Posted September 20, 2023

By Sean Ring

The Fed Skips Another Period?

Good morning from Asti on another gray day.

Autumn will officially be here on Saturday, but I think it’s arrived early.

I don’t mind, as writing in the cold is much easier than in the heat.

What I do mind is being wrong.

I thought the Fed would hike today. In fact, I was sure Powell would go and then do one more before the end of the year.

But it looks like I was wrong, and the Fed will hold today. This, even though the CPI has climbed year-on-year for three months.

Let’s get straight into why Jay Powell will, in all likelihood, hold rates steady today.

Today is the Day

The Federal Reserve is expected to hold interest rates at 5.25%-5.50% at its meeting on September 20-21, 2023.

The Fed wants to assess the impact of its previous rate hikes and give the world economy time to adjust. I stress the “world” economy because the strong dollar is chewing up economies overseas, and their central banks would rather not hike right now.

Seven Fed rate hikes in the last twelve months. Credit: FRED

The Fed has raised interest rates seven times in the last 12 months to combat inflation, which is coming off a 40-year high.

However, the Fed has finally figured out that raising rates too quickly could lead to a recession.

Here are three reasons why the Fed is likely to hold rates steady today:

- Inflation isn’t “out of control” … yet. Inflation is still high but hasn’t jumped. The Consumer Price Index (CPI) rose 3.6% in August 2023 from a year ago, up from 3.2% in July and 3.0% in June. I thought this would make them hike. The CPI has risen for three months consecutively, but this seems not to bother the Fed. It bothers me, and I think they’re being too complacent here.

- The economy is slowing. Economic growth has slowed in recent quarters, and some economists fear a recession may be on the horizon. The real US economy grew at an annual rate of 2.1% in the second quarter of 2023, down from 4.0% (year-on-year) in the first quarter. The Fed is unlikely to raise rates further if it believes that could push the economy into a recession. However, the Atlanta Fed has Q3 GDP growth coming in at 4.9%, so again, I disagree with Powell’s team.

Credit: The Atlanta Fed

- The Fed wants to give the economy time to adjust. The Fed's rate hikes can take years to impact the economy fully. Raising interest rates too quickly can lead to a recession, as businesses are less likely to invest, and consumers are less likely to spend. The Fed wants to give the economy time to adjust to the rate hikes it has implemented before raising rates further.

This certainly applies to small businesses that couldn’t swap out their interest rate risk when rates were low.

Here are some additional factors that the Fed may consider when making its decision:

- The strength of the labor market: The US labor market remains strong, with unemployment near a 50-year low. This suggests that the economy can withstand further tightening in monetary policy.

- The global economic outlook: The global economy faces several challenges, including rising inflation and the ongoing war in Ukraine. The Fed will weigh these risks when making its decision about interest rates.

If the European Central Bank had to raise rates again to chase the Fed, it’d plunge the Euroland economy into a more significant recession than it already has.

The Fed is likely to hold rates steady today as it assesses the impact of its previous rate hikes and gives the world economy time to adjust.

It’s still important to note that the Fed's decision is uncertain - at least for the next few hours.

The Fed may - may - decide to raise rates today if it believes that inflation is not moderating quickly enough… but that’s an extremely low probability play.

What Jim Rickards Thinks

Here’s what Jim wrote yesterday:

We should make it clear that the Fed’s decision not to raise rates tomorrow is not the much anticipated “pause” in this rate hike cycle. A pause is understood as the end of the rate hikes. After the pause is reached, the Fed will sit tight for a prolonged period of time before cutting rates and starting a new rate cut cycle.

That’s not what’s happening.

Instead, this is another “skip” of the kind the Fed did at the June 14, 2023 meeting. A skip does not mean that the Fed is done hiking rates. It means they want to slow the tempo. So, instead of raising rates at every meeting, they can raise rates at every other meeting or any other tempo they choose.

The Fed raised rates last May, they skipped a rate hike in June, they raised again in July, and now they’re going to skip again in September. The “every other meeting” tempo seems firmly in place. That means we can expect another 0.25% rate hike on November 1, 2023, the Fed’s next meeting after this one. It’s too soon to make that a firm forecast, but that’s the most likely outcome as of now.

Later in his piece, Jim mentions the elephant in the room. Look at this chart of WTI:

Don’t you think this will translate at the gas pump?

Jim continues:

This reveals a 21% increase in crude oil prices in the past two months. Of course, that run-up in oil prices is part of what’s driving the increase in CPI with one important caveat. Wholesale prices take time to work their way to the gas pump where consumers actually notice the increase.

This means the September crude oil price increase has not made it to the gas pump yet, but it will. That’s a reason to expect the CPI will continue to rise as the September numbers are reported in October and beyond that.

Gas at the pump has risen 5.5% in the past year from $3.68 per gallon for regular to $3.88 per gallon. That number means more to consumers than CPI, PPI, PCE and all of the other inflation measures the eggheads use. It will get worse. It’s an election year. If Jay Powell can’t connect those dots, it’s another epic fail by the Fed. Powell’s trying to finesse inflation and recession. He’s likely to end up causing both.

Wrap Up

In all likelihood, the Fed will hold today. But Powell may raise rates at the next Fed meeting.

Powell’s playing with fire, and he’ll probably get burned.

I don’t see Russia and Saudi Arabia rushing to increase production in their new BRICS partnership to give Joke Biden a hand.

Jay Powell may regret not hiking before the real problems begin.

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

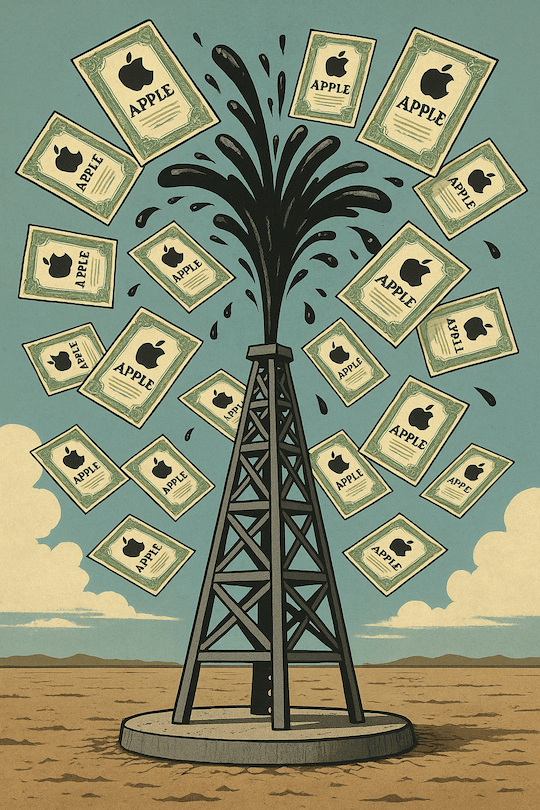

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring

J.P. Morgan’s Last Rescue Mission

Posted May 02, 2025

By Sean Ring