Posted June 03, 2024

By Sean Ring

The Big Bounceback

May 2024 Monthly Asset Class Report

In my mind's eye, Jerome Powell will cut rates at this June meeting.

Cutting rates so far from the election makes it look like he's not doing it for political purposes. The economic data has been slow enough that he's got cover. Besides, all his fed Governors want to cut as well.

I don't have data to back up this assertion; it's just a hunch from many years of being a political spectator.

My friend and erstwhile colleague Jim Rickards is right that the Fed doesn't matter as much as it used to. However, Wall Street will use the Fed as the biggest excuse to buy stock.

I still love gold and silver and feel they will rally hard over the coming months. Although I don’t include them in this monthly class report, I’m long multiple gold and silver miners.

Both the SPX and the Nasdaq are powering along. That the Russell is doing well confirms the stock market trend for us.

I’m still not a fan of bonds in an inflationary environment, but crypto did very well last month.

And base metals also performed well.

With that said, let’s get to the charts.

S&P 500

From three months ago:

Looking at this chart, there’s no reason in the world to be short.

We may take a breather in the coming weeks, but I’d still participate in this rally.

The long-term target remains 6,000.

After a much-needed rest last month, the broad market came roaring back. Not only did we pop back above the 50-day moving average, but we retested it last week and it bounced up off it.

I remain bullish.

Nasdaq Composite

Although we had a crappy month-end, the Nazzie is still soaring. We simply cannot call time on this rally yet.

Russell 2000 (Small caps)

The Russell wants nothing to do with its 50-day moving average. It seems to like staying above it.

It’s silly to be bearish here.

The US 10-Year Yield

I may be terribly off on this, but I think Powell will cut in June. Here’s why: it’s far enough from Election Day to make a cut look apolitical. The economic data hasn’t been great lately. And his fellow FOMC members really want to cut.

Most importantly, Powell doesn’t want to work for Donald Trump again. In any event, Trump will fire Powell at the first opportunity.

How does this affect the 10-year yield? In theory, if the Fed cuts, the 10-year yield should follow it down. But it may not, if we have the rapid curve steepening because the bond market thinks the Fed has lost control.

Dollar Index

We broke back down after I thought we’d be heading back to 115. Now, I’m not sure. We may get a temporary strengthening when the ECB and BOE cut rates, but right now, it looks like the trend is sideways.

USG Bonds

We bounced back to 90, but as the Fed starts to unleash another round of cuts, we should be heading back down.

Investment Grade Bonds

We had a rally last month, but I think this is short-lived.

There’s still too much inflation in the system. I can see a retest of 104.

High Yield Bonds

Junk keeps moving up slowly. No reason to short this here, yet.

Real Estate

Another good month, but I think real estate is going to tank soon.

Energy: West Texas Intermediate (Oil)

Oil is down another five bucks or so. It’s amazing that with this constant stream of inflation, oil is trading so poorly. Next stop: $70, unless the Fed starts cutting prematurely.

Base Metals: Copper

From last month:

We blasted through my 4.30 call to 4.56.

But this rally was too much, too fast, and I can see us heading back to 4.30 before taking off again.

Precious Metals: Gold

***NEW MONTHLY RECORD CLOSE OF $2,345.80.***

From last month:

$2,609 is our new target, but it may take a few months to get there.

The yellow metal’s price detail shows a nice consolidation between 2300 and 2450.

Precious Metals: Silver

From two months ago:

Up $2 from last month. When silver awakens, watch out!

Above $26, and it’ll start to chase, and then surpass, Gold’s performance.

GIDDYUP!

We powered past $32 temporarily, and then Mr. Slammy came in to hammer it. But we still closed above $30 for the first time in about a dozen years. Still think we’ll hit $50.

Cryptos: Bitcoin

We rebounded back to $68,000, but we could head sideways a long way before BTC starts its ascent again.

Cryptos: Ether

ETH rebounded bigly after it looked like the SEC was ready to approve ETFs for them, as well.

Again, this chart, like Bitcoin’s, could move sideways to consolidate before beginning another ascent.

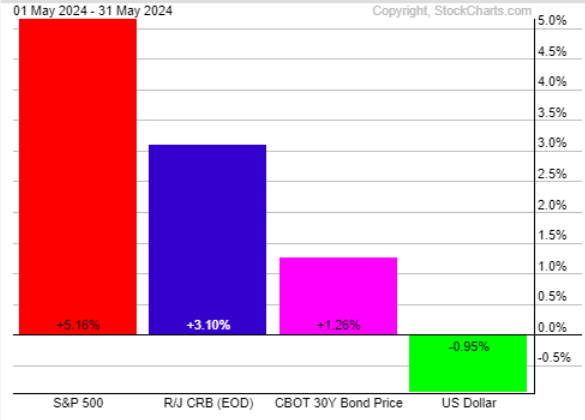

Trad Asset Class Summary

The dollar won in April, which meant everyone else was down.

In May, we had the reverse. The USD was down about a percent, so everything else rallied.

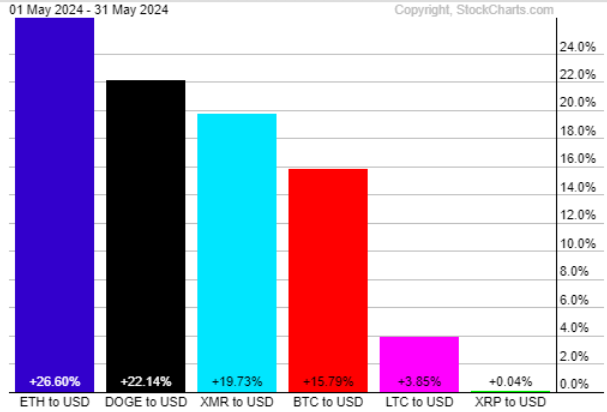

Crypto Class Summary

The April showers genuinely brought May flowers, as everything crypto was celebrated. Ether led the way with a 26.6% return, followed by Dogecoin at 22.14%, Monero at 19.73%, Bitcoin at 15.79%, Litecoin at 3.85%, and Ripple at a nearly flat 0.04%.

Wrap Up

Buy stocks, commodities, and crypto. I imagine this trend will continue in the medium term, at least.

We’re just getting started on the commodities rally, that’s for sure. But even though the stock rally is a bit long in the tooth, there’s no reason to sell them now.

Finally, let’s take a moment, courtesy of the Twitterverse:

Have a wonderful week!

King: “It Can’t Happen Here”? Hey, It Just Happened Here!

Posted July 25, 2024

By Byron King

Nothing is Biden’s Fault

Posted July 24, 2024

By Sean Ring