Posted November 01, 2024

By Sean Ring

Thank Powell For This Dog’s Breakfast

October 2024 Monthly Asset Class Report

Jay Powell was supposed to bring the punch bowl. Instead, he made a dog’s breakfast of the markets.

I love that term. When I moved to London in 1999, I had to learn British English and all its wonderful slang. A dog’s breakfast is a mess, chaos, or disorder. You know, like your dog’s breakfast.

As you know by now, I thought Powell should’ve cut 25 basis points in June and become the first central banker ever to get ahead of the curve. But he needed more data.

Then I had hoped Powell would cut 25 basis points in July, to no avail. He needed more data.

Finally, in September, Powell cut 50 basis points. Too much, too late, and in the middle of the most active part of the presidential campaign.

That day, he went from the next Paul Volker to the next Arthur Burns. But because the bond vigilantes woke up and hiked yields 50 bps, essentially telling Powell to take a flying leap, he’s now the next Rodney Dangerfield.

King Dollar followed yields straight up, but after I had already lost my bet with Alan Knuckman. (I hope it hits 115 for a moral victory.)

As a result, Treasury bonds have fallen out of bed. Despite the increased yield, gold and Bitcoin are way up. Mr. Slammy has to crush silver nearly every New York open, or the bullion banks will be remade into city apartments with beautiful views.

The stock market has had a wobble at all levels.

And oil has exposed the world economy for what it is right now: in a dire state.

It’s no time to panic, as opportunities are opening up everywhere.

With the election on November 5th and the FOMC meeting on the 7th, many variables are at play.

Without further ado, let’s get to the charts.

S&P 500

Boy, have we had a tough week so far! Let’s see how it ends today before we start getting nervous.

Also, we’ve got the election and the FOMC meeting next week - lots of moving parts.

We’re right at the 50-day moving average line. A pullback like we’ve had is healthy.

I still target 6,000.

Nasdaq Composite

We ended slightly down on the month, thanks to this last awful week. NVDA, which has been carrying the index, may be affected by SMCI’s auditor case, which knocked that stock down 33%. SMCI is one of NVDA’s largest customers.

Still, the technicals point north of 20,000 for the index, so we’re still bullish.

Russell 2000 (Small caps)

The Russell is slightly down this month. Small caps better pray for a Trump victory, or these stocks can get smoked under the guise of regulation and taxation.

SMCI is the Russell’s biggest component stock, which isn’t helping matters.

The US 10-Year Yield

Can you imagine being Jay Powell? In one decision, he went from the next Paul Volker to the next Arthur Burns to the next Rodney Dangerfield.

The FOMC’s idiotic 50 bps cut did indeed spook the market, and you need no more proof than this: Yields have gone up 50 basis points to 4.29%.

“I meant to do that!” - Jay Powell or Pee Wee Herman?

Dollar Index

Boy, did I get this wrong last month! I thought we’d head south because the Fed “over-delivered” on its rate cut.

But because the bond market was having none of it, and yields rose, the dollar had to follow suit. We only got slight relief this week.

This is putting massive pressure on the asset markets. If the Fed cuts again next week, the uptrend may continue. Welcome to Clown World!

USG Bonds

Ok, this makes much more sense to me. With inflation in the air and the Fed exacerbating that situation with rate cuts, the long bond is falling out of bed.

Treasuries may not have any default risk, as the USG can always print its way out of debt, but it sure has price risk.

Investment Grade Bonds

Again, we got turned around here. We’re technically in the middle of No Man’s Land.

But I’ll say that 107.35 is the next target down, followed by 102.

High Yield Bonds

Real Estate

We’ve had a rough couple of weeks, but the target remains to the upside.

First, 116. Then, a possibility of hitting 135.

Energy: West Texas Intermediate (Oil)

What do you get when you cross a crappy world economy with China driving electric cars?

Sub-$70 oil.

Oil has been terrible since April.

Base Metals: Copper

Copper fell the second I got bullish last month. My instincts say the world economy is crap, and no one is building. But the technicals are still bullish and targeting $6.25.

I wouldn’t touch it with a barge pole.

Precious Metals: Gold

***HIGHEST MONTHLY CLOSE OF 2,749.30***

We hit our upside target of $2,759. I’m still looking for $3,000. My friend and colleague, Zach Scheidt, thinks we can get there by the end of this year. He may be right.

Precious Metals: Silver

Mr. Slammy keeps waking up in the NYC morning and selling the crap out of silver. It’s tiresome.

But once we break through $35, which may take a while, the next stop is $38.80.

From there, $50 will be much easier to hit.

Cryptos: Bitcoin

This indeed became a bull flag, as I wrote about last month.

We’re now looking at a target of $91,406.82.

Cryptos: Ether

From last month (no changes):

Ether has broken down. I’m unsure what the problem is, but ETH is considerably weaker than BTC.

We could see ETH hit $1,950 from here. The charts are targeting a woeful $790.

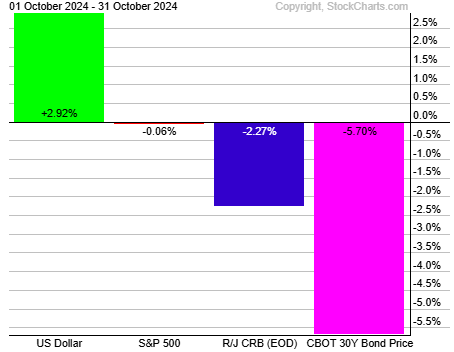

Trad Asset Class Summary

Even though the Fed cut the base rate by 50 bps, yields soared by 50 bps. It’s not supposed to happen that way. As a result, King Dollar was up 2.92%. The long bond was crushed, down 5.70%, while commodities took a 2.27% hit.

The broad market was flat for the month, though the last week has been tumultuous.

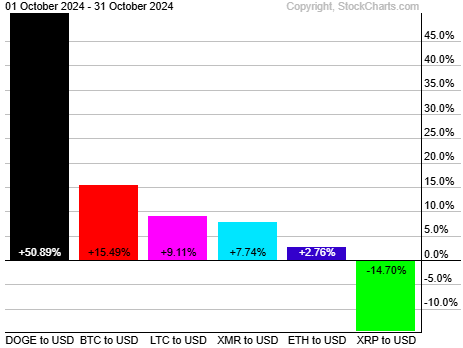

Crypto Class Summary

Dogecoin ripped another 50% last month, after being up 20% in August. Bitcoin was up double digits. Litecoin, Monero, and Ether all were positive. Only Ripple paired back last month’s gains.

Wrap Up

Oh, Jay Powell, what a mess you’ve made!

Let's see how it goes with the election and the FOMC meeting next week.

Finally, let’s take a moment, courtesy of the Twitterverse:

Have a wonderful weekend!

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali

How Options Boss Stocks

Posted February 20, 2026

By Nick Riso

Investing is So Taxing!

Posted February 19, 2026

By Sean Ring