wrote for HuffPo. Yes, in a parallel universe a few years ago, good writers wrote for HuffPo:

What I am seeing and hearing on the news -- the reappointment of Bernanke -- is too hard for me to bear. I cannot believe that we, in the 21st century, can accept living in such a society. I am not blaming Bernanke (he doesn't even know he doesn't understand how things work or that the tools he uses are not empirical); it is the Senators appointing him who are totally irresponsible -- as if we promoted every doctor who committed malpractice. The world has never, never been as fragile. Economics makes homeopaths and alternative healers look empirical and scientific.

Taleb took time off after that, only reemerging when staying mum was too much to bear.

Wrap Up

No matter the outcomes, the powers that be will elevate their “yes men” to high status to justify their means.

Ben Bernanke printed trillions and, worse, led successive Fed chairpersons to print even more.

But that behavior is rewarded in the Clown World we live in.

Until tomorrow.

The Next Commodity Supercycle Winner

Posted January 09, 2026

By Sean Ring

The Best Stocks, Countries, and Books

Posted January 08, 2026

By Sean Ring

From The Shores of Tripoli to Caracas

Posted January 07, 2026

By Sean Ring

¡Seremos Bienvenidos Como Libertadores!

Posted January 06, 2026

By Sean Ring

Empire At Gunpoint

Posted January 05, 2026

By Sean Ring