Posted September 18, 2025

By Sean Ring

The First Cut is the Shallowest

By Jay Powell’s reckoning, the sky isn’t falling… but he’s already handing out parachutes.

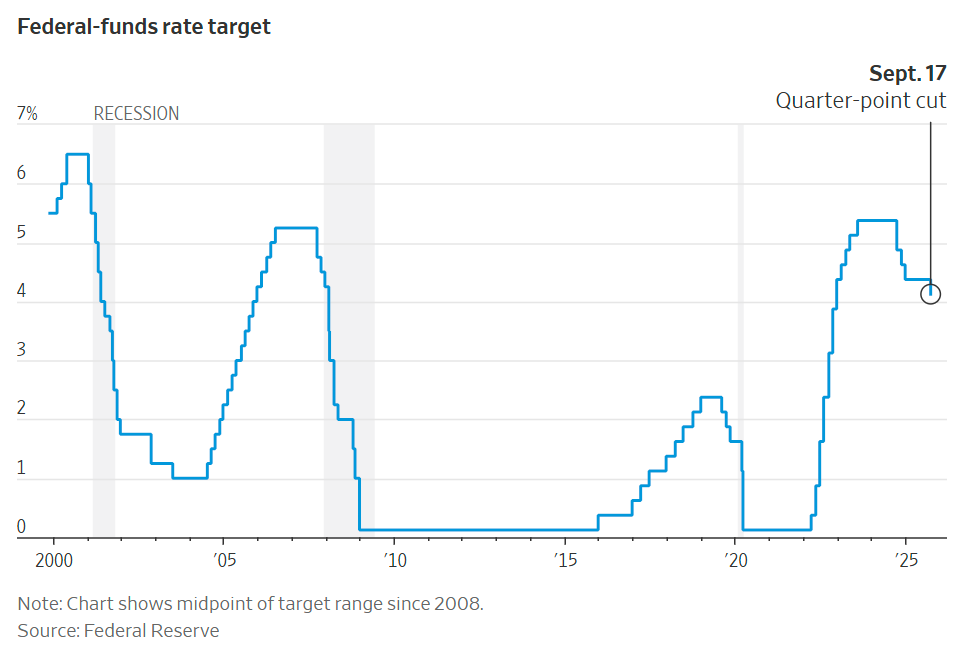

For the first time since the Fed’s December 2024 trim, the FOMC trimmed its benchmark interest rate by 0.25% (25 basis points, or bps), dropping the federal funds target range to 4.00%–4.25%. Chairman Pow strolled up to the podium yesterday’s looking calm, but sounding just a tad nervous — like a pilot telling you it’s “just a little turbulence” while quietly tightening his harness.

Markets had been salivating for this cut for months. They got their snack… and then looked queasy.

Putting Out a Fire That Isn’t Burning (Yet)

Powell justified the move by citing “a moderation in growth” and “a softer labor market.”

Translation: growth is sputtering, job creation is evaporating, and the unemployment rate has quietly climbed to 4.3% (as of August). Payroll gains have averaged a paltry 29,333 a month over the last quarter — an ominous whisper compared to the 200k+ days of the post-pandemic boom.

Credit: The Wall Street Journal

Credit: The Wall Street Journal

He framed it all as a “shift in the balance of risks” — fancy Fed-speak for “we’re more scared of mass layoffs than lingering inflation right now.”

And Powell made a point of emphasizing this was not the start of a panic spiral. The Committee, he insisted, is continuing its balance sheet runoff and will stay “data dependent.” (Every time he says “data dependent,” somewhere an algo sheds a tear.)

The Split Between Caution and Capitulation

Interestingly, there was one dissent — Stephan Miran, the newly appointed governor, wanted a 50-bp cut, arguing that the Fed is already behind the curve. Powell shot that down, saying there was “no widespread support at all” for such a drastic move.

Yet the dot plot now implies two more cuts by the end of 2025. That’s not nothing. That’s a subtle but unmistakable pivot: from fighting inflation to cushioning employment.

This is the first time in this cycle that the Fed has publicly prioritized jobs over prices. If you squint hard enough, you can see the ghost of Arthur Burns pacing in the background, muttering about how “just one little cut” becomes a slippery slope.

The Market’s Lukewarm Reaction: Buy the Rumor, Fear the Reality

Equities popped on the headline, then sold off into the close. Bond yields barely budged. The dollar wobbled.

In other words: relief that the cut finally came… dread about what it signals.

If the Fed is cutting, things must be worse than they look. Right? That’s the whisper running through trading desks tonight.

And they’re not wrong to wonder. The Fed is supposed to cut when the economy is in the ditch. It’s cutting while GDP is technically still expanding and inflation is still running hotter than target. That’s… unusual.

My friend and colleague Jim Rickards is right in that lower rates aren’t indicative of a healthy economy.

Politics in the Background, Powell on Stage

Powell, ever the central-banker monk, tried to project “independence” — reminding everyone the Fed is above politics even as President Trump’s complaints grows louder.

But make no mistake: political heat is rising. Calls from the Hill for easier money have grown shriller as job losses continue to increase. Powell’s move gives him cover: “See? I’m not oblivious to pain on Main Street.”

Still, he’ll catch flak from both sides — doves will say he’s moving too slowly, hawks will say he’s risking a second inflation wave. Welcome to the most thankless job in America.

Cutting Into the Wind

Here’s the uncomfortable truth: This cut won’t fix what’s broken.

- If the slowdown is real, 25 bps is aspirin for a heart attack.

- If inflation resurges, this cut just lit the fuse.

Either way, Powell’s in a box. He had to move or lose credibility on the “dual mandate.” Or worse, face The Wrath of The Donald.

But now he’s trying to steer a 300-million-passenger cruise ship with a cocktail straw.

And by floating two more cuts this year, he just told Wall Street: “If you panic, don’t worry — Daddy will be back with more candy.” That might prop risk assets for a bit… until the next bad payroll print hits like a brick.

This isn’t a pivot. It’s a pre-emptive flinch.

Wrap Up

Traders wanted rate cuts. They got one. But as every old market hand knows:

The Fed cuts rates because something’s breaking.

Today’s 25 bps isn’t stimulus. It’s triage.

If Powell’s right, this is just an “insurance cut” and all will be well.

If he’s wrong, this is the opening bell of the recession.

Either way, don’t be the last one standing when the music stops. The Fed just changed the tune.

The Safety is in The System

Posted September 17, 2025

By Sean Ring

The Ghost of Louis XVI Warns Trump

Posted September 16, 2025

By Sean Ring

Something like 1980 is about to happen…

Posted September 15, 2025

By Sean Ring

The Curious Incident of the Dog in the Night-Time

Posted September 12, 2025

By Sean Ring

America’s Rubicon: Two Murders That Changed Everything

Posted September 11, 2025

By Sean Ring