Posted October 14, 2025

By Sean Ring

Silver Squeezes the Yankee Miners

Yesterday, Canadian stock exchanges were closed for their Thanksgiving holiday. That’s why those stocks didn’t move. So today, I’ll talk about gold, silver, and the U.S. miners.

But before I do, my friend and colleague Adam Sharp wrote something in the Daily Reckoning yesterday that is of paramount importance.

I haven’t sold any of my silver or silver miners yet, and plan to continue to hold. If I decide to sell any of my silver positions, I’ll let readers know before that happens. Currently, the plan is to hold at least 3-5 more years.

To echo Adam’s sentiments, I haven’t changed my position on silver and the miners, though I’ve rotated out of some stocks. And notice his expected holding period. We’re talking years here, not months or weeks. If that’s how long it takes silver to manifest triple-digit pricing, then we’re in for the long haul.

Another essential point to steel your nerves for the miners is one I made in Nashville. The greater danger to your portfolio now is selling too early rather than holding for longer. All I want you to do is to lift your head when you’re thinking about price targets for these stocks. We think they have a long way to go.

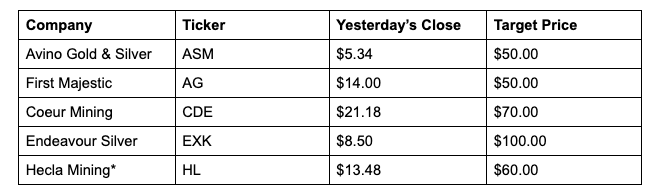

For instance, Don Durrett, perhaps the best mining stock analyst in the world, holds the following targets for companies currently in the unofficial Rude portfolio. Don uses a hypothetical $5,000 gold price and $100 silver price to come up with these estimates.

* I own an options position in Hecla that isn’t a part of the unofficial Rude portfolio.

* I own an options position in Hecla that isn’t a part of the unofficial Rude portfolio.

Notice how many “bags” away we are from Don’s target prices. There’s no guarantee we’ll hit those target prices, but that’s how high we’re aiming.

So it’s long duration and high expected (but not guaranteed) returns, Adam and I are looking for with our miners’ positions. Please understand that as we move forward.

Gold and Silver Themselves

When Asia opened up yesterday, it looked like a Black Friday rush for the precious metals. As I mentioned at the top of yesterday’s Rude, gold was trading around $4,079.85, and silver had hit $51.71 when I was looking at it.

Today, gold was trading $100 higher at $4,179.75, before settling down to a much more sensible $4,119.35. Silver hit $53.58 before falling to $50.85, and then recovering to $52.00. So we’re still up, just not rallying to the moon like early Monday morning.

Here’s this morning’s gold 1-minute chart. You can see Mr. Slammy snuck a sucker punch in.

And the same happened to silver on the 1-minute chart:

That’s from this morning, my time. Now let’s see how the miners did yesterday.

The Miners

Next, I’ll show you the weekly charts (remember, the ones above are 1-minute charts) of the current U.S. miner positions in the unofficial Rude portfolio. Keep in mind, the most recent candle is only yesterday’s price action.

AG

Our long-term target for AG is $50. We’ve got a way to go to get there. The only thing that worries me about this chart is that it’s starting to go vertical. Other than that, it’s about as bullish as you can get.

ASM

This may be the most beautiful bullish chart in the world. It’s on a 45-degree trajectory from the lower left to the upper right. There’s nothing but bullish sentiment here.

CDE

After spending April 2024 to April 2025 in a massive consolidation phase—remember, CDE bought Silvercrest—Coeur took off in May this year. You can see that massive “God candle” just above the “M” for May 2025. After the first jump, we had a second one in July, and the party just kept going. We’re looking for $70 before contemplating a sale.

EXK

I feel better that Endeavour had so much trouble from mid-24 to mid-25. It couldn’t catch that big bid. Suddenly, it overcame $5.50, and we haven’t looked back since then. If EXK hits $100, the returns will be measured with an “x” and not a “%”.

KGC

Another gorgeous chart. There’s no one reason to sell this stock yet. Leonardo couldn’t have drawn it better.

SBSW

I bought and sold this stock twice before hanging onto it. Then I sold half my position at that big break in the rally. But that’s ok, as long as my Canadian juniors start to perform… any day now. This is more of a platinum and palladium play, but I thought I’d include it for completeness. The chart still looks good.

VZLA

This is a great chart, and I wish I had gotten in sooner. Never mind. It still looks good, and I expect more to come in this rally.

Wrap Up

There we have it. A wild rally in gold and silver. The U.S. miners had a great day yesterday. Canada’s miners are back in today; let’s see if they can match American investor enthusiasm.

Remember, we’re looking for big gains over the long term. Think of it not as a Get Rich Quick thing, but rather as a “Get Rich After an Appropriate Interval.”

Everything Rally Returns as Markets Go “Comical Ali” On Us…

Posted October 21, 2025

By Sean Ring

Red Screens, but a Clear Mind

Posted October 20, 2025

By Sean Ring

HODL Your GODL!

Posted October 17, 2025

By Sean Ring

I See Black Gold Risin’…

Posted October 16, 2025

By Sean Ring

Send in the Golden Meteor!

Posted October 13, 2025

By Sean Ring