Posted December 01, 2025

By Sean Ring

Silver Surfing... and Bonus Tickers!

Every month, I publish this monthly asset class report not to predict the future, but to show you exactly where we are right now.

The charts are simple candlesticks, with the 50-day (10-week) and 200-day (40-week) moving averages. At the end, I present a couple of performance charts to illustrate the relative trading positions of traditional asset classes and cryptocurrencies.

If you’re a new subscriber, please email feedback@rudeawakening.info with any questions, comments, or concerns. Our mailbag is lively, and I try to publish reader feedback at least once a month. Enjoy!

One of the reasons I loathe the current Fed is that its throw-away line that rate cuts weren’t certain was both unnecessary and nonsensical.

For one thing, I’m sure the Fed will cut this month. Second, it’s over for Jay Powell. Come May, we get a new Chairman. So I wish he’d just give up the charade that he has anything meaningful left to do. Therefore, the recent volatility was nothing but a whipsaw pain-in-the-ass for investors.

Still, gold, silver, the miners, and equities recovered nicely by the end of last week, despite the Fed’s - and the CME’s - best efforts.

Let’s get right to the charts for some fun.

S&P 500

***NEW MONTHLY CLOSING HIGH OF 6,849.09***

After a few awful weeks, the SPX rallied hard. It closed up 9 points on the month, for a new record.

The overall target for the SPX is now 9,100. But let’s get to 7,000 first. That’s just over 2% away.

There’s nothing in this chart that says it’s a sell.

Nasdaq Composite

The Nazzie finished slightly down on the month, but it needed to correct. I still think there’s more to run, but the cracks are starting to appear in tech. From the NVDA-ORCL-OpenAI circle jerk to crypto’s recent beating - more on that below - there’s reason for caution.

I’ve been out of tech stocks for a year. The new price target I’ve got for the Nazzie is 20,380, which is, of course, bearish. I wouldn’t short this market, but I’d be careful about adding to any positions.

Russell 2000 (Small caps)

Like the SPX, the Russell recovered well last week, but didn’t set a new monthly closing high. We’re looking at a 287 price target for the index.

The US 10-Year Yield

Jay Powell will cut again, and the market knows it. Over the course of the year, the 10Y has trended downward on average, but with enough bumps and spikes to frustrate any trader. Currently at 4.02%, I reckon we’ll finally get below 4% after the next cut and a new Fed chairman next year. Of course, that will take the USD down next, speaking of which…

Dollar Index

Last week, and to start this week, the dollar has fallen nearly a whole point. That’s excellent news for The Donald, the USG, stocks, and the metals.

But we’re still targeting 108 on the upside, so the Fed must print more, and Congress must spend less, to keep rates down. The first is a given; it’s all the Fed does. The second? Good luck with that…

USG Bonds

TLT rallied over the last two weeks of the month, and the chart looks bullish. As I’ve said before, I wouldn’t touch bonds with a barge pole, but the new upside target is 109.

Investment Grade Bonds

Admittedly, this chart looks excellent, as well. From here, the next target is 116.50, before looking at 127. I don’t buy the story in the long term.

High Yield Bonds

From three months ago:

I don't know if HYG can go much higher. Stalled at these nosebleed levels, a turnaround may be in order soon.

Same as it’s been for a while.

Real Estate

VNQ was up a couple of points this month. Despite still targeting 100, the uptrend is choppy.

Energy: West Texas Intermediate (Oil)

Base Metals: Copper

Copper’s rally is real, and it’s spectacular. We’re right on target for $5.29. After that, it’ll target the pre-Liberation Day daily closing high of $5.86.

Precious Metals: Gold

***NEW MONTHLY CLOSING HIGH OF 4,216.71***

Despite the recent turmoil in the metals markets, gold has posted its highest monthly closing price ever of $4,216.71. Thanks to this recent thrust, it’ll be a cinch to recapture the old highs before the end of the year.

$4,355, the highest daily closing price, is the next target. Once that’s captured, we can look forward to $4,916.

As I’ve said many times over the past year, this is one trend you want to ride until the end.

Precious Metals: Silver

***NEW MONTHLY CLOSING HIGH OF 56.37***

Silver massively broke out to a new all-time high last month and is already up another 2% as I write this morning. It closed in Shanghai at 58.34, so we’ve got more room to run right now.

Some commentators are calling for a run to $72, while my target is $70.50. Let’s see what Mr. Slammy tries this week, if he’s got any tricks left in his bag. The CME “outage,” on one of the lightest trading days of the year, didn’t go as planned. Pricks.

BONUS CHARTS: The Unofficial Rude Portfolio

AG had an enormous up thrust at the end of last week. It still hasn’t recovered its daily high, but the last time we saw a weekly candle like that, the stock rallied about $7. We’re looking at a $23 price target now.

ASM

ASM hasn’t reached its once lofty levels, and its recent ATM share offering isn’t helping matters.

Avino has permitted itself to slowly sell up to US$60M of new shares into the market whenever it wants, at the then-current price. If they use this facility, percentage ownership and per-share claim on future cash flows will be diluted.

Still, the next upside target is $7.50. Hopefully, management won’t screw this up for shareholders.

CDE

CDE has a way to go, thanks to its recent acquisition of New Gold. And yet, $23.70 is the new upside target.

Ace mining analyst Don Durrett sees a target price for CDE of $100-120. That’s good enough for me to hold.

DSV.TO

Discovery’s chart is gorgeous. We’re looking at an upside target of $11.70.

EXK

EXK looks fine as well—huge candle for last week. The new upside target is $15.

FVL.TO

Freegold may be my worst-performing stock, though it’s still up big on the year. Targeting $1.70 first, and then perhaps hoping someone acquires it.

Again, it’s one of Eric Sprott’s largest holdings, so that’s something.

HL

Another gorgeous chart. I only own HL through an options play, but its new upside target is $24.

ITR.V

Another new weekly high, just beautiful. Looking at $5.90 for the upside target for now.

JAG.TO

Another outstanding mining stock. Upside target is $9.80.

KGC

With an upside target of $35.50, KGC has been a stalwart of the portfolio since Day 1.

SBSW

Our South African platinum and palladium play looks great, though its next target is only $14. I’m looking for $21 before I sell it.

VZLA

Another strong week, looking at a $6.50 target next.

BONUS CHARTS: Stocks I Like Now, But Sold Earlier

ABRA.TO

I sold ABRA earlier in the year, but now that it’s had this breakout week, it’s a sure thing again. Next target is $12.80.

AYA.TO

While AYA’s chart has been choppy - no thanks to the false reports of fraud - the next price target is $31. I sold it earlier as well, but it looks good right now.

Cryptos: Bitcoin

We got the rollover I thought I was seeing last month, but I don’t expect a crash. We may even see a rebound up to $100,000. But I think the writing is on the wall: BTC is about to head into a bear market.

Cryptos: Ether

Another awful chart, ETH is now looking at a $2,520 price target. Avoid.

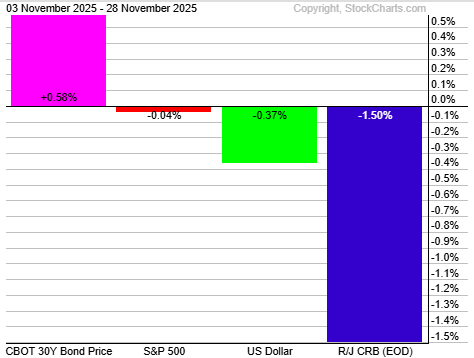

Trad Asset Class Summary

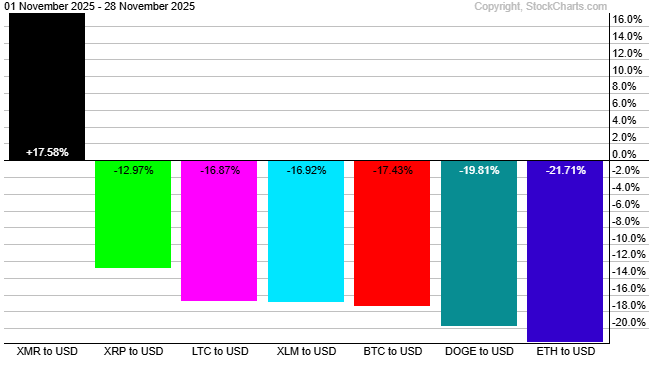

Crypto Class Summary

For the second consecutive month, Monero was the only cryptocurrency in the black, finishing up by 17.58%. The rest were double-digit disasters.

Wrap Up

It’s been a wild month, but stocks, gold, silver, and mining stocks look fabulous.

Crypto, along with Michael Saylor and his Strategy, got taken out behind the woodshed. BTC may recover in the short term, but in the long term, the chart is ugly. ETH also looks spent.

Stay long your gold, silver, and miners. It’s a once-in-a-lifetime opportunity.

Finally, let us laugh, courtesy of the X-verse:

Have a great week ahead.

The Most Expensive Way to Go Broke

Posted February 18, 2026

By Sean Ring

The Bears Gather

Posted February 17, 2026

By Sean Ring

Omar Khayyam: Poet, Rebel, Astronomer

Posted February 16, 2026

By Sean Ring

The Devil in Mexican Mining

Posted February 13, 2026

By Matt Badiali

Is Civil War on the Cards?

Posted February 12, 2026

By Jim Rickards