Posted April 10, 2024

By Sean Ring

The Club You Ain’t In

I can hear philosopher-truck driver John Ring saying: “You can’t fight city hall!”

Or, more apropos, would be one of my father’s favorite comedians, George Carlin:

Growing up in America, I always believed the playing field was level. I thought my old man was crazy. I thought George Carlin, though one of the funniest men on earth, was jaded.

But, as usual, they were right, and I was wrong.

Much of this muchness started to happen when the Democrats went from being the people’s blue-collar party to the party of the metrosexual. Once the Democrats realized that you just needed the city vote to control most of the country, it was game over for the grassroots.

Across the pond, a similar transformation occurred in England. The ascension of Tony Blair to Prime Minister in 1997 marked a turning point for the Labour Party. It shifted from being the party of the miners to the party of the London multiculti metrosexual, a change that reverberated through the political sphere.

Think about it: thirty years ago, could you ever imagine farmers warring with the Leftist parties?

And now we’ve got Joke Biden, whose administration is just a walking scandal. But this particular scandal isn’t like the others.

A Strange Email

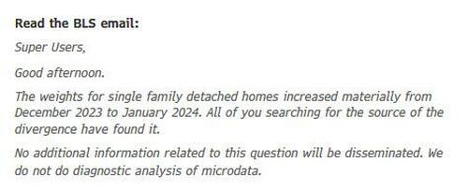

I can assure you that I didn’t receive this email from the Bureau of Labor Statistics:

“Super Users?” The BLS has “Super Users?”

What are Super Users, exactly?

Super Users

The Bureau of Labor Statistics (BLS), a key federal agency responsible for collecting, analyzing, and disseminating essential economic data, has been sharing non-public inflation data with a secret group of Wall Street "super users."

These individuals, who receive preferential treatment and insider explanations of where the data may diverge from expectations, have the potential to influence market decisions based on this privileged information.

This revelation came to light when the BLS sent the above email to a group of data "super users" explaining a surge in a measure of rental inflation, which left analysts puzzled.

The BLS initially tried to clear the confusion with a notice on its website and claimed the email was a mistake. However, it has since been revealed that this was merely the latest lie by a Biden agency. The dissemination of economic information to this secret group of "super users" is likely to prompt a deeper look, as it has implications for how major assets trade and Federal Reserve policy.

For instance, if these 'super users' were to act on the non-public inflation data they receive, it could lead to significant market fluctuations or influence the Federal Reserve's decision-making process.

The scandal has raised concerns about the transparency and accountability of the BLS, as well as the potential for insider trading or other forms of market manipulation. These actions not only threaten the integrity of the financial markets but also have implications for the average citizen.

A select group of individuals' preferential access to sensitive economic data leads to a distorted view of the economy, potentially affecting public perception and confidence in the economy.

The BLS still urgently and thoroughly needs to explain the scandal and address the concerns market participants have rightly raised. This incident has starkly underscored the importance of transparency and accountability in disseminating economic data and the critical need for safeguards to prevent the misuse of sensitive information.

Who’s Who of Wall Street

In retrospect, it appears the BLS really did have something to hide, because in a follow up from both the NYT and Bloomberg, we now learn that an economist from the Bureau of Labor Statistics was corresponding on data related the monthly CPI print with major firms like JPMorgan and BlackRock, in what Bloomberg said "raised questions about equitable access to economic information."

…

The back and forth between the financial firms and the economist "who has been with the BLS for many years" was first reported by the New York Times; as discussed previously, the government bureaucrat sent several emails to a broader group, which he called “my super users” in one of the emails obtained by Bloomberg. The BLS previously lied when it said it doesn’t maintain a list of “super users.”

In mid-February, one user asked if they could be added to the “super user email list,” to which the BLS economist replied minutes later, “Yes I can add you to the list.” The move was an attempt by the lowly paid government worker to curry favor with his much better paid peers on the sell- and buyside so that he could, one day, trade the preferential data access for a cushier job in some hedge fund or Wall Street firm.

As Bloomberg details, while the recipients’ names were redacted from the request, email signature details or disclosures from their employers were visible in some of the provided records. And in addition to BlackRock and JPMorgan, other banks, hedge funds and research firms — Brevan Howard, Millennium Capital Partners LLP, Citadel, Moore Capital Management, High Frequency Economics, Nomura Securities International, and BNP Paribas — appeared in the exchanges and declined to comment. Pharo Management and Wolfe Research also came up in the emails but didn’t provide comment.

Brevan Howard, Millennium Capital Partners LLP, Citadel, and Moore Capital Management are among the largest hedge funds in the world.

Wrap Up

Never demand fairness because the honest road we take sweetens the victory.

At the same time, let’s face it: it’s us against them. And the best revenge we can have is to make as much money as possible to live our best lives.

Rude Remnant, let’s make that happen.

How Options Boss Stocks

Posted February 20, 2026

By Nick Riso

Investing is So Taxing!

Posted February 19, 2026

By Sean Ring

The Most Expensive Way to Go Broke

Posted February 18, 2026

By Sean Ring

The Bears Gather

Posted February 17, 2026

By Sean Ring

Omar Khayyam: Poet, Rebel, Astronomer

Posted February 16, 2026

By Sean Ring