Posted December 02, 2025

By Sean Ring

The Curious Case of the Disappearing Silver

It’s always a pleasure to wake up to my good friend and colleague, Adam Sharp, writing about silver in his Daily Reckoning column.

Adam charts out a path to $200 silver, and that just warms the cockles. Though I think he’s onto something, I’ll reserve my excitement for a $70 ounce, and then $100. Once we hit triple digits, there’s no telling where the Devil’s Metal will stop. Adam may well be correct on his $200 call, and I’ll be the first to buy him a beer if he’s right.

Next, I caught up with Dave Gonigam’s 5 Bullets, where Dave discussed the metals and the stock market's rise through yesterday’s session.

It’s drinks all around for now, and I think we’ll be uncorking the champagne happily come December 31st. That is, the rally should continue, and for the metals, that’ll be through the first quarter of 2026 at least. In fact, I’d say $100 silver and $5,000 gold are no longer pipe dreams. They’re inevitabilities.

But going from $4,200 to $5,000 in gold is only a 19% move. Silver’s mountain to climb is much higher. So why are we convinced a $100 silver ounce will happen? Read on.

The Media’s Story

Silver is nudging up against its highest nominal level in history. If you ask the financial press why, they’ll confidently tell you it’s because Jerome Powell might cut rates in December. Apparently, the lamestream media reduces the entire global silver ecosystem — refineries, solar factories, EV supply chains, vault inventories, Indian festival demand, and strategic U.S. procurement — to a single variable: the Fed funds rate.

It’s adorable, really.

Tune into Bloomberg or CNBC, and the story is always the same. Rate cuts weaken the dollar, metals rise, and everyone pats themselves on the back for understanding macro.

Industrial demand is strong because we all buy electronics, solar panels, and Teslas. Inventories are falling because, well, they just are. Tariffs create spooky vibes, geopolitics create even spookier vibes, and a few fund managers mutter “safe haven flows” like it’s a magic incantation.

None of that is false. It’s just the kiddie-pool version of what’s actually happening.

Where Did All the Silver Go?

The real story begins with a silver market that’s been running a structural deficit for years. Mine supply hasn’t grown meaningfully in more than a decade. Discoveries are smaller. Grades are declining. Permitting is slow. Environmental restrictions are tightening.

Even when investor interest is low, industrial demand continues to grow, depleting inventories. This fundamental imbalance is inherent in the system.

Indian Demand

Against that backdrop, India has decided to hoover up physical silver like an overcharged Dyson. Festival and harvest seasons send imports soaring, but this year the dynamic is different. Because risk managers understand the impending squeeze, U.S. vaults are preventing silver metal from being released for export.

This situation is forcing India to source its silver from London and all other available locations, driven by a confluence of massive cultural, seasonal, and precautionary demand.

Strategic Silver

Simultaneously, the U.S. is quietly treating silver the way it treated rare earths a decade ago. Once Washington slapped a “critical mineral” label on it, the rules of engagement changed. Government agencies can stockpile it. Defense-linked corporations can stockpile it. The press won’t call it a strategic accumulation program, but we can see the hallmarks. A steady drawdown of London bars, shrinking COMEX deliverables, and enormous flows into U.S. vaults tell the story better than any press release.

Yes, The Fed

Then there’s the broader policy uncertainty. Everyone obsessively quotes rate-cut probabilities, but that’s only one piece of the puzzle. Markets are also handicapping potential new trade restrictions, another round of tariffs, and speculation about who might chair the Fed next. Industrial and financial risk managers aren’t waiting around to find out. They’re securing metal now because the policy regime is unstable, and volatility in silver — unlike volatility in tech stocks — has physical consequences.

The Technicals

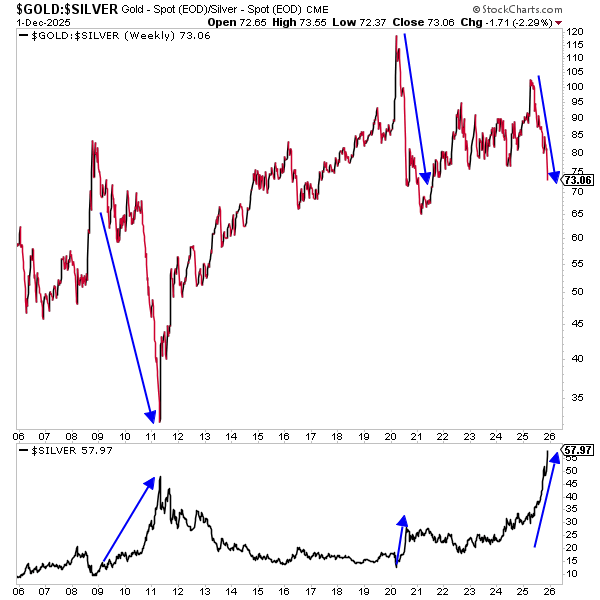

Silver has been ripping above every major moving average, the momentum stacks look like a SpaceX launch, and the gold–silver ratio (GSR) has fallen to levels that force systematic funds to rebalance into silver.

Breakouts accelerate quickly because the physical market is already strained. The algos aren’t creating a trend; they’re reacting to one that already exists.

Note in the chart below how, when the GSR collapses (top), the silver price rallies hard (bottom):

Industrial Demand

Industrial demand remains the monster hiding under the floorboards. More than half of all silver consumption now comes from electronics, electrical systems, solar panels, and EVs.

Every circuit board, conductor, relay, switch, solder joint, battery management unit, and autonomous-driving sensor needs silver. Data centers and AI infrastructure have become major consumers. Solar photovoltaics alone account for up to a mid-teens’ share of global output.

Modern cars demand more silver every year, even if sales are flat, and EVs demand dramatically more. Medical uses are rising as antimicrobial coatings become standard in hospitals. Power grids, charging networks, smart-grid controls, and 5G components all need silver.

None of this is discretionary. None of it slows easily. And none of it is being matched by new mine supply.

Another Case of Dilution

In the middle of all this, unofficial Rude portfolio holding Endeavour Silver (EXK) did what miners always do during a breakout: it raised money.

Over the last five sessions (Friday to Friday, as we were closed for Turkey Day), EXK had rallied 41.65%. Yesterday, it was down 5.34%, far more than any other holding. Immediately, I knew what had happened.

EXK launched a sizeable convertible senior notes offering — roughly $300 million of unsecured paper due 2031, with an additional $45 million available if purchasers exercise the option.

The proceeds will pay down its secured credit facility and push the Pitarrilla project forward while Terronera ramps up.

This is classic “raise into strength” behavior. After running 170% year-to-date and nearly 40% last week alone, EXK took the opportunity to extend maturities, improve liquidity, and fund growth — at the cost of future equity dilution when the notes convert.

If Terronera and Pitarrilla deliver low-cost ounces into a structurally tight market, nobody will care about the dilution. If they don’t, the convert will sting.

But the financing is almost beside the point. The deeper story is that EXK’s timing only works in a market this tight. If silver were still sitting at $22 as the macro tourists expected, no CFO on Earth could have priced an unsecured convert of that size. The fact that EXK just did is proof of how radically the landscape has changed.

Wrap Up

The bottom line is simple: this isn’t a rate-cut rally. It’s a stress rally. A structural rally. A supply-deficit rally. A sovereign-accumulation rally. A grid-and-EV-and-solar rally.

The media wants a clean, single-variable narrative, but the real drivers are tangled, physical, messy, and much more powerful than anything Jay Powell scribbles on an FOMC notepad.

When silver decisively breaks above $60, the lamestream media will finally start asking the questions they should have asked back at $30:

Why is the world short of silver?

Why are inventories falling everywhere?

Why is India inhaling metal and the U.S. hoarding it?

Why is supply stagnant while demand goes vertical?

By the time they find the answer, silver will be far more expensive than $60.

The Most Expensive Way to Go Broke

Posted February 18, 2026

By Sean Ring

The Bears Gather

Posted February 17, 2026

By Sean Ring

Omar Khayyam: Poet, Rebel, Astronomer

Posted February 16, 2026

By Sean Ring

The Devil in Mexican Mining

Posted February 13, 2026

By Matt Badiali

Is Civil War on the Cards?

Posted February 12, 2026

By Jim Rickards