Posted March 04, 2025

By Sean Ring

Tariffic Trading!

Justin Trudeau, Canada's virtue-signaling outgoing Prime Minister, still hasn’t found the exit. And all he did was piss off The Donald even more than he has already. President Trump just imposed tariffs on Canada and Mexico. However inevitable the tariffs were, I’m sure they were easier to apply because of Ottawa’s attachment to the WEF agenda and Ukraine.

Trump said:

Tariffs are easy, fast, efficient, and they bring equity. It’s going to be very costly for people to take advantage of this country. They can’t come in and steal our money and our jobs and take our factories and our businesses and expect not to be punished, and they are being punished with tariffs.

I think back to Felix Leiter in Casino Royale, when James Bond asks what he must do with the massive pool of winnings after Leiter backed him in his game of Texas Hold’em with Le Chiffre. Leiter asks incredulously, “Does it look like we need the money?”

Those days of American largesse are over. Clearly, The Donald, JD Vance, and the American electorate are sick and tired of paying for Europe’s follies. (Serbia, Libya, and Ukraine are on Europe, mainly France and the UK.) Europe counters by saying they always jump when America asks them to, but that breeds contempt.

It was better when the UK acted as a trusted advisor rather than a vassal. Remember, the UK didn’t participate in Vietnam because the pipe-smoking then-UK PM Harold Wilson thought it was a stupid idea. History proves he was correct.

With that said…

The Beatings Will Continue Until the Morale Improves!

My good friend and colleague Dave Gonigam passed on a blog post from Gilbert Doctorow yesterday that read:

As for Keir Starmer, he must be the stupidest of the [European leaders]. When in Washington meeting with Donald Trump, he was offered a tariff-free trade deal with the USA that his country has sought ever since Brexit. He failed to see that this was the deal: you get tariff free trade if you just shut up about Ukraine. But shut up this oaf could not do. As they say in Washington, there now will be consequences.

As a British passport holder, I’m appalled the moron could pass up such a sweet deal to commit blood and treasure to Ukraine. But then again, Starmer was always more pro-Davos than pro-UK.

Those “consequences” sound ominous.

Let’s turn to economics for a moment, before we head to the markets.

Atlanta Fed GDP Projection Nosedives

The Atlanta Fed published a quite frankly staggering projection for 2025 Q1 GDP:

It’s now -2.8%, down from positive 2.3% only two weeks ago.

The accompanying comment was this:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -2.8 percent on March 3, down from -1.5 percent on February 28. After this morning’s releases from the US Census Bureau and the Institute for Supply Management, the nowcast of first-quarter real personal consumption expenditures growth and real private fixed investment growth fell from 1.3 percent and 3.5 percent, respectively, to 0.0 percent and 0.1 percent.

In other words, this had nothing to do with the impending tariffs.

Credit: The Kobeissi Letter

Credit: The Kobeissi Letter

Things may get ugly. For crypto, it already has.

Bitcoin Bad, Ether Worse

My goodness, did Bitcoin get walloped! And it’s still getting hammered as I write.

If you look at the above chart, the last three candles are telling. The first white candle shows a rally of around $8,000 from $86,000 to $94,000. The next red candle is the same move down. This is terribly bearish. It’s as if all the market bears told the bulls they were idiots for believing in the “Crypto Strategic Reserve” and then proved the point. The final candle shows another $2,500 down move. Ugly.

Ether’s chart is even uglier in my view.

The moves are more pronounced. As I wrote in our MACR yesterday, Ether’s downside target is $1,300 and certainly can hit it from here.

But crypto wasn’t the only thing that got hit.

NVDA Nosedive

Let’s revisit the NVDA chart I built for you last week:

We’ve just fallen below that first support level of about 114.60 (the orange circle). The premarket right now is trading around Friday’s close of 114.06. The balance of probabilities suggests we continue our descent to 102.80. I remain long one cheeky May 110 put. Depending on the size and speed of the move, I’ll probably close out at 102.80 or thereabouts. If we speed through there, I may wait until 92, but there’s no guarantee we’ll get through that level. NVDA’s current bearish price target is 107.25.

Despite the coming inflation, the bond ETFs, TLT and LQD, continue to climb. Thanks to Trump's inflationary tariff policy, gold and silver rose yesterday, and I expect that to continue. The miners were muted.

Wrap Up

Gold and silver still look like they’re taking their time on the way up. Bitcoin and Ether don’t look at all like safe havens, but resemble tech stocks. NVDA was down over $10, or 8.69%.

Things are looking shakier and shakier. If bonds are doing well in this environment, you can tell we’re heading into a “risk-off” world soon.

Stay deliberate in your thinking.

The Age of Hephaestus Has Begun

Posted May 08, 2025

By Sean Ring

Fed’s “Stealth” QE Pushed Gold Above $3,400

Posted May 07, 2025

By Sean Ring

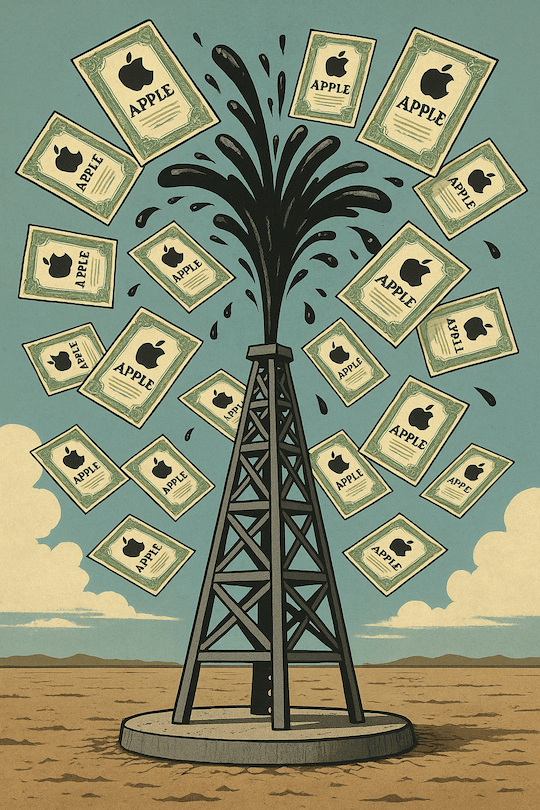

Turning Oil Into Apple

Posted May 06, 2025

By Sean Ring

Goodbye to the GOAT

Posted May 05, 2025

By Sean Ring

J.P. Morgan’s Last Rescue Mission

Posted May 02, 2025

By Sean Ring