Posted March 18, 2025

By Sean Ring

Seanie’s Gold: 10 Miners I Personally Own

My portfolio is 100% gold and silver miners.

People may think I'm greedy. That I've got a Midas complex.

But they'd be dead wrong. Today I'll show you why, and the TEN companies in my personal portfolio...

First, let's talk about that Midas guy…

The Midas Hedge

King Midas, famous for his golden touch, comes from Greek mythology. The god Dionysus granted Midas his wish to turn everything he touched into gold after Midas was kind to Dionysus's companion, Silenus, the satyr.

Midas was thrilled at first, but he realized the curse of his wish when he turned his food and daughter into gold. Desperate, he begged Dionysus to take back the wish. The god instructed him to wash in the Pactolus River, which supposedly made the river rich in gold.

“To hedge” in finance means “to mitigate” or “to reduce” risk.

The tale of Midas is usually a cautionary one against limitless greed. But not today. If you loaded up on gold, silver, or their miners, you protected yourself from The Donald’s tariff whims.

You also took advantage of the coming crisis at the London Bullion Market Association (LBMA), which is why Comex is receiving all that physical gold. On Friday, Comex delisted the Gold Kilo Futures, London Spot Gold Futures, London Silver Spot Futures, and Cleared OTC London Gold Forwards (collateral margin) contracts. By doing this, Comex has removed itself from the LBMA’s imminent retirement party. I’ll explain this in plainer English further down.

But first, let’s look at gold’s recent performance.

Since the NASDAQ Peak

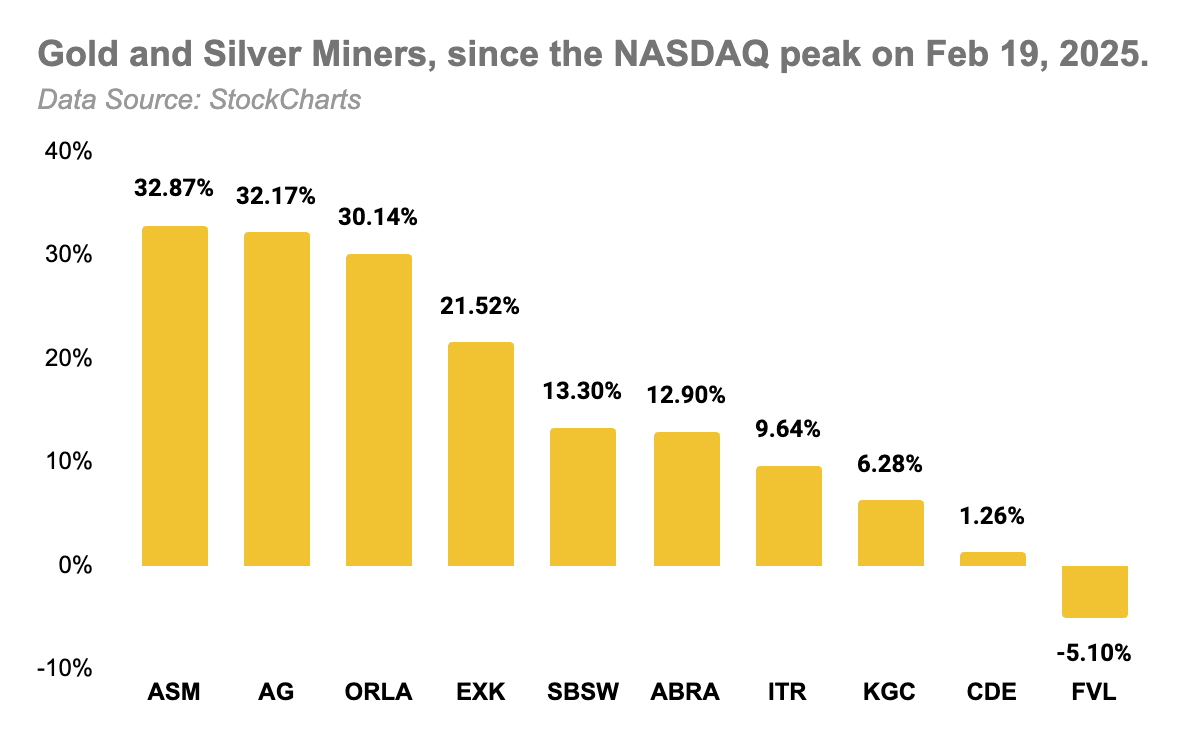

I put this chart together this morning so you can see how the gold and silver miners I’ve invested in have performed since the Nasdaq peak on February 19th. (The tech market has been down 10.66% since then.) For reference, the GDX (gold miners ETF) was up a fair 7.29%, and the GDXJ (junior gold miners ETF) was up a better 10.72%.

Disclosure: I own all these stocks. Freegold Ventures (FVL) has had a shocker, losing 5.10%. Coeur Mining (CDE) just swallowed SilverCrest, so its share price is up a measly 1.26% over the period. I expect it to perform much better over the rest of the year and beyond. Kinross Gold (KGC) needed a breather because it’s already vastly outperformed.

Integra (ITR), AbraSilver (ABRA), and my favorite platinum group metal (PGM) play, Sibanye Stillwater (SBSW), have all done well.

But where we’ve shined is with Endeavour Silver (EXK), Orla Mining (ORLA), First Majestic (AG), and Avino Gold and Silver (ASM). EXK is up over 20% in less than a month. The rest are up over 30%!

These stocks can hold onto their gains as gold and silver are set to soar due to tariff-induced inflation and supply issues.

Supply Issues: Comex, the LBMA, and Gold Repatriation

The tariff issue is easy to understand: tariffs are taxes and make imported goods and services more expensive.

But the mechanics of the market are a bit more complicated.

Comex gold repatriation and the LBMA’s troubles are closely linked and signal potential instability in the global gold market.

Comex, the New York-based futures exchange, primarily deals in paper contracts rather than physical gold. Remember, 97% of all futures contracts do not go to delivery. In fact, Comex is clear that it’s not set up for physical delivery beyond keeping the market honest.

More investors and institutions have recently demanded physical delivery of gold instead of cash settlement, and for good reason. To meet these demands, Comex has been importing gold from London, where most of the world’s bullion is kept.

This move has pressured the London Bullion Market Association (LBMA), the global hub for physical gold trading. As Comex withdraws gold, LBMA’s reserves are shrinking. At the same time, central banks and large investors—such as China and Russia—are also repatriating their gold from London vaults. This raises concerns that London could run out of available gold to back the massive amount of paper gold being traded. If LBMA’s stockpile falls too low, it could cause a crisis.

As Comex demands more physical gold, the LBMA’s supply dwindles, increasing the risk of a supply crunch. Then, more investors will rush to secure physical gold, making things worse. This would drive gold prices much higher and incentivize countries and institutions to hoard physical gold. If LBMA’s troubles escalate, it could ripple through the global economy.

Gold Price Target and Demand Issues

One of the most important lessons an investor can learn is that most of their portfolio returns will come from investing in the right asset class, not picking the right stocks. So, at this point, just holding precious metals is the right move, and your portfolio will reveal that to you in the form of higher returns.

But here are some numbers that back up that assertion.

Jeremy DuPlessis, one of the world’s foremost technical analysts and chief proponent of the Point and Figure chart, puts his next gold target at $3,828.10.

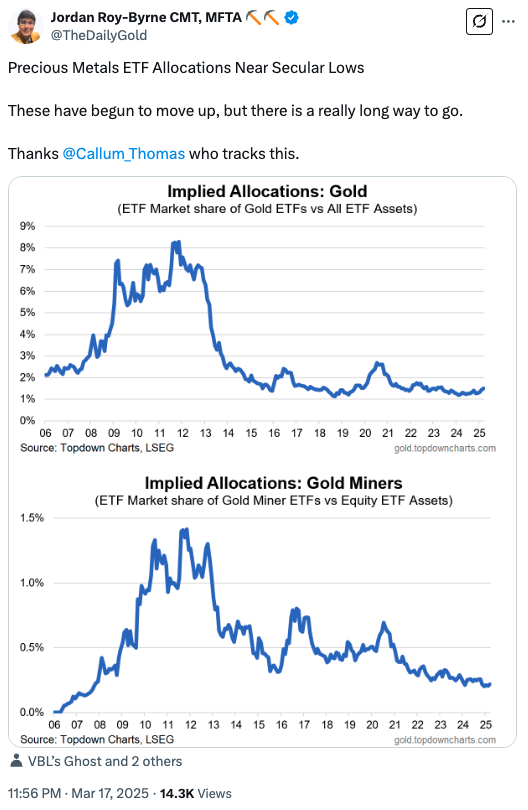

Our good friend and billionaire resource investor, Rick Rule, has often said investors are under-allocated in gold, silver, and miners. In an interview with me, Rick also said that a return to “normal allocation” of 2% of one’s portfolio from ½% should four times the price of gold. (At the time, gold traded at $2,500, implying a $10,000 price target.)

Yesterday, Jordan Roy-Byrne posted the below on X, proving Rick correct about the under-allocation:

Remember, this already considerable move has been due to central bank purchases. Russia and China, especially, are selling treasuries to buy gold. They do this to innoculate themselves from U.S. sanctions… and it’s working. Institutional and retail investors aren’t even in the game yet.

The implication is that once institutional and retail investors realize how late they are to the party, it’ll be like squeezing their money through a garden hose, as the great investor Doug Casey likes to say. There simply aren’t enough mining stocks to satiate institutional and retail demand. Gold, silver, and the miners will soar more than they already have and perhaps more than we dream they can.

Wrap Up

It’s a great day to be a precious metals investor. Not only do we have evidence of a sustained rally, but we also have good reason to think this rally will continue long into the future. Perhaps we’ll see a $4,000 gold ounce by the end of the year.

The general stock market doesn’t look that good.

So, far from being greedy, gold protects you like a Midas shield!

A National Security Sh*tshow

Posted March 25, 2025

By Sean Ring

DOGE Alert: The Top 10 Dumbest Things YOU Paid For

Posted March 24, 2025

By Sean Ring

Silver Manipulation 101

Posted March 21, 2025

By Sean Ring

Bessent's Strange New Policy: "Yield The Dog"

Posted March 20, 2025

By Sean Ring

Keeping The Green in Ireland

Posted March 17, 2025

By Sean Ring