Posted April 13, 2023

By Sean Ring

The Inflation Story Isn’t Over Yet

- March’s month-on-month CPI was up only 0.1%.

- The year-on-year number is 5.0%, much better than in previous months.

- For the year, food prices are up, and energy prices are down.

Good morning from another overcast day in Asti!

It’s Thursday, so there are only two full days left to go. But before you crack open a bottle of something cheerful, let’s grab a cup of joe and chat about the elephant in the room: inflation.

Yesterday’s numbers weren’t terrible by any measure. But what they do indicate to me is that Powell isn’t done yet.

There’s a lot more inflation slaying that Chairman Pow has on his schedule. And the market may not like that so much.

Overall

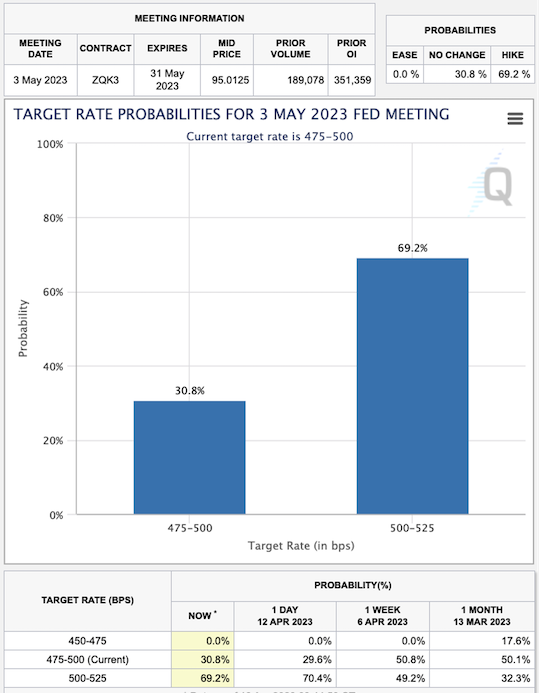

Let’s first look at the probability of a rate hike the market currently assigns to the May 3, 2023, FOMC meeting:

Credit: CME Group

The market is pricing in a 69.2% chance of a 25 basis point hike for the May 3, 2023 meeting.

That seems fair enough, though I think a 25-bp hike is a sure thing.

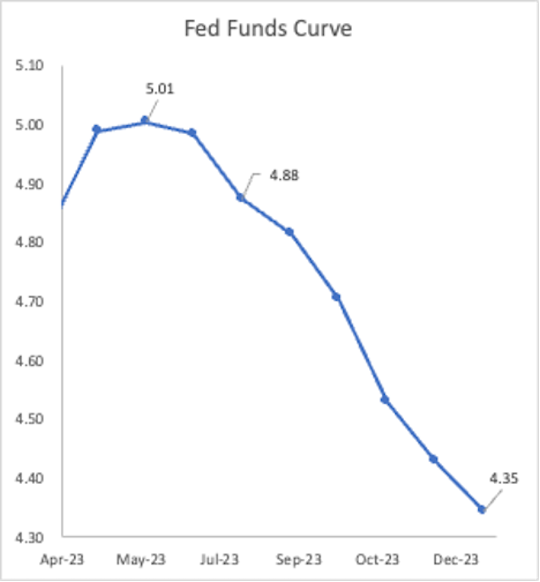

The current Fed Funds futures curve looks like this (from a rate perspective):

Credit: Sean Ring via Marketwatch

This curve shows the market pricing in the terminal rate as 5.00%, will the Fed cutting rates almost immediately after getting there.

I just don’t see that happening. I reckon Powell, like his predecessors, will let the terminal rate of 5.00% reign for a while longer.

And that’s assuming 5.00% will be the terminal rate. I wouldn’t be surprised to see him hike again in June. Then something really will break.

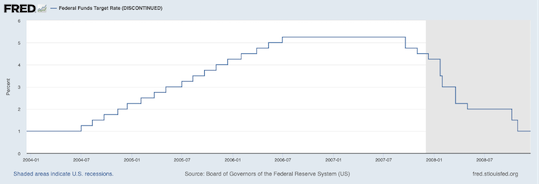

After all, The Bernank let his terminal rate of 5.25% sit from July 2006 to September 2007.

I bring all this up to show where inflation fits into the Fed’s narrative. Let’s start with food.

Food

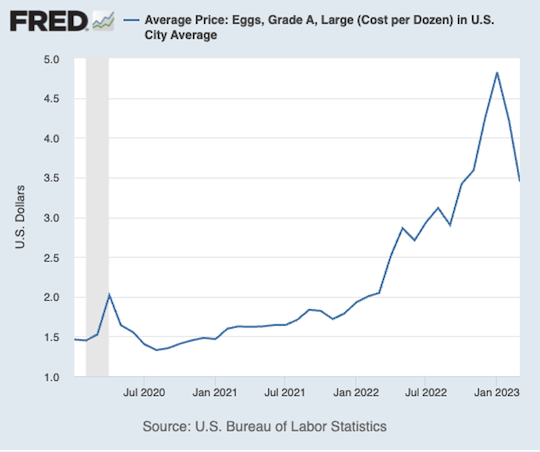

Let’s have some fun first. Bloomberg ran this headline:

Credit: Bloomberg

This is not a lie. Let me repeat: this is not a lie.

And they even put “...After Recent Surge” to make the headline even more truthful. Bloomberg should be lauded for this honesty. Really.

But while this is mathematically and even logically true, it doesn’t show the whole picture.

Here’s the whole picture:

Suppose most people could buy a dozen eggs for $1.50 during “normal times.”

Then those damn sanctions and supply chain issues and bad governance caught up with us.

Eggs go from $1.50 to $4.50 (roughly). That means the price of eggs tripled.

Then, from that peak, eggs now fall back to $3.50.

So, yes, Bloomberg is honest and correct. Egg prices did indeed fall by a great deal.

But a more honest and correct headline would read, “Eggs Still 133% More Expensive Than When Scrambled-Brained Biden Assumed The Position.” ($3.50/$1.50) - 1 = 1.33

With all that said, the news is better on the food front.

Month-on-month food at home prices were unchanged. That’s good news.

Month-on-month food away from home was down 0.3%. That’s good for inflation, but I think this speaks to the demand destruction that Powell is trying to cause.

After all, can the average American afford to go out as much as they did before?

Still, we’ll take this as positive news for now.

Year-on-year food prices remain elevated, up 8.5% since March 2022.

Energy

This is straight from the BLS CPI Index Summary:

The energy index fell 3.5 percent in March after decreasing 0.6 percent in February. The gasoline index decreased by 4.6 percent in March, following a 1.0-percent increase in the previous month. (Before seasonal adjustment, gasoline prices rose 1.0 percent in March.) The natural gas index decreased 7.1 percent over the month, following an 8.0 percent decline in February. The index for electricity decreased by 0.7 percent in March, the largest decline in that index since January 2021.

The energy index fell 6.4 percent over the past 12 months. The gasoline index decreased 17.4 percent over the last 12 months, while the fuel oil index fell 14.2 percent over the span. In contrast, the index for electricity rose 10.2 percent over the last year, and the index for natural gas increased 5.5 percent over the same period.

The month-on-month numbers are good. Energy overall, gasoline, natural gas, and electricity all declined. That’s good news for inflation, but I worry about demand destruction.

Interestingly, for the year-on-year numbers, electricity (up 10.2%) and natural gas (up 5.5%) increased quite a bit.

This tells me that even if we’re entering into, or already in, a recession, energy is one of the critical sectors to remain invested in.

The Fed’s Next Move

The Fed will surely hike at their May meeting, a mere twenty days away.

The market believes this 25 basis point hike will be Powell’s last in this cycle.

I disagree with the market. I think he’ll go again in June. And for the “Sell in May and go away” crowd, it’ll be a shock.

If they really have sold in May, they’ll be happy. But I think cheeky longs will be wrong.

Then we’ll have our paradigm shift. Powell is serious, and he’s going to pull a Volcker.

For those who think Powell’s done a bang-up job, I simply think it’s too early to call the race.

Remember, it’s only 13 months after his rate hikes. To this day, we haven’t seen the full effects of those hikes.

Wrap Up

To summarize, food and energy prices are going the right way: down.

But I don’t think this is enough to get Chairman Pow to relinquish the Hiking Hat yet.

He’ll surely hike in May… and I think he’ll hike again in June.

I hasten to add that almost no one in the market agrees with me, and there’s a high probability that I’m incorrect on this call.

Nevertheless, I’ll stick with it until I’m proven wrong in June or something monumental changes my mind before then.

With that said, have a wonderful day today!

How a Missed Phone Call May Cost Trump Big

Posted April 23, 2025

By Sean Ring

Charlie Munger’s Mental Models

Posted April 22, 2025

By Sean Ring

The People Who Need and Deserve Our Help

Posted April 21, 2025

By Sean Ring

The Order of Love: Why Nations Must Prioritize Their Own

Posted April 18, 2025

By Sean Ring

We’re Screwed If We Don’t Do the Math

Posted April 17, 2025