Posted June 11, 2025

By Sean Ring

The 3 Best Trades Nobody’s Talking About

I get it. It feels like the SPX is about to recapture its all-time high. We’re only 2% away from that outcome. However… we haven’t hit it yet, and I think there are far smarter places to put your money right now than in tech stocks.

Still, everyone’s clamoring over Nvidia and Apple, even as their multiples defy gravity and their growth slows to a crawl. Meanwhile, the Fed continues to hint at rate cuts, as if they were handing out candy, and the market is priced for a fairytale ending.

But here’s the thing: real investors buy value, not fantasy.

And if you’ve been paying attention, you’ll notice three assets that still wear the ugly duckling costume—but are quietly turning into swans: silver, Ether, and platinum (with a special nod to Sibanye Stillwater, ticker: SBSW).

Let’s break it down…

Silver and Silver Miners: The Forgotten Rocket

Silver’s recent rally isn’t just a technical bounce—it’s a shift in narrative.

The grey metal has surged back toward 13-year highs, brushing past $35 and setting up for a likely move toward $40 and beyond. This is momentum plus macro. Silver investors can put the hopium pipe down for a change.

Why? Silver sits at the intersection of monetary pressure and industrial demand. It’s both a hedge and a necessity—something gold can’t fully claim. With governments printing again and the Green New Scam roaring ahead (solar panels, EVs, semiconductors) in places like the UK and EU, silver’s utility has finally outpaced its suppression.

Meanwhile, miners have lagged the metal itself, as usual. That means one thing for savvy investors: leverage. While silver is up, many miners are still priced as if it were 2019. That’s a gift.

Look at the tickers I own, like AG, EXK, ASM, CDE, and DSV.

PAAS, HL, VZLA, and ABRA are ones I don’t own, but are worthy of consideration.

Even the juniors have moonshot potential. Their margins expand exponentially as silver climbs, especially above $35.

Want to buy cheap? Buy what no one’s bragging about at cocktail parties yet.

That’s silver. For now.

Ether: The Silent Breakout

I’m not going to convince you of the merits of cryptocurrencies in this piece. But as a trading instrument, Ether’s chart is compelling. Bitcoin gets all the headlines, but Ether just pulled off a stealth rally—and it’s now staring down a price target of $3,665.

And this chart was in The Chart Report this morning:

It shows that Ether can massively outperform Bitcoin over the next few years.

This isn’t about meme coins or “number go up” hype. It’s about structural positioning. The SEC’s begrudging nod to Ether ETFs has opened the door to a new wave of institutional flows. Unlike Bitcoin, Ether actually has a roadmap: smart contracts, tokenization of real-world assets, Layer 2 scaling, and decentralised finance.

Its recent rally—from about $1,400 to $2,800—isn’t speculative froth. It’s re-pricing.

And if Bitcoin continues to push toward $120,000 or higher, Ether’s historical beta suggests it could easily tag $4,000-$4,500—possibly more, depending on ETF inflows.

What’s more, Ether is still cheap relative to itself. In the last cycle, it hit nearly $5,000. With stronger fundamentals today and better institutional access, that’s not just possible—it’s likely.

If you’re late to the Bitcoin party, Ether is your second shot at the open bar.

Platinum and SBSW: The Overlooked Industrial Story

Since it bottomed out on April 7th, platinum has quietly staged a 35.14% rally.

It’s not just an industrial rebound. It’s supply shock plus a weak dollar. Platinum mines—particularly in South Africa—are facing significant structural issues, including labor strikes, electricity shortages, and political instability. Combine that with an EV push that still needs catalytic converters in the interim, and you have a recipe for higher prices.

Enter Sibanye Stillwater (SBSW)—the battered miner that’s more than just platinum. They’ve been crushed in the past year, bottoming out at $3.19 on February 8th. As of yesterday’s close, it’s priced at $6.74, a 110% return!

However, here’s what investors often overlook: this is a diversified precious metals and battery metals producer with exposure to platinum, palladium, rhodium, gold, and lithium.

At these levels, SBSW is priced like the world is ending. But if platinum holds this new uptrend and metal prices continue to firm, SBSW could double or more on margin expansion alone.

And with a fat dividend (albeit volatile), you’re even getting paid to wait.

The highest weekly close in 2021 was $20.56. We can hit that level again.

This is a deep value play. Not a meme. Not a trade. An investment.

Summation

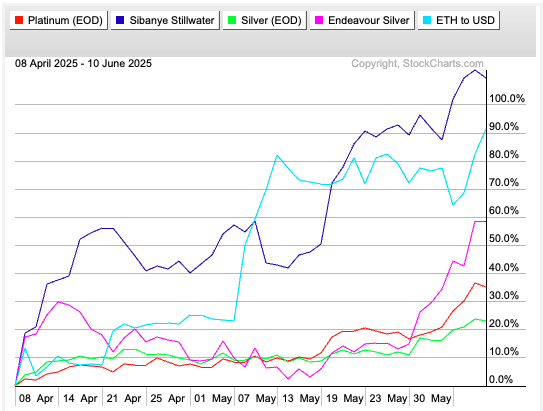

Since platinum bottomed out on April 7th, here are the returns put in by platinum, SBSW, Silver, Endeavour Silver (EXK), and Ether.

SBSW is up nearly 110%, leveraging platinum’s 35.145% return. EXK is up 58.14%, leveraging silver’s 22.93% return. And Ether is up 91.38%, and that party may just be getting started.

Wrap Up

As the S&P 500 flirts with 6,100 and the usual suspects make new highs, remember this: the smart money doesn’t chase headlines. It positions itself before the story hits the front page.

Silver and its miners are still discounted relative to gold. Ether is still undervalued compared to its use case and adoption trajectory. And platinum, along with SBSW, is being ignored by nearly everyone except the most contrarian investors.

In a world where bubbles are dressed as blue chips, value hides in plain sight.

You just have to know where to look.

And now… You do.

“That’s A Disgusting Assessment of the Conflict!”

Posted June 30, 2025

By Sean Ring

Oh, Cry Me a Canal!

Posted June 27, 2025

By Sean Ring

“You Better Get A Big Shovel!”

Posted June 26, 2025

By Sean Ring

مرحباً بكم في مدينة نيويورك!

Posted June 25, 2025

By Sean Ring

A Most Cordial War

Posted June 24, 2025

By Sean Ring