Posted September 09, 2024

By Sean Ring

The Charley Horse Markets

Remember those awful pains you’d get in your calves as a kid if you were dehydrated and played too much? It still happens after a few nights in a row drinking Geman beer for me.

The involuntary cramping. The indescribable pain. The desire to scream as loudly as I can. The futile attempt to flatten my foot to stretch my calf muscle.

I felt the same pain - albeit emotionally - as I opened my app to check the stock prices of my portfolio constituents. The involuntary cramping, the indescribable pain, the desire to scream… it was all there.

Last week was awful, and I’m starting to think the Fed isn’t going to rescue us even if they cut rates a little over a week from now. To be sure, the nonfarm payrolls number missed, but not by much. What started the mess was Federal Reserve Governor Christopher Waller saying he would "advocate" front-loading rate cuts if that is appropriate.

According to Zero Hedge, “Then Nick “Nikileaks” Timiraos of The Journal interpreted the Fed's speech as much more hawkish than it appeared, saying that "Fed governor Chris Waller’s speech doesn’t explicitly say “25” or “50” but it leans into endorsing a 25 bps cut to start, explicitly reserving the option to go faster “as appropriate” if “new data” show more deterioration."”

That first rate cut may be a sell signal instead of a buy signal. But one thing’s for sure: we need to see how stocks react to the cut before we do anything else.

Let’s look at some charts.

The Economics

For a while now, I’ve said we need to see what happens with initial jobless claims, the steepening yield curve, and oil prices. It’s still an interesting story.

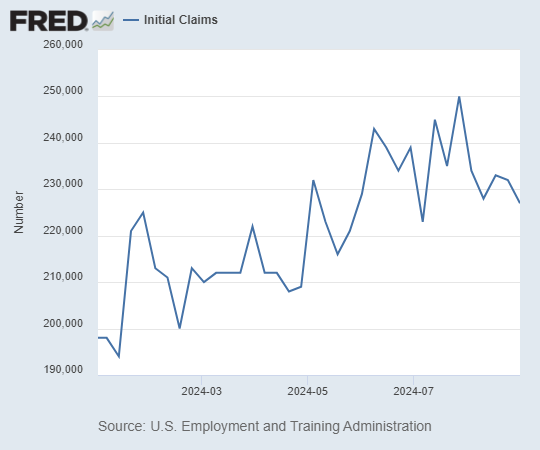

Initial Jobless Claims

Initial jobless claims, a key indicator of the labor market's health, were on a general uptrend until the last reading.

But we dipped off in August. This could be because job seekers and businesses are on holiday. My friend and colleague Andrew Zatlin had this to write about it:

Initial Claims: 227K (vs Consensus 230K)

Continuing Claims: 1.838M (down 0.02M from prior week)

Outside August Survey Period, But Still Relevant

Recent Jobless Claims data is more positive.

HOWEVER the bulk of the improvement happened AFTER the NFP survey period. Nevertheless, the intent to hire would have been underway during the survey period.

It suggests that during the survey period businesses were preparing to hire and simultaneously were firing less. Both of these sentiments are positive for payrolls.

Ok, so maybe we don’t even have a Strike 1.

Yield Curve Steepening

The 2s10s curve has steepened so much it’s now positive at 0.06. What’s that? That curve compares the yield on the 2-year treasury to the 10-year treasury yield. It had been inverted since July 2022.

Usually, when the yield “un-inverts” quickly, we wind up in a recession.

But thanks to the banker in me, I follow the 3m-10s curve. Banks lend long, primarily to the public, thanks to the U.S.’s 30-year fixed mortgage. But most folks only stay in their homes on average for 10 years. Banks fund those mortgages by borrowing short in the interbank markets for about 3 months on average and then roll that funding. Here’s what that curve looks like:

This curve is still inverted, so we haven’t reached the recession phase yet.

Here’s a handy table, if you’re interested in these yield curves:

Now, let’s turn to oil prices.

Oil Prices

This is staggering. Oil has just fallen out of bed.

We are officially in a technical bear market, with price < 50-day MA < 200-day MA. And this is with a weakening dollar! Oil should be rocketing from here, but it isn’t.

From oilprice.com:

Usually, high-impact OPEC+ decisions trigger a notable reaction in the oil markets, but not this time. Sentiment has soured so much that the oil group’s decision to postpone the return of barrels they’ve cut in 2023 barely resonated at all, reinforcing fears that next year will see balances swinging heavily towards oversupply. As ICE Brent futures hover around $73 per barrel, oil prices are set to close this week at their lowest level since June 2023.

OPEC+ Delays Output Increase by Two Months. Citing worse-than-assumed economic data from China and the United States, eight members of OPEC+ that were scheduled to unwind their 2.2 million b/d of voluntary production cuts have agreed to delay their production hikes by two months.

So, it looks like oil prices won’t be increasing soon.

Let’s go back to Andrew Zatlin:

Nothing in the data indicates that the wheels are about to fall off

It's very easy to argue that we are easing into a recession or similar slowdown:

- GDP Going from 3% 2Q to 2% 3Q (per Atlanta Fed)

- Payrolls looking choppy

- 3 months of payroll run-rate very soft

- Latest month trending up but maybe not enough

- CPI slowing

- More macro pain coming as companies continue to delay spending due to election and pending rate cuts

History would argue that things tumble quickly and not slowly.

HOWEVER that same history needs to account for a few things.

- Lean economy: This isn't the dotcom boom or the housing boom. The AI spending is not driving the economy (except for the stock market). There are no major sector bubbles. The opposite, actually:

- CAPEX: Inventories have been managed down aggressively

- Staffing: hiring will kick in quickly

- Payrolls are lean: up 4.6% since February 2020 pre-COVID vs 11% Real GDP growth during that time.

- Layoffs: already undertaken and mostly offshore. Jobless Claims benign.

- Companies ready to spend: once the election is done and rate cuts start, spending will kickoff.

Ok, so things may be better than we think. What about the dollar?

The Dollar

With the economy looking okay, you’d expect the dollar to strengthen a bit, which it did. But when oil falls out of bed, you’d expect a crazy dollar rally. That’s not what’s happening.

Since the end of June, the USD has fallen from 106 to 101.188. You’d expect that to goose oil prices, but it didn’t. Weak dollar, weaker economy? Or is oil getting hammered because of the oversupply? I favored the former argument, but my publisher Matt Insley has long argued that America’s oil abundance has kept prices down. The evidence is turning in his favor.

What about the shiny stuff?

Gold & Silver

Gold has held up wonderfully well. Thanks to an overspending Congress, I still think it’ll break $3,000.

Gold looks to be consolidating at $2,500 for another rally. The next price target is $2,630.

Alas, silver’s chart isn’t as bullish:

But a weaker dollar will surely help both these metals out.

Gold & Silver Miners

The senior miners (GDX) and the juniors (GDXJ) have similar charts, with the juniors being the more volatile of the two.

They’re both in a clear uptrend, but I suspect it’ll be a bumpy ride until Powell is well into the cutting cycle.

For the silver miners, let me show you Hecla’s chart. I’m a long-suffering owner myself.

As my trading buddies in London would say, “Whore’s drawers, mate. Up and down. Up and down.”

I just want silver to pop to be rid of this beast. But owning silver miners is to own pain.

Tech Stocks

I don’t want to call time on the tech rally just yet, at least not until we’re below the 200-day moving average.

But this chart is starting to look shortable. The second peak is lower than the first. The 50-day MA is beginning to turn south. And Friday had a massive down candle. We may bounce off the 200-day MA, so we wait and see.

Wrap Up

Sorry to throw so much at you on a Monday morning. So let me tell you what I’ve told you.

Initial jobless claims look much better and are no longer trending upward. The 2s10s curve has “un-inverted,” but the 3m10s has not. And oil prices are going down faster than students at a Willie Brown career advancement seminar. So, despite our common sense, it doesn’t look much like a recession.

Though the dollar has slightly increased over the last week, its primary trend is down. While this has done nothing for oil, it’s helping gold. Silver struggles to stay near the $28 level.

As for anyone who owns the miners, hold and buy some Alka Seltzer.

Finally, the Nasdaq looks a bit peaked, but we’re not selling yet.

I hope that helps. Stay hydrated to avoid those charley horses, and have a wonderful week ahead.

How a Missed Phone Call May Cost Trump Big

Posted April 23, 2025

By Sean Ring

Charlie Munger’s Mental Models

Posted April 22, 2025

By Sean Ring

The People Who Need and Deserve Our Help

Posted April 21, 2025

By Sean Ring

The Order of Love: Why Nations Must Prioritize Their Own

Posted April 18, 2025

By Sean Ring

We’re Screwed If We Don’t Do the Math

Posted April 17, 2025