Posted March 21, 2025

By Sean Ring

Silver Manipulation 101

I don’t usually quote song lyrics… but as Axel Rose once crooned, “All we need is just a little patience.”

Why patience? Because silver will hit $50/ounce, perhaps before summer. And I don’t want you to dump your silver out of frustration. That’s why I want to dedicate this Rude to the great question Chuck A. sent in about the silver price and manipulation.

Hey Sean,

I’m a lifetime Strategic Intelligence member and love your stuff. Your free emails are better than most of the stuff I pay for from other publishers. I can’t say thanks enough. Could you address the Commercials’ large silver short position and whether it’s an attempt to suppress silver prices? Thank you!

Chuck A

Thank you for writing in and for the kind words, Chuck! It’s a privilege and a pleasure!

To answer your question, I’ll explain some things. For you and the rest of the Rude faithful, consider this your “Silver Manipulation 101” class. If you dare invest in my FAVORITE metal, you need to know some of these basic silver mechanics.

First things first: we need to define some terms. (Stick with me, I promise you’ll know more about silver manipulation than 99.9% of investors after today.)

First up, what’s a hedge? To hedge means to reduce risk.To hedge with futures contracts means to take the opposite of your physical position. So if you own silver, you’d short silver futures to offset prices falling. If you don’t have the silver yet and must buy it (say, to make jewelry), you’d buy silver futures to hedge against price increases.

Speculation is trading or investing in an asset—such as stocks, commodities, or futures contracts like silver—to profit from price movements rather than use or produce the asset itself.

Next, what’s the COT? The Commodities and Futures Trading Commission (CFTC) issues the COT weekly. It’s a breakdown of the long and short positions in 20 commodities trading in the U.S.

Now that you understand those terms, we can move on to the game’s players.

Who’s Playing the Game?

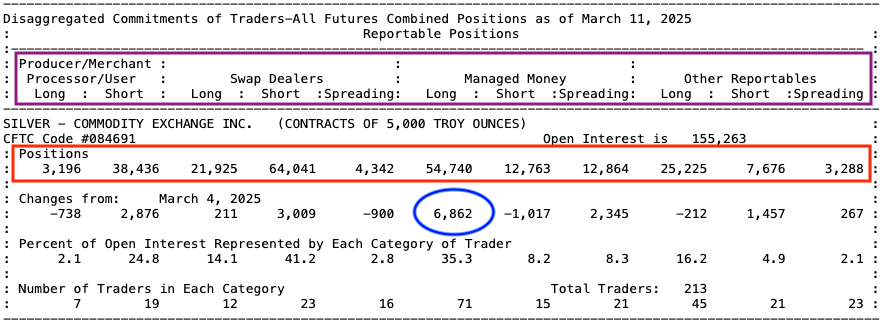

Commercial traders include bullion banks, silver producers, and swap dealers. Non-commercial traders are speculators like hedge funds. In the most recent Commitment Of Traders (COT) report below, "Commercials" combine Producer/Merchant, Processor/User, and Swap Dealers—those with a business tie to the physical market.

To further break down the categories, producers/merchants are those involved in the physical production or handling of the commodity, such as mining companies, refiners, or agricultural producers in other markets. They usually short futures to hedge against falling silver prices.

Processors/Users are businesses or entities that process or consume the commodity—e.g., manufacturers using silver in electronics, solar panels, or jewelry. They’re usually long futures to hedge against price increases. (They’re buying silver from producers/merchants to make jewelry out of silver.)

Swap dealers are large financial institutions, often banks (e.g., JPMorgan, Goldman Sachs), that act as intermediaries or market makers in derivatives markets. They’re usually short futures in precious metals, reflecting their role in balancing client demand. Their positions can be huge, which directly relates to your question.

"Non-Commercials" include Managed Money and Other Reportables.

Managed money is institutional speculators like hedge funds, commodity trading advisors (CTAs), or mutual funds. These are professional money managers who bet on price movements. Depending on their view of the silver market, they may be either long or short.

Other Reportables are traders (speculators) who don’t neatly fit into the above categories but still meet the CFTC’s reporting threshold (large enough positions to warrant tracking). These might include smaller funds, wealthy individuals, or niche players. Again, depending on their sentiment, they may be either long or short.

How to Read the Commitment of Traders (COT) Report

By the end of this section, you’ll read this report like a pro! What I’m about to teach you applies to all the COT Reports, so you’ll know where the “smart money” is placing their bets.

The report below shows the categories we just defined, along with “Long,” “Short,” and “Spreading.”

“Spreading” means a trader simultaneously holds long and short positions in futures contracts, typically across different contract months (e.g., buying June silver futures while selling December silver futures). This isn’t about taking a directional bet on price going up or down—it’s about exploiting price differences or relationships between those contracts. Since they typically offset each other, we only need to look at longs and shorts.

Producers and processors are in one category and are overwhelmingly short (38,436 contracts to 3,196 longs) for hedging purposes. Swap dealers, which include our big banks, are also short by a nearly 3-to-1 margin. Again, this makes sense.

However, the non-commercials of managed money and other reportables are far more bullish. Managed money is long 54,740 contracts while short only 12,763 contracts. Managed Money also increased its long position by 6,862 contracts. Other reportables are 25,225 long to 7,676 short. From this, we can infer that “smart money” is bullish and expects silver prices to increase.

So Is Silver Manipulated Or Not?

Historically, commercials tend to carry a net short position in silver on the COMEX (the primary U.S. futures market for silver) to offset risks rather than speculate on price direction.

The size of the commercial short position is substantial. For context, it’s not uncommon for the net short position of commercials to equate to hundreds of millions of ounces of silver—sometimes exceeding a quarter of annual global mine production (around 800-900 million ounces). This scale has fueled speculation that such positions are used to cap silver prices, especially when fundamentals like industrial demand or physical shortages suggest prices should rise.

The suppression argument depends on two points.

First, the futures market allows for "paper silver"—contracts that vastly outnumber available physical metal, often by ratios like 100:1 or more. Critics argue commercials (especially banks) create downward pressure on prices by selling large volumes of these contracts, discouraging speculative buying and keeping spot prices lower than they would otherwise be.

Second, lawsuits against banks such as JPMorgan for alleged "spoofing" (placing fake orders to manipulate prices)—lend credence to the idea that some institutions have the means and motive to influence markets. Remember, JPMorgan paid a $920 million fine in 2020 to settle spoofing allegations in precious metals markets. But it’s important to acknowledge this doesn’t directly prove systematic price suppression.

But there’s an argument against speculation rooted in market mechanics. Commercial short positions are balanced by corresponding long positions elsewhere—sometimes in less transparent markets like London’s over-the-counter (OTC) market.

This is why I’m reluctant to say, “Yes! Definitely!” I was a futures broker in London, so I only saw the futures side of the trade. I didn’t know if it was speculative or a hedge unless I asked my client. Now, banks allow their swaps traders also to trade futures, so they see the entire motive behind the positions.

Bullion banks, acting as market makers, short COMEX futures while holding physical silver or offsetting longs OTC, meaning their net exposure isn’t as bearish as it appears. Moreover, futures markets require buyers for every seller; if commercials are heavily short, someone—often speculators—is taking the long side, betting on price increases. If suppression were the sole goal, sustained shorting would eventually face physical delivery demands or a short squeeze, as seen in past events like the 1980 Hunt Brothers’ Silver Saga, where silver prices spiked to $50/ounce for the first time.

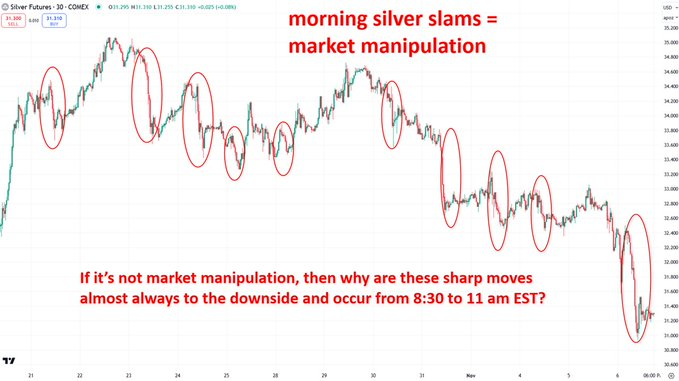

What I will say is that it’s undeniable that someone is coming in NY mornings and slamming the silver price quite often:

Credit: @TheBubbleBubble

Credit: @TheBubbleBubble

Jesse Colombo (@TheBubbleBubble) tirelessly covers this. Is that market manipulation? I think so. Is it a vast conspiracy? I can’t prove that. But banks getting fined for things like spoofing doesn’t help their case.

Wrap Up

Thank you, Chuck A., for the great question. I had promised someone earlier to do a COT breakdown and never got around to it.

I hope this helps you better understand the inner workings of the markets. Now, you can read COT reports as well as any trader. Most people aren’t even aware they exist.

Have a wonderful weekend!

The Metal That Powers AI

Posted February 06, 2026

By Matt Badiali

ANNIHILATION!

Posted February 05, 2026

By Sean Ring

How The Machine Ate Itself

Posted February 04, 2026

By Nick Riso

My Secret to Finding Great Miners… and Avoiding Promoters

Posted February 03, 2026

By Matt Badiali

The Massacre of the Innocents

Posted February 02, 2026

By Sean Ring