Posted August 01, 2025

By Sean Ring

The Copper Faceplant

Every month, I publish this monthly asset class report not to predict the future, but to show you exactly where we are right now.

The charts are simple candlesticks, with the 50-day (10-week) and 200-day (40-week) moving averages. At the end, I present a couple of performance charts to illustrate the relative trading positions of traditional asset classes and cryptocurrencies.

If you’re a new subscriber, please email feedback@rudeawakening.info with any questions, comments, or concerns. Our mailbag is lively, and I try to publish reader feedback at least once a month. Enjoy!

What the heck was that?

Copper posted its worst one-day drop in futures history—nearly 24%—and you can thank The Donald for it. But not in the way you might think.

The plunge wasn’t caused by the idea of tariffs, but by the way those tariffs were rolled out. When The President floated a sweeping 50% copper import tariff in early July, the market panicked. Traders scrambled to front-run the taxman, stockpiling refined copper like it was going extinct. U.S. copper futures surged, trading over 30% above London prices.

But when the actual policy landed, it was full of loopholes: refined copper, ores, and concentrates were all exempt. Only semi-finished goods like pipes and wires were hit. That surprise twist detonated the arbitrage trade. Suddenly, all that hoarded metal became dead weight, and copper futures collapsed in a tidal wave of unwinding.

The record-breaking crash wasn’t about demand. It was about a textbook case of speculative overreaction to policy design. Tariffs were priced in—but never showed up. The result? A historic market faceplant, proving once again that the real risk isn’t always the policy… it’s the expectation of it.

The gold market's reaction has been relatively muted compared to copper’s swan dive. Recent price action reflects the impact of a stronger U.S. dollar, as well as ongoing trade and tariff uncertainty after the Trump administration’s broad and rapidly changing tariff policy.

Silver has been hit harder and more directly by the copper crash, partly due to its industrial character and close relationship to the broader base metals sector. The sharp selloff in copper undermined sentiment for silver as well, which is often seen as an industrial precious metal.

The divergence arises because gold is viewed mainly as a monetary hedge and safe haven, while silver shares these traits but is also more sensitive to global growth and industrial demand signals—areas directly impacted by the copper rout.

Now, let’s get to the rest of the charts.

S&P 500

***NEW MONTHLY CLOSE HIGH OF 6,339.39***

The equities market keeps on trucking on, with a slight downturn this week. But there’s nothing in these charts that indicates a pending sell off. Keep riding that beta train!

Nasdaq Composite

***NEW MONTHLY CLOSING HIGH OF 21,122.45***

After the recent surge, my friend and colleague, Enrique Abeyta, just bought more SQQQ. That means he’s short-term short the Nazzie. Enrique has been right 77% of the time since he’s joined Paradigm, which would have earned him a burning at the stake if we were back in Salem.

Tread carefully with the tech stocks.

Russell 2000 (Small caps)

Again, we may be seeing the beginning of an equity turn this week. As the Russell is more volatile and has poorer earnings, this may be the way to trade a downturn. However, we’ve still got a bullish price target of 262.

The US 10-Year Yield

Though the President wants this yield down to 3%, he hasn’t been able to do that. We’ve been pretty stagnant in July, as well.

Until he gets Jay Powell on board with his policies, this will remain a thorn in The Donald’s side.

Dollar Index

The Fed doesn’t hike, the economic numbers surprise to the upside, and tariffs weakened the competition means the dollar was way up.

Now that you need less dollars to buy stuff, the asset markets have fallen.

USG Bonds

The long term bonds fell a bit this month on the stronger dollar. The price target remains 76.82.

Investment Grade Bonds

We had a breakout signal in June, but LQD is having trouble breaking above its recent highs. Price target remains around 121.

High Yield Bonds

Not sure if HYG can go much higher. Stalled at these nosebleed levels, a turnaround may be in order soon.

Real Estate

VNQ had a big sell off this week, but the price objective remains 101.

Energy: West Texas Intermediate (Oil)

Oil is starting to catch a bid, despite the strong dollar. The new price target is 79.81.

Base Metals: Copper

We’ve detailed the copper faceplant in the opening. We may fall all the way to 3.88, before staging a comeback. This was a historic blow. It’ll take some time to recover.

Precious Metals: Gold

This could be a consolidation before another up move. But, likelier, it’ll be a down stage to $3,000 before returning to surging form.

Precious Metals: Silver

Similar to gold, silver may head down to 34 before resuming its historic run.

Cryptos: Bitcoin

***NEW MONTHLY CLOSING HIGH OF 115,416.72***

Even after a down week so far, BTC still managed to post a monthly ATH. We’re looking at a temporary downside target of 108,500.

Cryptos: Ether

Ether well-exceeded last month’s target by a considerable distance, but we may be looking at a 3,300 downside target.

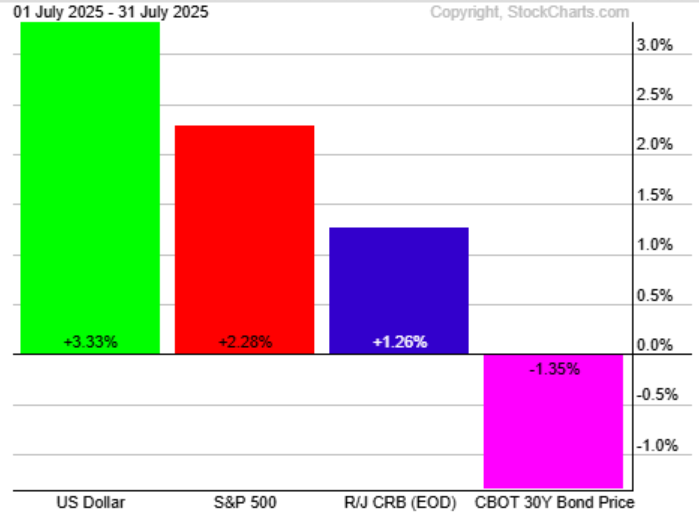

Trade Asset Class Summary

This month, the USD recovered, up 3.33%. The SPX and commodities (for some reason), were also up 2.28% and 1.26%, respectively. The long bond took a breather, down 1.35% in July.

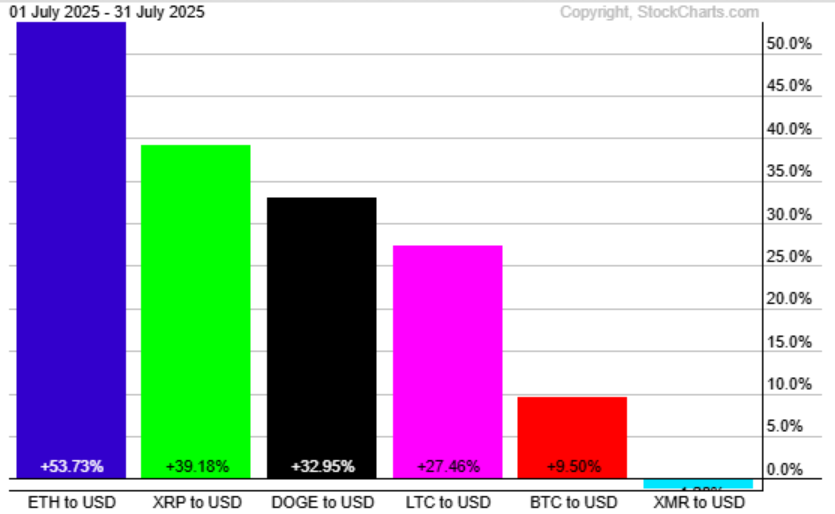

Crypto Class Summary

Ether, Ripple, Dogecoin, and Litecoin were all up substantial double digits in July, while Monero was a rare loser. Bitcoin finished the month up 9.50%.

Wrap Up

Copper and the metals had a rough one after the tariff mess, and dollar surge, while equities kept on trucking. Expect a slow August.

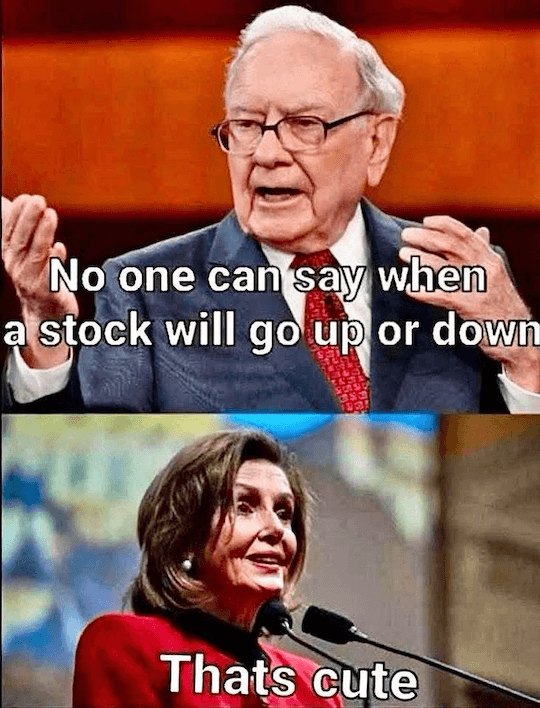

Finally, let us laugh, courtesy of the X-verse:

Have a great weekend!

A Money Pit That Saved Investors?

Posted August 29, 2025

By Byron King

A Philosophy For Living

Posted August 28, 2025

By Sean Ring

The Crowd’s Madness Saves Uncle Herschel

Posted August 27, 2025

By Sean Ring

The Fed's Cook is Goosed

Posted August 26, 2025

By Sean Ring

The Ascent of Ag in 5 Tweets

Posted August 25, 2025

By Sean Ring