Posted August 08, 2025

By Sean Ring

“Smart… For Someone Who Doesn’t Have a PhD.”

I hadn’t checked the mailbag in a while and saw how far behind I am. I must apologize to all who haven’t received a reply yet. I’ll do my best to get a bunch out soon.

But never mind all that, this edition is a corker! I hope you enjoy.

Against the PhD

To Whom It May Concern:

The Rude Awakening has quickly become my favorite subscription! Sean Ring is at another level. He has yet to publish a bad edition. I particularly enjoyed last week's article about PhDs. "The Dumbest Smart People on Earth.” I'm glad someone said that about PhDs. I've had the same sentiment for some time, but I've never been able to articulate my thoughts like Sean. Finally, I hope he continues to update us on his precious metal holdings. He's got some gems! Keep up the good work!

Murray B.

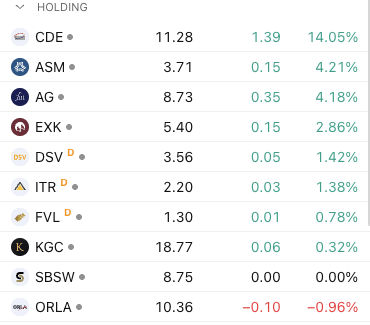

Thank you for the kind words, Murray! As for my holdings, here they are, as of last night:

CDE popped yesterday, and KGC broke out the day before. I’m still not happy that I sold ABRA to buy DSV, but I still have high hopes, as Eric Sprott owns a truckload of it.

Sean: Welcoming you back Stateside, if only for a bit. Great article, re “The Dumbest Smart People....” “Educated fools from uneducated schools.” (Curtis Mayfield). The aim of an education should be to make you realize how much you don’t know, humble you, and make you become an apprentice for life. And yet, sadly, the only things these degrees seem to confer are arrogance, contempt, and the belief that they know everything and cannot possibly learn anything from anyone else. Generally, the smartest person in the room often doesn’t know or think that they’re the smartest person in the room. Often, folks with humility are open to collaboration and cooperation. (Funny quip I once heard: One should aim to be the smartest person in their circle. However, once you believe that you are the smartest person in your circle, it’s time to expand your circle.) Thanks. Basil O.

I agree, PhDs have no common sense. I worked with many PhDs during my career, and I was scared every time they left the safety of their office. One such PhD told me I was really smart, for a person without a PhD. He thought he was giving me a compliment, but I didn’t see it that way. To be smart, you need a reasonable IQ and excellent common sense. The best way to eliminate the FED is to ask their PhDs what they have accomplished in the last 30 years. Jim R.

Isn’t it wonderful that these PhDs are getting a $2.5 billion renovation to their castle? Why didn’t DOGE catch any of that? Or did they? Terry T.

Awesome comments! Thank you, gentlemen!

Consumer Price Inflation Versus Asset Price Inflation

Dear Sean,

It's Monday. I'm pretty sure the trillions of dollars in pandemic aid, not related to the minuscule direct checks to citizens, are what caused the bulk of the inflation. Do you think forgivable loans to already rich millionaires and billionaires may have been used to inflate the stock market? Could an inflated stock market have made regular folk feel at least a little disposable wealth for a fleeting moment? A couple of thousand from the government helps with groceries and medical bills. That by no means allows a citizen to purchase a new house or vehicle. Even for a family of 4, what's an extra $10k? That's a lot of groceries or a small amount of stock. Any new vehicles would still have to be financed by the millionaire billionaires who were allowed to lend out or purchase paper with their forgivable taxpayer-funded handouts.

Best,

Ben M.

Hi Ben! No. You’re confusing consumer price inflation with asset price inflation. The loans (margin loans from private banks, not governments) to already-rich folk went into the stock market, where they remain, and have elevated it since 2009. That’s asset price inflation. By the way, margin loans are collateralized with stock, bonds, houses, and other assets. The bank takes those assets if the borrower doesn’t repay. So they’re not “forgivable” in the way you’re using the term.

But direct stimulus checks lit the consumer price inflation fuse that we saw under Biden. We now know that large central bank printing, which doesn’t trickle down to retail folk, doesn’t raise prices for most goods. But let me quote you: “That’s a lot of groceries.” An extra $10,000 to every household buys a lot of stuff at the store. It’s not like Americans saved any of it. They piled into the supermarkets and malls. Those businessmen knew there was a lot of money chasing too few goods, and raised their prices.

While it’s painful to think the scamdemic “remedy” became the “cause” of inflation, that’s precisely what happened.

Sean,

I do hope Trump will avoid Stimmie’s. One big sugar rush. Never nice what follows after the rush. Besides, Walmart (er, ChinaMart), Dollar Stores, et al will just jack up their prices to fleece the bleating sheep. (There’s no free lunch, boys and girls.) “Too many dollars chasing too few goods.” And, as you pointed out, it will be his constituency taking it in the shorts once more.

Thanks,

Basil O.

I couldn’t agree more, Basil!

The Mathematics of Returns

Sean,

I am a little confused (it doesn't take too much). You said initially that there was a 24% drop in copper futures, then said that was after a 30% surge due to speculative overreaction. Doesn't that equate to a 6% overall increase in the futures price, putting it basically back to where it started, but even a little better? Or did I lose track of where you were going with the whole discussion?

Bill D.

Hi Bill! Thank you for asking this question. How I’d explain it to my class is this way: start with $1. If you earn 30% on that dollar, you have $1.30. Next, you lose 24% on that $1.30: that would be $1.30 x (1 - 0.24), which equals $0.988. So you’re down about 1.2% overall.

Here’s a handy chart showing what you need to make back with every loss. This is why money management is so important.

| Loss (%) | Required Gain (%) |

|---|---|

| 10 | 11.11 |

| 20 | 25.00 |

| 30 | 42.86 |

| 40 | 66.67 |

| 50 | 100.00 |

| 60 | 150.00 |

| 70 | 233.33 |

| 80 | 400.00 |

| 90 | 900.00 |

But with futures, the way you’d be trading copper, it’s even worse because you’re leveraged.

If you’re trading copper futures, a single contract is 25,000 pounds of copper, and the minimum price fluctuation is 0.0005 per pound, which equals $12.50. As a former futures broker, that chart almost made me puke.

Just for a goof: If I bought at the top ($5.760) and sold at the low ($4.777) on the day The Donald removed tariffs on copper ore, I would’ve lost $0.983 per pound on one contract. That’s $0.983 x 25,000 = $24,575. Ten contracts would’ve resulted in a $245,750 loss, and a hundred contracts would’ve seen a $2,457,500 loss.

This reminds me of my first broking trade ever. A client asked me to buy 1,000 bund (German 10-year) contracts at 120.00. I bought at 120.01 by accident. So I had to make the client whole. While that looks like a penny, a one-tick move is worth EUR 10, and since I screwed up 1,000 contracts, I had to pay the client EUR 10,000. My boss lit me up. I got careful, quickly.

Central Bank Gold

Hi Sean,

I get way more emails than I can possibly read, but I always make a point of reading those from you. I find them informative, interesting, and entertaining. I have a question regarding central banks purchasing gold, which I understand as the main driver for gold's recent price rise. My question is, “What do the banks actually DO (or intend to do) with the gold that they purchase?” The main reason for my interest is anticipating the banks possibly changing course at some point and selling their gold.

Regards,

Kurt H.

Hi Kurt! Thanks for the kind words. Central banks aren’t buying gold to sell it anytime soon, but to hold as a strategic reserve. It’s a hedge against economic shocks. And though Ben Bernanke might deny it, it signals strength. CBs may use it in emergencies or to earn small returns, but as the gold agreements and recent trends show, large-scale gold sales are coordinated, rare, and carefully managed to avoid disrupting the market. If global policy or confidence changes and banks start selling, it could pressure gold prices downward, but we’re nowhere near that point. All I see is accumulation for the foreseeable future.

Wrap Up

Thanks for the stimulating letters. I’ll do my best to get another one out soon.

A Money Pit That Saved Investors?

Posted August 29, 2025

By Byron King

A Philosophy For Living

Posted August 28, 2025

By Sean Ring

The Crowd’s Madness Saves Uncle Herschel

Posted August 27, 2025

By Sean Ring

The Fed's Cook is Goosed

Posted August 26, 2025

By Sean Ring

The Ascent of Ag in 5 Tweets

Posted August 25, 2025

By Sean Ring