Posted February 03, 2025

By Sean Ring

The Great Rotation Into Gold?

January 2025 Monthly Asset Class Report

On Thursday, Jay Powell sat on his hands and didn’t cut. No one expected he would. And I’m not sure it even matters anymore. The Fed has lost the plot and is behind the curve. Now, with The Donald intent on implementing tariffs, it looks like we’re entering a new era of inflation.

The funny thing is Americans are actually on board with it. Not because anyone wants to pay more for their eggs, but because they think this is the way to clean out the American economic system. We’re moving from a time of unbridled belief in neoliberalism to a period of neomercantilism.

I’m not sure if it’ll cure America’s problems, but it’s clear America couldn’t have continued as it did. Nearly 14% of Americans need food banks for food security, and almost 11% pay the minimum on their credit cards. The Joke Biden presidency may have been the most deleterious waste of time since Jimmy Carter was in office and over his head.

With DeepSeek urinating all over Sam Altman and his ClosedAI, open-sourcing it to the world, the entire AI sector took a hit a week ago. Much of it has recovered, but NVDA is still down. It may yet close the gap between here and $142.50, but that may be the end of its bull cycle. And with that, the Nazzie rolls over. And with that, the SPX follows it. Heck, the IWM is already hurtling toward its downside targets. Equities markets may feel some pain in the months to come.

And bonds? Gentlemen may prefer them, but only when giving an inflation-beating return. That’s not going to happen for a long while now.

With yields increasing and the Almighty Dollar getting mightier, you’d think gold was heading for a dropoff. But that’s not going to happen. It’s my pleasure to inform you gold is on its way to $3,300. Sure, it may take a breather at $3,000. But we’ll get to $3,300.

As for silver, does a $37 price target sound good? Because that’s where it looks like we’re heading… with The Donald’s blessing. There’s no sign the USG will intervene to keep the price down.

S&P 500

Though this isn’t the highest weekly close ever, it’s the highest monthly close for the SPX at 6,040.53. While I’d generally say, “There’s no reason to sell here,” NVDA’s chart looks weak. That doesn’t mean we haven’t had some good breadth over the past month; it just means some caution is warranted.

As I wrote last month, the price target is still around 7,500, but I’m waiting for it to drop.

Nasdaq Composite

We may still be in an uptrend, but it looks like we’re rolling over. Our new downside target is 17,850. NVDA can pull the whole thing down. Proceed with caution. I’ve included the X post below to illustrate.

Russell 2000 (Small caps)

I’m not a fan of the IWM right now. Although it looks like it escaped a bear trap on January 15th, the Russell ETF finished below its 50-day moving average, and that line is pointing down. So we’re in a short-term bear market, at least. But I wouldn’t be surprised if this ETF fell another ten points in February. I still like the 192 target from last month.

The US 10-Year Yield

We hit well above the 4.64% target we set last month, and the 10Y fell right afterward. The question is, “Does the 10Y stop at 4.30% (where resistance turns into support), or does it crash through there on its way to 3.50%?”

Jay Powell won’t cut anytime soon (unless The Donald pressures him enough), so we may return to 5.00% after hitting 4.30%.

Dollar Index

We barely moved this month, but I expect that to change immediately. For now, I think we’re heading up following the 10Y.

And the technicals still point north, all the way above 120. But I don’t think that will happen anytime soon.

USG Bonds

We indeed fell to 85.50, as I suspected, but popped back up. I can’t explain that other than to claim this is a sucker’s rally. What I can say is I haven’t the faintest idea why anyone would want to own bonds in this environment.

Investment Grade Bonds

This is another sucker’s rally. I reiterate that my next target is 101.50.

High Yield Bonds

Junk popped a point in January, much to my surprise. I don’t have a further upside target. We’ll be moving sideways for a while… before the fall.

Real Estate

We’re in the middle of another sucker’s rally. It’s a good time to short this, as the downside target is 73.

Energy: West Texas Intermediate (Oil)

Base Metals: Copper

Copper rose a bit this month, but again, I think it’s a sucker’s rally. The next price on the way down is $4.00.

Precious Metals: Gold

Dance a little jig, you gold bug. Go ahead. Feel good. On Friday, gold finished the week with a new all-time weekly AND monthly high of $2,835. It broke out of that last base of 2024 and will now, almost surely, continue straight through to $3,000 on the double.

The new upside target is $3,350. This should be a boon to the gold miners, as well.

Precious Metals: Silver

We robustly reached above $30. Once above $33.50, we’ll head to our next target of $37.

The silver miners will love the next few months. And investors will love the miners.

Cryptos: Bitcoin

I called for a Bitcoin top a month early. I think this is a likely point for a pullback, though that isn’t guaranteed.

Bitcoin’s downside target is about $89,000. Perhaps we’ll see if Bitcoin is a currency or a tech play after all.

Cryptos: Ether

I’m divided about Ether. It’s above its 200-day moving average and has an upside target of $4,175.

However, the chart looks like it topped, and I can see $2,500 as a downside target.

This gets a big “avoid” from me.

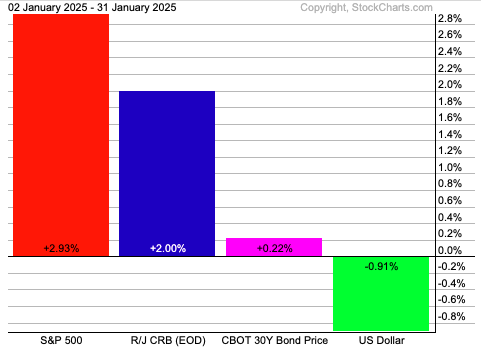

Trad Asset Class Summary

The Almighty Dollar fell almost 1%, relieving the other asset classes. The SPX led the way, recovering from a terrible December, gaining nearly 3%. Commodities were up a solid 2%, which may only be the beginning of an extended rally. The long bond crept up 22 basis points, but I’m bearish on bonds with the coming inflation.

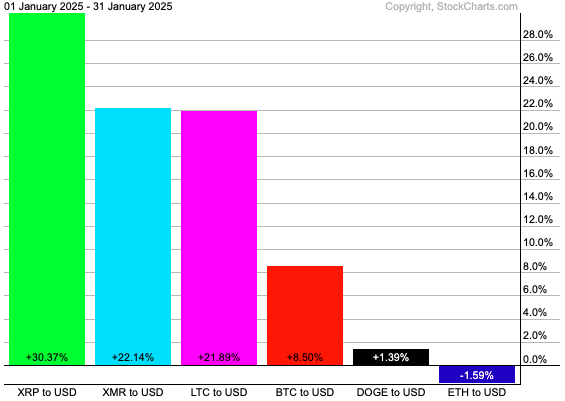

Crypto Class Summary

Thanks to the crypto bros sniffing out the next round of inflation, everything but the suddenly woeful Ether was up in January. Ripple, the government’s crypto baby, was up the most, followed by Monero and Litecoin. All posted triple-digit returns. Bitcoin was up 8.5% and Dogecoin crept up 1.39%. Ether was a loser, down 1.59%.

Wrap Up

Now’s the time for gold to shine. We’ve been bullish since it was bouncing its head off $2,000. That was over 40% ago. We’re heading to $3,300.

And don’t forget silver. $37 is only the first step toward $50… perhaps even higher.

If you’re not in yet, I think it’s the last time to buy in before it goes parabolic. Physical, ETFs, miners… just get in!

Finally, let’s take a moment, courtesy of the X-verse:

Canada: From Trudeau to Worse

Posted March 11, 2025

By Sean Ring

Bitcoin’s Wild Weekend!

Posted March 10, 2025

By Sean Ring

From Cotton King to Charity Prince

Posted March 07, 2025

By Enrique Abeyta

Incentives, Outcomes, and Confirmations

Posted March 06, 2025

By Sean Ring

“Pochahantas Says, ‘Yes!’”

Posted March 05, 2025

By Sean Ring