Posted June 27, 2024

By Sean Ring

The Golden Age of Minors

Finance theory dictates that between 75% and 91% of all portfolio returns are because of asset class selection rather than stock selection.

For this reason, we recommend commodities and commodity stocks at Paradigm Press. We believe this is the beginning of a commodity supercycle. Many of you have doubtless done well already by owning these commodities either via futures or stocks.

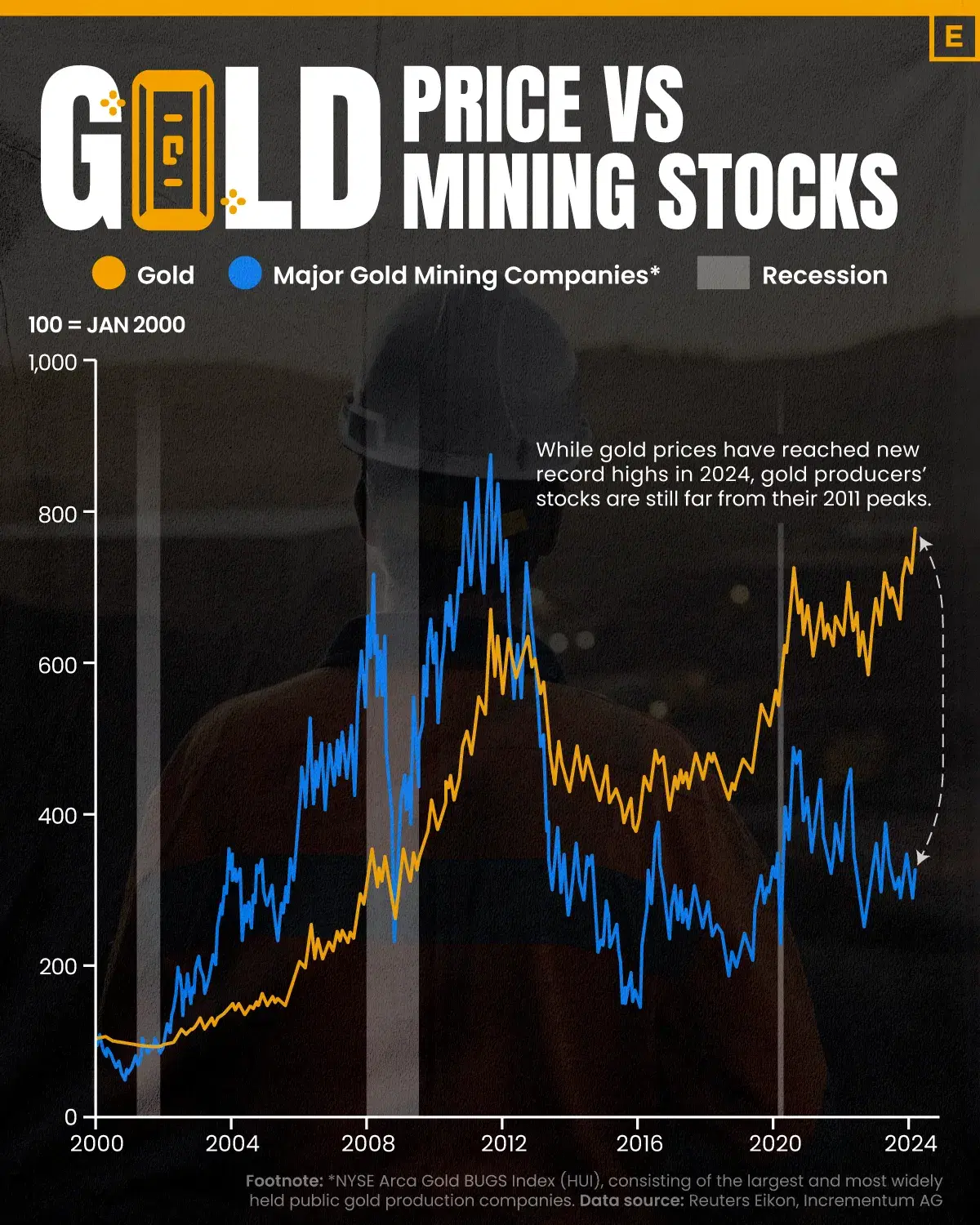

One of the many things we’ve seen is the difference between the price of gold and gold miners. A yawning gap has opened up between the two, meaning the miners are historically cheap compared to the metal.

Credit: Visual Capitalist

As a result, buying mining stocks is an unusually good bet.

Today, I’ll go into what I’m personally holding. Please don’t feel like you have to replicate any part of my portfolio. It’s only to show you what I’ve already done rather than what you should do. Only you know your portfolio well enough to judge that.

Remember that I said I was “swinging for the fences” a while back. I’m big into taking risks (especially with my silver positions). That’s very important. It’s not to everyone’s taste.

Also, I’m more of a chart guy, so I’ll discuss the technical perspective more than anything else.

One last thing: many of these picks are in Paradigm Press portfolios, such as Strategic Intelligence. I trust my colleagues more than anyone else. That is, I eat Paradigm Press’ cooking!

Let’s get into it.

Gold Miners

Kinross Gold (KGC)

Dan Amoss recommended selling this stock in the last Strategic Intelligence June portfolio update. It’s been in their portfolio for a long time. While locking in a 70% gain is a good thing for subscribers, I’m hanging onto this stock. I got in later (purchase price: $6.04), and I think we’re about to begin another upswing.

Also, the chart is just too good-looking for me to sell it right now.

Avino Silver & Gold Com NPV (ASM)

This is a small miner that rates highly. Don Durrett of GoldStockData.com loves this stock, and his analyses are incredibly useful.

Right now, ASM is taking a breather and consolidating before its next up leg. It just bounced off its 50-day moving average.

Silver Miners

First, the silver futures chart:

Silver rocketed to over $32/oz. but then it cooled down. It didn’t fall off a cliff by any means. It just didn’t continue its meteoric rise. This has put a dampener on my silver mining stocks. I expect this to reverse when silver exceeds $35/oz. Right now, it’s sitting on its 50-day moving average.

Hecla Mining (HL)

This is one of the uglier charts, as the 50-day moving average line is declining. We should see a recovery as long as HL doesn’t fall through support at $4.70. You may view this as a buying opportunity if you're not in yet.

First Majestic Silver Corp Com NPV USD (AG)

Another silver stalwart, this chart needs to bounce off the 200-day moving average to retain any hope.

Silvercrest (SILV)

This is still a hold in the Strategic Intelligence Pro portfolio, and I agree with it. It’s only a matter of time before SILV regains its 50-day moving average. And the chart still heavily uptrends.

From Dan Amoss’ commentary on SILV:

SilverCrest’s financial results, reported on May 14, were excellent.

SilverCrest has the balance sheet, cash flow, and track record to expand the mine’s life through further drilling programs.

SILV remains an attractive play on rising silver prices.

Copper Miners

HudBay Minerals Inc (HBM)

On April 8th, I wrote that instead of buying Freeport McMoron FCX, you could buy HBM. Byron King, our Senior Geologist, said, “It's a Sturdy old company. They keep a low profile but do good work. Very efficiently run.”

It’s also another company hugging its 50-day moving average before heading up again.

Platinum Group Metals (PGMs)

Sibanye Stillwater (SBSW)

This is my one real stinker so far. It’s essentially a bet on South Africa and platinum group metals. I had hoped I caught it off the bottom, and that scenario may still play out.

But right now, this position is underwater by about a buck per share.

Royalty Companies

Orogen Royalties Inc. (OGN.V)

Orogen Royalties is a company Rick Rule recommended at the Paradigm Shift Summit 2023 in Las Vegas. When Rick recommended it, OGN.V was trading at roughly CAD 0.65. It’s now at CAD 1.11, after peaking at CAD 1.35. It just bounced off its 50-day moving average, so I expect a leg up from here, hopefully moving through 1.35 soon.

Wrap Up

We’ve been bullish on commodities for years, and rightfully so.

But right now, the gap between commodities and stock prices is at its widest spread in 50 years.

Whenever this happened, it triggered the start of a massive “supercycle” inside the commodities market that squeezed prices higher and higher.