Posted November 03, 2025

By Sean Ring

The Joyless Bull

Don’t Overprice Risk with Mining Companies

Posted March 04, 2026

By Matt Badiali

With mining companies, perspective matters.

America First!

Posted March 03, 2026

By Sean Ring

If Israel is going to war, America goes first!

WAR! What’s It Good For?

Posted March 02, 2026

By Sean Ring

Metals, energy, and bonds look set to profit from the Iran action.

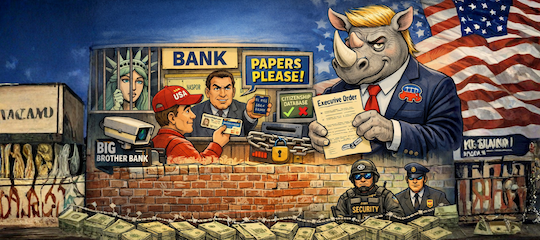

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

A new executive order threatens Americans’ privacy.

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

The best casino trades five days a week in New York.

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

The Donald nearly broke his arm patting himself on the back.